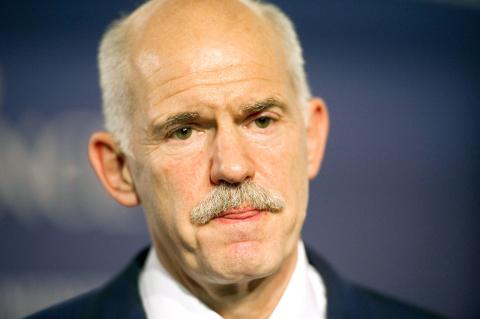

Demands mounted yesterday for Greek Prime Minister George Papandreou to resign and let a coalition government approve a European bailout plan instead of holding a risky referendum on it.

Papandreou’s proposal earlier this week to put the hard-fought bailout package to a referendum horrified Greece’s international partners and creditors, triggering turmoil in financial markets as investors fretted over the prospect of a disorderly default and the country’s exit from the eurozone.

The instability in Greece sent immediate ripples throughout Europe. Italian Prime Minister Silvio Berlusconi’s government was teetering as well after it failed to come up with a credible plan to deal with its dangerously high debts, while Portugal demanded more flexible terms for its own bailout.

Photo: AFP

The European Central Bank made a surprise decision yesterday to cut interest rates by a quarter of a percentage point to 1.25 percent, responding to the financial turmoil.

The drama also dominated the G20 meeting in the French resort of Cannes, where the leaders of the world’s economic powerhouses had gathered to solve Europe’s debt crisis, which threatens to push the world back into recession.

Papandreou was holding an emergency meeting yesterday with his ministers. Several of them called for a coalition national unity government that would approve the bailout package without a referendum and make sure the country receives vital funds to prevent imminent bankruptcy.

Rumors abounded about a possible Papandreou resignation, but two officials in his office denied reports that he would visit the country’s president and tender his resignation in the afternoon. The president’s office also said it had no knowledge of such a meeting.

Several of Papandreou’s close associates said they did not know what his intentions were, but he was delivering a speech to ministers.

“He wrote the speech himself. Nobody knows what’s in it,” said one close associate, who spoke on condition of anonymity.

Antonis Samaras, the leader of the main opposition party, called for a transitional government to ratify the European debt deal and prepare for early elections.

“Under the weight of these dramatic events, we have witnessed a crisis of the ability to govern. The country must immediately return to a state of normality,” Samaras said. “Under the current conditions, the new debt deal is unavoidable and must be safeguarded.”

State TV said lawmakers were sounding out former European Central Bank vice president Lucas Papademos as a possible unity government leader.

If the Greek government did fall, it would mean that every EU nation that had already received a bailout — Greece, Portugal and Ireland — had seen their governments fall during the economic turmoil.

Earlier yesterday, Papandreou’s own finance minister, Evangelos Venizelos, broke ranks with him and declared his opposition to a referendum.

“Greece’s position within the eurozone is a historic conquest of the country that cannot be put in doubt,” Venizelos said, adding that it “cannot depend on a referendum.”

Venizelos said the country’s attention should be focused on quickly getting a crucial 8 billion euros (US$11 billion) installment of bailout funds, without which it faces bankruptcy within weeks.

“What matters now, is that we must save what we can, to remain united,” Greek Health Minister Andreas Loverdos said.

The CIA has a message for Chinese government officials worried about their place in Chinese President Xi Jinping’s (習近平) government: Come work with us. The agency released two Mandarin-language videos on social media on Thursday inviting disgruntled officials to contact the CIA. The recruitment videos posted on YouTube and X racked up more than 5 million views combined in their first day. The outreach comes as CIA Director John Ratcliffe has vowed to boost the agency’s use of intelligence from human sources and its focus on China, which has recently targeted US officials with its own espionage operations. The videos are “aimed at

STEADFAST FRIEND: The bills encourage increased Taiwan-US engagement and address China’s distortion of UN Resolution 2758 to isolate Taiwan internationally The Presidential Office yesterday thanked the US House of Representatives for unanimously passing two Taiwan-related bills highlighting its solid support for Taiwan’s democracy and global participation, and for deepening bilateral relations. One of the bills, the Taiwan Assurance Implementation Act, requires the US Department of State to periodically review its guidelines for engagement with Taiwan, and report to the US Congress on the guidelines and plans to lift self-imposed limitations on US-Taiwan engagement. The other bill is the Taiwan International Solidarity Act, which clarifies that UN Resolution 2758 does not address the issue of the representation of Taiwan or its people in

US Indo-Pacific Commander Admiral Samuel Paparo on Friday expressed concern over the rate at which China is diversifying its military exercises, the Financial Times (FT) reported on Saturday. “The rates of change on the depth and breadth of their exercises is the one non-linear effect that I’ve seen in the last year that wakes me up at night or keeps me up at night,” Paparo was quoted by FT as saying while attending the annual Sedona Forum at the McCain Institute in Arizona. Paparo also expressed concern over the speed with which China was expanding its military. While the US

SHIFT: Taiwan’s better-than-expected first-quarter GDP and signs of weakness in the US have driven global capital back to emerging markets, the central bank head said The central bank yesterday blamed market speculation for the steep rise in the local currency, and urged exporters and financial institutions to stay calm and stop panic sell-offs to avoid hurting their own profitability. The nation’s top monetary policymaker said that it would step in, if necessary, to maintain order and stability in the foreign exchange market. The remarks came as the NT dollar yesterday closed up NT$0.919 to NT$30.145 against the US dollar in Taipei trading, after rising as high as NT$29.59 in intraday trading. The local currency has surged 5.85 percent against the greenback over the past two sessions, central