Subsidiaries of multinational corporations and companies headquartered in Taiwan will be exempt from a ceiling on China-bound investment when it is relaxed on Aug. 1, the Executive Yuan announced after approving the proposal at its weekly Cabinet meeting yesterday.

The large-scale relaxation of restrictions on capital flows to China is one of the three major policies of the Ma Ying-jeou (馬英九) administration, aimed at enhancing cross-strait economic integration.

The measures opening Taiwan up a limited degree to Chinese capital will be implemented next month and the next step is to partially lift the ban on China-bound investment in high-tech industries, Minister of Economic Affairs Yiin Chii-ming (尹啟銘) said.

“The main goal of the policies is helping local businesses richly cultivate Taiwan and reach out to the world,” Yiin told a press conference after the Cabinet meeting.

Under the proposal passed yesterday, the government will allow businesses registered with the government to invest higher proportions of their consolidated net worth, or the net worth of an individual enterprise across the strait.

The proposal will lift the cap of 20 percent, 30 percent or 40 percent of a company’s net worth, depending on its paid-in capital, to a ceiling of 60 percent.

Yinn rebutted criticism that the relaxation would result in local industries moving to China, saying that many businesspeople had told the ministry that they would continue to invest in Taiwan and would even be willing to remit their overseas profits back to Taiwan when the cap is relaxed.

“The relaxation will contribute to an increase in capital inflows as it removes the worry for businesspeople that they will have trouble sending money out of Taiwan because of the ceiling,” Yinn said.

Yinn said the ministry was unable to estimate the additional potential capital outflow from Taiwan to China following the relaxation.

“We don’t have an estimate as some businesses will shift their capital to China from overseas and not directly from Taiwan,” Yinn said, adding that the ministry could only assess the impact of Taiwan’s capital outflow to China one year after its implementation.

Last year, the ministry approved 996 China-bound investment projects worth US$9.97 billion, a 30.46 percent increase over 2006, accounting for 60 percent of total overseas investment.

Article 35 of the Statute Governing the Relations Between the Peoples of the Taiwan Area and Mainland Area (台灣地區與大陸地區人民關係條例) requires businesses registered with the government to obtain permission before investing in China.

Based on the article, the Guidelines Governing the Review of Investment or Technical Cooperation in the Mainland Area (在大陸地區從事投資或技術合作審查原則) specifies a three-tier system — with the current ceilings of 20 percent, 30 percent or 40 percent — to regulate China-bound investment.

The ministry said that 52 companies had reached the current investment ceiling and 131 companies were near the investment ceiling.

Meanwhile, in response to requests by the American Chamber of Commerce in Taipei and European Chamber of Commerce Taipei, subsidiaries of multinational corporations and companies with their headquarters in Taiwan would be exempt from the ceiling on China-bound investment.

The new policy will benefit 577 companies with headquarters in Taiwan and more than 200 subsidiaries of multinational companies, Yiin said.

“Scrapping the ceiling will not lead to the companies diverting their investments from Taiwan to China,” Yiin said. “We knew that companies headquartered in Taiwan have put, or are planning to put, a total of NT$2.214 trillion into 66 investment projects here.”

The proposal also raised the cap on China-bound investment by small and medium enterprises with paid-in capital below NT$80 million and by individuals.

Small and medium enterprises can either abide by the current cap of NT$80 million, or if higher, 60 percent of the enterprise’s net worth, up from 40 percent.

Individuals, who are currently allowed to remit a maximum of NT$80 million to China annually, will be able to remit up to US$5 million (NT$150 million), the upper limit stipulated in Foreign Exchange Regulations (外匯管理條例).

The Democratic Progressive Party (DPP) yesterday called for an investment guarantee pact with China if the government is to allow Chinese capital into the domestic market at an earlier date than planned.

Taiwan and China must clinch an investment guarantee accord to secure Taiwanese business interests in China, head of the DPP’s international affairs department Lin Cheng-wei (林成蔚) said in a press release.

ADDITIONAL REPORTING BY CNA

Also see: Firms will see immediate rewards: FSC

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), spokeswoman Yang Chih-yu (楊智伃) and Legislator Hsieh Lung-chieh (謝龍介) would be summoned by police for questioning for leading an illegal assembly on Thursday evening last week, Minister of the Interior Liu Shyh-fang (劉世芳) said today. The three KMT officials led an assembly outside the Taipei City Prosecutors’ Office, a restricted area where public assembly is not allowed, protesting the questioning of several KMT staff and searches of KMT headquarters and offices in a recall petition forgery case. Chu, Yang and Hsieh are all suspected of contravening the Assembly and Parade Act (集會遊行法) by holding

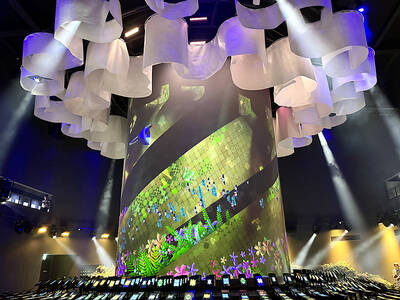

PRAISE: Japanese visitor Takashi Kubota said the Taiwanese temple architecture images showcased in the AI Art Gallery were the most impressive displays he saw Taiwan does not have an official pavilion at the World Expo in Osaka, Japan, because of its diplomatic predicament, but the government-backed Tech World pavilion is drawing interest with its unique recreations of works by Taiwanese artists. The pavilion features an artificial intelligence (AI)-based art gallery showcasing works of famous Taiwanese artists from the Japanese colonial period using innovative technologies. Among its main simulated displays are Eastern gouache paintings by Chen Chin (陳進), Lin Yu-shan (林玉山) and Kuo Hsueh-hu (郭雪湖), who were the three young Taiwanese painters selected for the East Asian Painting exhibition in 1927. Gouache is a water-based

Taiwan would welcome the return of Honduras as a diplomatic ally if its next president decides to make such a move, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. “Of course, we would welcome Honduras if they want to restore diplomatic ties with Taiwan after their elections,” Lin said at a meeting of the legislature’s Foreign Affairs and National Defense Committee, when asked to comment on statements made by two of the three Honduran presidential candidates during the presidential campaign in the Central American country. Taiwan is paying close attention to the region as a whole in the wake of a

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by