The TAIEX plunged 2,065.87 points, or 9.7 percent, to close at 19,232.35 yesterday, the highest single-day percentage loss on record, as investors braced for US President Donald Trump’s tariffs after an extended holiday weekend.

Amid the pessimistic atmosphere, 945 listed companies led by large-cap stocks — including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Hon Hai Precision Industry Co (鴻海精密) and Largan Precision Co (大立光) — fell by the daily maximum of 10 percent at the close, Taiwan Stock Exchange data showed.

The number of listed companies ending limit-down set a new record, the exchange said.

Photo: Cheng I-hwa, AFP

The TAIEX plunged by daily maxiumu in just 10 minutes after the market opened, even though the Financial Supervisory Commission announced temporary measures on Sunday that aim to curb short selling and keep local shares stabilized.

“The Taiwan index is tech-dominant and their tech companies are closely tied to US clients, thus suffering from dual concerns related to the US over AI [artificial intelligence] investments, and both first and second order impact of tariffs,” Aberdeen Investments fund manager Ng Xin-yao (黃新耀) told Bloomberg News.

Despite the sell-off, turnover on the local market totaled only NT$147.295 billion (US$4.46 billion), the lowest single-day total in more than two years, while foreign institutional investors bought a net NT$16.82 billion of shares yesterday, exchange data showed.

“The low turnover showed many investors were reluctant to buy the dip as they expect more losses to follow due to the tariff shocks,” Mega International Investment Services Corp (兆豐國際投顧) analyst Alex Huang (黃國偉) said.

The local stock market was closed for a holiday on Thursday and Friday last week as trillions of US dollars were wiped off the value of global stocks and nations scrambled to limit the impact of Trump’s reciprocal tariffs announced on Wednesday last week, which imposed an unexpectedly high 32 percent tariff on Taiwan.

Taiwan Stock Exchange chairman Sherman Lin (林修銘) said before the market opened that the local bourse would inevitably fluctuate because of the shocks from global markets.

“The exchange will pay attention to the changes in the international situation and cooperate closely with local companies,” Lin said. “The government will support local industries with full force and start conversations with the US government to seek the possibility of lowering the tariffs.”

Lin also encouraged listed companies to make financial information transparent, keep investors posted on their responses to Trump’s reciprocal tariffs and implement share buyback schemes to stabilize prices and bolster investor confidence.

Meanwhile, the steering committee of the National Stabilization Fund is expected to hold a meeting as soon as today to discuss how and when to utilize the NT$500 billion fund to help buffer the market sell-off, the Ministry of Finance said.

Beyond Taiwan, Asian and European equities collapsed on a black Monday for markets after China hammered the US with its own hefty tariffs, ramping up a trade war that many fear could spark a recession.

Hong Kong lost 13.22 percent, its worst performance in nearly three decades, and Shanghai shed more than 7 percent. Tokyo and Singapore fell almost 8 percent, while Seoul gave up more than 5 percent, triggering a so-called sidecar mechanism — for the first time in eight months — that briefly halted some trading.

Sydney, Wellington, Manila and Mumbai were also deep in the red, Frankfurt dived 10 percent, while London and Paris both dropped about 5 percent.

Additional reporting by AFP and CNA

The Central Election Commission has amended election and recall regulations to require elected office candidates to provide proof that they have no Chinese citizenship, a Cabinet report said. The commission on Oct. 29 last year revised the Measures for the Permission of Family-based Residence, Long-term Residence and Settlement of People from the Mainland Area in the Taiwan Area (大陸地區人民在台灣地區依親居留長期居留或定居許可辦法), the Executive Yuan said in a report it submitted to the legislature for review. The revision requires Chinese citizens applying for permanent residency to submit notarial documents showing that they have lost their Chinese household record and have renounced — or have never

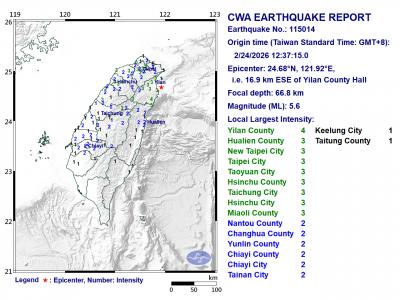

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents