Taiwan would liberalize banking and investment rules to establish itself as a regional financial hub, President Tsai Ing-wen (蔡英文) told the Taiwan Capital Market Forum in Taipei yesterday.

Recent world events could be an opening for Taiwan to become an international center for business investments and financial management, Tsai said at the forum, which was organized by the Chinese-language Liberty Times (the sister publication of the Taipei Times).

“We’re facing unknowns in the world right now, including the continuing impact of US-China trade tensions and the reorganization of the global supply chain after COVID-19,” Tsai said. “These bring new challenges and opportunities.”

Photo: Liu Hsin-de, Taipei Times

Tsai said that Taiwan has two major advantages.

“First, our transparent laws and efficient courts are appealing to international businesses. Second, our comprehensive financial institutions,” she said.

In addition, dividend yields are high in Taiwan, transactions are stable and transparent, and compared with surrounding countries, the liquidity of Taiwan’s capital markets is high, Tsai said.

The ratio of foreign investors holding Taiwanese equities is at a historic high, at 41.2 percent as of the end of last year, Tsai said.

There are 1,717 publicly traded companies in Taiwan with a combined value NT$39.84 trillion (US$1.35 trillion), up 106 percent and 331 percent respectively from 2000, she said.

“While the world’s stock markets are all affected by COVID-19, Taiwan’s market hit a 30-year high. It is clear to see we are increasingly favored by foreign investors,” she said.

However, market liberalization would be the key to attract banks and other investment institutions to set up shop in Taiwan amid a government goal to make the nation Asia’s top destination for business financing, Tsai said.

“We are going to make Taiwan the No. 1 center in Asia for capital movement. In the future, we are going to relax rules for international finance institutions to establish offshore banking units [OBU] in Taiwan and make it more convenient to use foreign currencies. With more OBUs in Taiwan, we will be able to strengthen manufacturing development with all that capital,” she said.

“Secondly, we also wish to establish ourselves as a wealth management center,” Tsai said. “This means loosening rules and providing more diversified financial products and services. We can expand the scale of wealth management businesses, and attract more international institutions and capital to Taiwan.”

Tsai said that some businesses have been unable to go public as planned due to profit being hit by the COVID-19 pandemic.

“We’re working with those businesses proactively, loosening requirements and helping them obtain loans to get back on their feet,” she said.

Premier Su Tseng-chang (蘇貞昌) told the forum that Taiwan has taken advantage of the US-China trade dispute by encouraging investment.

“There has been more than NT$1 trillion in investment in Taiwan since last year’s rise in US-China trade tensions,” Su said. “According to last month’s international assessments, Taiwan is the safest investment environment in Asia, and third in the world, after Switzerland and Norway."

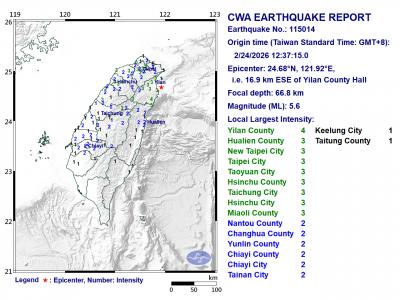

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at

TRUST: The KMT said it respected the US’ timing and considerations, and hoped it would continue to honor its commitments to helping Taiwan bolster its defenses and deterrence US President Donald Trump is delaying a multibillion-dollar arms sale to Taiwan to ensure his visit to Beijing is successful, a New York Times report said. The weapons sales package has stalled in the US Department of State, the report said, citing US officials it did not identify. The White House has told agencies not to push forward ahead of Trump’s meeting with Chinese President Xi Jinping (習近平), it said. The two last month held a phone call to discuss trade and geopolitical flashpoints ahead of the summit. Xi raised the Taiwan issue and urged the US to handle arms sales to

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents