The post-World War II, post-Cold War system of globalized free trade led by the US looks increasingly insecure, a system that Taiwan is deeply reliant on.

Taiwan is a mid-sized maritime trading power that punches well above its weight economically. In the second quarter, trade in goods and services was 118.5 percent of nominal GDP.

The entire neighborhood is trade-dependent. Bloomberg estimates half of all world trade goes through the Taiwan Strait.

Photo: Reuters

Though it runs trade deficits with some countries — notably South Korea and Japan — Taiwan overall runs big trade surpluses, including with the US, China and Hong Kong. The European Union and the ASEAN nations are also high on the list of trading partners, but Taiwan trades with nearly everyone worldwide, at times not entirely legally and from time-to-time Taiwanese get caught breaking sanctions on places like North Korea and Russia.

The trade surplus this year is estimated at a massive 15 percent of GDP. Ideally, there should be a trade balance rather than a surplus and the economy more driven by higher wages and a stronger currency boosting domestic demand by increasing people’s buying power, but East Asian governments are obsessed with boosting the fortunes of exporting companies first and foremost.

This is coming to haunt East Asian countries as it is a significant contributor to demographic collapse, with Japan having suffered from it for years. According to the CIA World Factbook the lowest birthrate in the world is in Taiwan, surpassing even South Korea, which came in second to last out of 227 countries and territories. China is probably even worse, but no one trusts their reported numbers and the CIA did not bother including them on the list.

Photo: Reuters

SUPPLY CHAINS IN THE SPOTLIGHT

Worldwide there are threats to Taiwanese trade. One crucial issue that few gave the slightest bit of thought to five years ago is now recognized as a big threat to Taiwan’s extreme dependency on supply chains.

Even prior to the pandemic, the “just-in-time” supply chain model pioneered by the Japanese was showing some signs of strain, but during the pandemic it became painfully obvious. Lockdowns at factories and ports — especially in China — led to damaging shortages around the world.

Photo: EPA-EFE

Then the challenges kept coming. In 2021 the container ship Ever Given, run by Taiwan’s Evergreen Line, ran aground in the Suez Canal, grinding all shipping through that key chokepoint to a halt for six days.

In February 2022 Russia invaded Ukraine, partially cutting off Ukrainian exports while sanctions cut off Russian trade with much of the world. While Ukrainian successes in hobbling the Russian Black Sea fleet and various agreements have partially restored Ukrainian exports, for a time energy, grain, fertilizer and various chemical and mineral prices sharply spiked.

Then drought hit the Panama Canal starting in November, 2022 cutting the number of ships able to traverse one of the world’s other key chokepoints. Only now — two years later — is shipping returning to normal. The drought was brought on by the El Nino weather system, but a changing climate could make this a more regular occurrence.

It gets worse. Following the brutal Hamas attack on Israel followed up with the brutal Israeli invasion of Gaza, Houthi rebels in Yemen began firing at ships passing through the Bab el-Mandeb Strait into the Red Sea, which hosts the Suez Canel at the other end. The Houthis claim that this was to put pressure on Israel to end their invasion.

TAIWAN’S FRAGILE SITUATION

All of this underscores the fragility of Taiwan’s extreme reliance on trade. It starts with inputs — Taiwan is a big importer of energy, food and raw materials. Without these, it would not be able to export much of anything, let alone keep the lights on.

While exports of relatively simple products like plastics, rubber and agriculture require relatively few imported inputs, most of Taiwan’s exports are enormously complex electronics and semiconductor products with extensive supply chains spanning the globe.

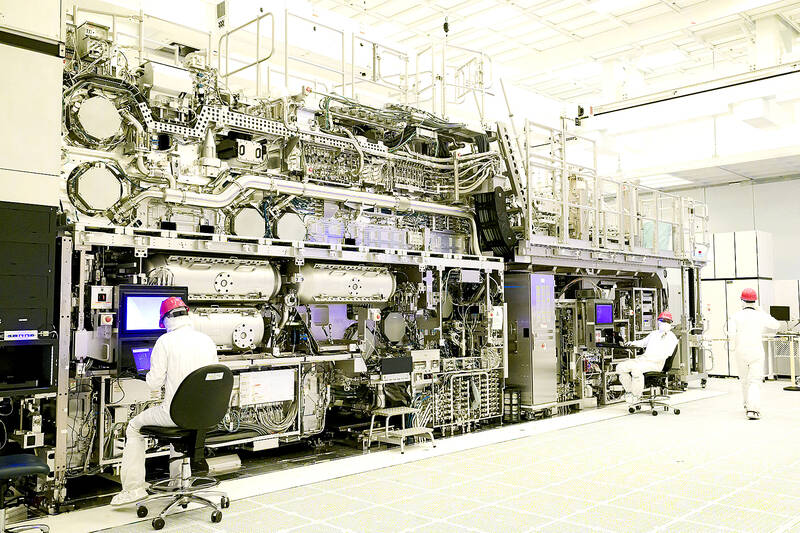

The semiconductor industry supply chain is extraordinarily complex, especially when suppliers of suppliers are accounted for, and can extend into the thousands or even tens of thousands. Once a Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) chip exits the fab, it still needs to be tested and packaged, often by ASE Technology Holding Co (日月光投控) in Kaohsiung.

