Various civic groups forming the “Youth Anti-Debt Alliance” voiced their concern yesterday, claiming that the new labor insurance system may cause a “financial black hole” and damage their right to collect payments when they retire.

Under the new system, the monthly labor insurance premium will be raised year by year from 7.5 percent of an employee’s monthly salary to 13 percent.

The insurance payment collection mechanism will also change from a single lump sum payment to a series of monthly payments after retirement at the age of 65.

“The new plan means that the younger you are, the more you have to pay,” Vincent Chou (周榆修), chairman of the Taiwan Young Democratic Union, told a news conference at the legislature.

“For example, I was born in the 1970s, I started working at 25, and when I reach my legal retirement age of 65, I will have paid NT$1.46 million [US$48,000],” he said. “Under the same set of circumstances, someone who is born in the 1980s will have paid NT$1.69 million, while my son, who is only 13 months old, will be paying a total of NT$1.83 million.”

However, there is no guarantee that an insured individual will be able to collect the payment after he or she retires.

“Under the old labor insurance plan which allows someone to collect a one-time payment after he or she retires, someone who makes NT$30,000 [US$990] per month will be collecting a total of NT$1.4 million,” said Lee Huai-jen (李懷仁), a spokesman for the anti-debt alliance.

“However, under the new system which allows one to collect the payment monthly, the longer you live, the more you would collect,” he said. “So for one who makes NT$30,000 a month, retires at 65 and lives until 78 — the average life expectancy — he or she will be collecting a total of around NT$2 million instead.”

Lee said that a “financial black hole” would thus be created.

The group’s worries are not baseless.

The Council of Labor Affairs admitted that, under the new plan, the labor insurance program may be broke within 19 years.

“What we need is inside-out labor insurance reform,” said Huang Yi-ling (黃怡翎), a member of the alliance. “Under the new plan, we don’t see any economic security for our old age.”

Taiwan Labor Front (TLF), on the other hand, yesterday praised the adoption of the new labor insurance pension system.

TLF secretary-general Son Yu-lian (孫友聯) said in a statement that he believed a pension system, rather than a one-time insurance payment collection “could better take care of laborers’ life in retirement,” while also pointing out some ideas for improvement.

“We expect that further amendments will require all workers — regardless of occupation — to be included in the labor insurance pension system,” he said. “And the options laborers have vis-a-vis the labor pension and the national pension systems must be explained to them so that they can make an informed decision,” Son said.

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), spokeswoman Yang Chih-yu (楊智伃) and Legislator Hsieh Lung-chieh (謝龍介) would be summoned by police for questioning for leading an illegal assembly on Thursday evening last week, Minister of the Interior Liu Shyh-fang (劉世芳) said today. The three KMT officials led an assembly outside the Taipei City Prosecutors’ Office, a restricted area where public assembly is not allowed, protesting the questioning of several KMT staff and searches of KMT headquarters and offices in a recall petition forgery case. Chu, Yang and Hsieh are all suspected of contravening the Assembly and Parade Act (集會遊行法) by holding

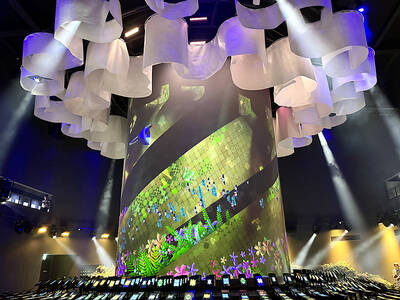

PRAISE: Japanese visitor Takashi Kubota said the Taiwanese temple architecture images showcased in the AI Art Gallery were the most impressive displays he saw Taiwan does not have an official pavilion at the World Expo in Osaka, Japan, because of its diplomatic predicament, but the government-backed Tech World pavilion is drawing interest with its unique recreations of works by Taiwanese artists. The pavilion features an artificial intelligence (AI)-based art gallery showcasing works of famous Taiwanese artists from the Japanese colonial period using innovative technologies. Among its main simulated displays are Eastern gouache paintings by Chen Chin (陳進), Lin Yu-shan (林玉山) and Kuo Hsueh-hu (郭雪湖), who were the three young Taiwanese painters selected for the East Asian Painting exhibition in 1927. Gouache is a water-based

Taiwan would welcome the return of Honduras as a diplomatic ally if its next president decides to make such a move, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. “Of course, we would welcome Honduras if they want to restore diplomatic ties with Taiwan after their elections,” Lin said at a meeting of the legislature’s Foreign Affairs and National Defense Committee, when asked to comment on statements made by two of the three Honduran presidential candidates during the presidential campaign in the Central American country. Taiwan is paying close attention to the region as a whole in the wake of a

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by