The US on Thursday imposed sanctions on Kong Kong-based and Emirati companies, as well as a network of Iranian firms that help export the country’s petrochemicals, a step that might raise pressure on Tehran to revive the 2015 Iran nuclear deal.

The US Department of the Treasury said it had imposed penalties on two companies based in Hong Kong, three in Iran and four in the United Arab Emirates (UAE), as well as on Chinese citizen Gao Jinfeng and Indian national Mohammed Shaheed Ruknooddin Bhore.

“The United States is pursuing the path of meaningful diplomacy to achieve a mutual return to compliance with the Joint Comprehensive Plan of Action,” US Undersecretary of the Treasury for Terrorism and Financial Intelligence Brian Nelson said in a statement, referring to the 2015 nuclear agreement.

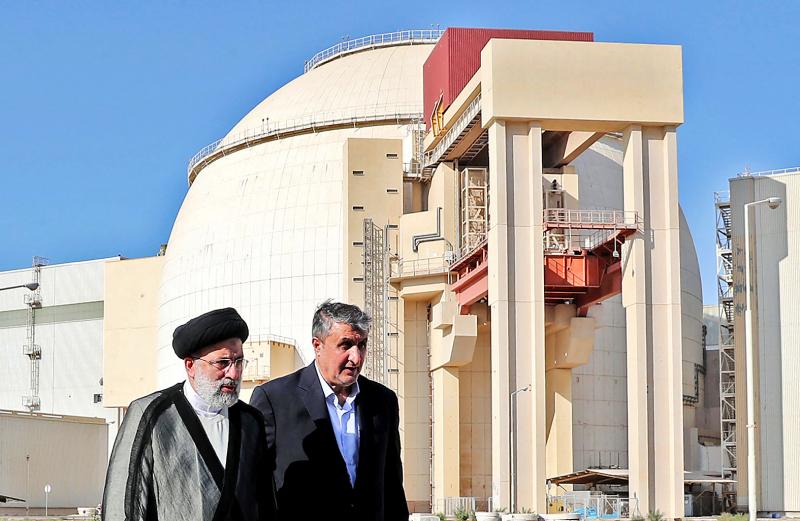

Photo: AFP / HO / IRANIAN PRESIDENCY

Under the pact, Iran limited its nuclear program, to make it harder for Tehran to obtain a nuclear weapon, in exchange for relief from US, EU and UN sanctions that had choked Iran’s oil-dependent economy.

Then-US president Donald Trump in 2018 pulled out of the deal and restored US sanctions, prompting Iran to start breaching the nuclear restrictions about a year later. Talks to revive the agreement have so far failed.

“Absent a deal, we will continue to use our sanctions authorities to limit exports of petroleum, petroleum products and petrochemical products from Iran,” Nelson said.

Iranian Deputy Minister of Foreign Affairs for Economic Diplomacy Mehdi Safari dismissed the new sanctions as ineffective.

“Our petrochemical industry and its products have long been under sanctions, but our sales have continued through various channels and shall continue to do so,” Safari told Iranian state TV.

Eurasia Group deputy research head Henry Rome said that the new sanctions might aim to raise pressure on Iran and to blunt US domestic critics who say that US President Joe Biden has failed to rein in Iran’s nuclear program.

“Washington is likely aiming to raise the costs for Iran of a continued no-deal scenario while also deflecting domestic and foreign criticism that it is allowing its Iran policy to drift,” Rome said, adding that any single sanctions action was unlikely to change thinking in Iran or China absent a broader strategy.

“Indeed, Tehran may calculate that given the state of the oil market and global inflationary pressures, a concerted [US] campaign to collapse Iranian energy exports to Trump-era levels is not in the cards in the near term,” Rome added.

The nuclear pact seemed near revival in March, but talks unraveled partly over whether Washington might drop the Islamic Revolutionary Guard Corps, which controls armed and intelligence forces that Washington accuses of a global terrorist campaign, from the US’ Foreign Terrorist Organization list.

The treasury department named the Hong Kong-based companies as Keen Well International Ltd and Teamford Enterprises Ltd, and the Iran-based firms as Fanavaran Petrochemical Co, Kharg Petrochemical Co and Marun Petrochemical Co.

The two Hong Kong-based companies and Gao could not be immediately reached for comment.

Kharg could not be reached for comment late on Thursday, the weekend in Iran, while Fanavaran and Marun did not immediately reply to e-mails seeking comment.

The treasury department listed the four UAE-based companies as Future Gate Fuel and Petrochemical Trading LLC, GX Shipping FZE, Sky Zone Trading FZE and Youchem General Trading FZE.

Reuters could not obtain contact information for them to seek comment.

All property and interests in property of the firms falling under US jurisdiction are blocked and those who deal with them might also be sanctioned or penalized under some circumstances.

CHIPMAKING INVESTMENT: J.W. Kuo told legislators that Department of Investment Review approval would be needed were Washington to seek a TSMC board seat Minister of Economic Affairs J.W. Kuo (郭智輝) yesterday said he received information about a possible US government investment in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and an assessment of the possible effect on the firm requires further discussion. If the US were to invest in TSMC, the plan would need to be reviewed by the Department of Investment Review, Kuo told reporters ahead of a hearing of the legislature’s Economics Committee. Kuo’s remarks came after US Secretary of Commerce Howard Lutnick on Tuesday said that the US government is looking into the federal government taking equity stakes in computer chip manufacturers that

POWER PLANT POLL: The TPP said the number of ‘yes’ votes showed that the energy policy should be corrected, and the KMT said the result was a win for the people’s voice The government does not rule out advanced nuclear energy generation if it meets the government’s three prerequisites, President William Lai (賴清德) said last night after the number of votes in favor of restarting a nuclear power plant outnumbered the “no” votes in a referendum yesterday. The referendum failed to pass, despite getting more “yes” votes, as the Referendum Act (公民投票法) states that the vote would only pass if the votes in favor account for more than one-fourth of the total number of eligible voters and outnumber the opposing votes. Yesterday’s referendum question was: “Do you agree that the Ma-anshan Nuclear Power Plant

Chinese Nationalist Party (KMT) lawmakers have declared they survived recall votes to remove them from office today, although official results are still pending as the vote counting continues. Although final tallies from the Central Election Commission (CEC) are still pending, preliminary results indicate that the recall campaigns against all seven KMT lawmakers have fallen short. As of 6:10 pm, Taichung Legislators Yen Kuan-heng (顏寬恒) and Yang Chiung-ying (楊瓊瓔), Hsinchu County Legislator Lin Szu-ming (林思銘), Nantou County Legislator Ma Wen-chun (馬文君) and New Taipei City Legislator Lo Ming-tsai (羅明才) had all announced they

Nvidia Corp CEO Jensen Huang (黃仁勳) yesterday visited Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), as the chipmaker prepares for volume production of Nvidia’s next-generation artificial intelligence (AI) chips. It was Huang’s third trip to Taiwan this year, indicating that Nvidia’s supply chain is deeply connected to Taiwan. Its partners also include packager Siliconware Precision Industries Co (矽品精密) and server makers Hon Hai Precision Industry Co (鴻海精密) and Quanta Computer Inc (廣達). “My main purpose is to visit TSMC,” Huang said yesterday. “As you know, we have next-generation architecture called Rubin. Rubin is very advanced. We have now taped out six brand new