Then the chip might be shipped off to a company like Hon Hai Precision Industry Co (鴻海精密), the world’s biggest electronics manufacturer, which has a complex worldwide supply chain of its own to assemble products powered with that TSMC chip, such as Apple iPhones. Meanwhile, Taiwanese shipping giants like Evergreen, Wan Hai Lines Ltd (萬海) and Yang Ming Marine Transport Corp (陽明) are all over the globe shuttling these bits and bobs needed to assemble the final product about.

TAIWAN BUSINESSES ADAPTING

Taiwan is in a more precarious position than most people realize. Overseas wars, sanctions, climate threats, a threatening neighbor and a series of looming tariff wars are all already causing problems.

TSMC needs, for example, neon gas to operate their Dutch-made ASML Holding NV lithography machines. Though the market has stabilized, Russia and Ukraine are big neon production centers and the war and sanctions sent prices soaring.

Russia is one of the world’s biggest exporters of oil, natural gas, gold and nitrogen-based fertilizers among other products, all of which Taiwan is heavily reliant on. The war caused prices for all to spike, regardless of whether an end client purchased from Russia or not.

These markets stabilized once supply chains shifted. For example, Russian oil intended for Europe rerouted to China and India, while the Middle East, Africa and North America increased supplies to Europe.

Batteries used in electronics are reliant on cobalt, 73 percent of which comes from the Democratic Republic of the Congo, which is periodically at war. China could at any point sever any number of supply chains Taiwan relies on.

Taiwanese firms are adapting as best they can. Moving factories to locations closer to end clients such as Mexico, or to friendlier nations like Vietnam or Thailand is only of limited use. It may help avoid risks associated with China, get around tariffs, reduce labor costs and reduce shipping costs of the finished product, but it does not change the fact that the supply chain still spans the globe.

Rerouting supply chains has become a necessity, and shipping has grown more costly through increased insurance fees, longer routes or having to pay extortion fees to the Houthis rebels — but at least for now shipping is still happening.

In some cases Taiwanese firms are adapting by acting unethically or outright illegally. Taiwan was Russia’s fifth-largest customer for coal earlier this year and Formosa Plastics continues to be a big customer. Instead of importing oil directly, Taiwan imported almost 114,000 barrels a day of Russian naphtha last month, which is a petroleum product.

Firms have also been getting around sanctions on Russia by exporting through third countries. These have included things essential to Russia’s war efforts, such as machine tools and even 20 percent of Russia’s nitrocellulose imports, which is a key component of smokeless gunpowder.

Donovan’s Deep Dives is a regular column by Courtney Donovan Smith (石東文) who writes in-depth analysis on everything about Taiwan’s political scene and geopolitics. Donovan is also the central Taiwan correspondent at ICRT FM100 Radio News, co-publisher of Compass Magazine, co-founder Taiwan Report (report.tw) and former chair of the Taichung American Chamber of Commerce. Follow him on X: @donovan_smith.

Jacques Poissant’s suffering stopped the day he asked his daughter if it would be “cowardly to ask to be helped to die.” The retired Canadian insurance adviser was 93, and “was wasting away” after a long battle with prostate cancer. “He no longer had any zest for life,” Josee Poissant said. Last year her mother made the same choice at 96 when she realized she would not be getting out of hospital. She died surrounded by her children and their partners listening to the music she loved. “She was at peace. She sang until she went to sleep.” Josee Poissant remembers it as a beautiful

For many centuries from the medieval to the early modern era, the island port of Hirado on the northwestern tip of Kyushu in Japan was the epicenter of piracy in East Asia. From bases in Hirado the notorious wokou (倭寇) terrorized Korea and China. They raided coastal towns, carrying off people into slavery and looting everything from grain to porcelain to bells in Buddhist temples. Kyushu itself operated a thriving trade with China in sulfur, a necessary ingredient of the gunpowder that powered militaries from Europe to Japan. Over time Hirado developed into a full service stop for pirates. Booty could

Before the last section of the round-the-island railway was electrified, one old blue train still chugged back and forth between Pingtung County’s Fangliao (枋寮) and Taitung (台東) stations once a day. It was so slow, was so hot (it had no air conditioning) and covered such a short distance, that the low fare still failed to attract many riders. This relic of the past was finally retired when the South Link Line was fully electrified on Dec. 23, 2020. A wave of nostalgia surrounded the termination of the Ordinary Train service, as these train carriages had been in use for decades

Lori Sepich smoked for years and sometimes skipped taking her blood pressure medicine. But she never thought she’d have a heart attack. The possibility “just wasn’t registering with me,” said the 64-year-old from Memphis, Tennessee, who suffered two of them 13 years apart. She’s far from alone. More than 60 million women in the US live with cardiovascular disease, which includes heart disease as well as stroke, heart failure and atrial fibrillation. And despite the myth that heart attacks mostly strike men, women are vulnerable too. Overall in the US, 1 in 5 women dies of cardiovascular disease each year, 37,000 of them