The job of any country's finance minister, when you come right down to it, is selling the economy.

Not only must he or she implement sound policies, but also convince the world theirs is a vibrant place to invest.

Philippine Finance Minister Jose Isidro Camacho is proving his worth, and then some, in that regard. He managed to convince the California Public Employees' Retirement System, the giant US state pension fund that in February decided to withdraw from four Asian countries, to stay put. While it's still pulling out of Indonesia, Malaysia and Thailand, Calpers will remain engaged in the Philippines.

Calpers claims it was all a misunderstanding -- a clerical error. Perhaps that's even true. If so, it's frightening that an outfit investing US$151 billion around the globe could make such a colossal blunder -- one that slammed stock markets around the continent.

Yet Philippine officials also influenced the reversal. Anyone who's spent time with Camacho understands the power of his sales pitch. The 46-year-old is bright, animated and, more importantly, he's got a point. After a revolving door of corrupt and ineffective governments, the Philippines suddenly has one that seems to get it. And one that's working to stabilize an economy neglected for decades.

"The point is, we've managed to restore calm after many years of chaos," Camacho said in an interview in Manila in late February. "Now, however, the real work begins, and there's much to do." Much, indeed. For all the good macroeconomic news -- like 3.8 percent growth -- no one should be under any illusions that the Philippine government doesn't have tons to do, especially at the micro level. Non-performing loans are undermining the banking system, while living standards are stagnant. Crushing poverty afflicts over 40 percent of Filipinos, while widespread crime casts a pall of insecurity over all socioeconomic groups.

Highly publicized kidnappings of executives, meanwhile, are hurting Manila's reputation with companies that create jobs. The risk of violence at the hands of rebels like the Abu Sayyaf, a Muslim kidnap-for-ransom group, in the southern Philippines is slamming the tourist industry. It's also spooking investors, who worry that high poverty rates make this a natural breeding ground for terrorist groups. Hence, the recent arrival of US troops.

The Philippine economy looks OK from the top down, but the bottom-up view is far less attractive. Too much debt, too little tax collection, unsteady transparency, underdeveloped capital markets, corruption and nepotism, etc. While President Gloria Macapagal Arroyo is working to boost tax receipts, there's concern in Manila her government isn't going after the really big fish.

Calpers said its initial decision to withdraw from the Philippines and three other Asian economies reflected concerns about financial transparency, human rights and labor conditions.

What rattled investors was that, at the time, Calpers held US$25 million of Philippine stock. The Philippines Stock Exchange Composite Index dropped 7.7 percent between the time Calpers said it was pulling out and its reverse course this week.

Back in February, Calpers seemed to be looking at Southeast Asia in pre-1997 terms. In the years before and after the Asian crisis, investors grouped the region's nations together. More recently, however, markets have viewed the economies independently. Even if investors steer clear of Indonesia or Malaysia, they may be putting money in Thailand. Calpers' decision to stay in the Philippines is a recognition of that phenomenon.

In retrospect, "the initial decision was a little odd considering that the Philippines never really conformed to the generalization under which Calpers lumped Thailand, Indonesia and Malaysia," analysts at IDEAglobal, a New York-based financial analysis company wrote Tuesday. Proving that point, they argued, the peso has risen versus the US dollar and investors have snapped up Philippine debt since the Calpers announcement.

For all the risks, though, investors may regret taking the Philippines off their radar screens. It may seem a contrarian suggestion, particularly when speaking about an economy as challenged and unpredictable as the Philippines. Yet the breadth of behind-the-scenes work taking place there to stabilize the economy is remarkable.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

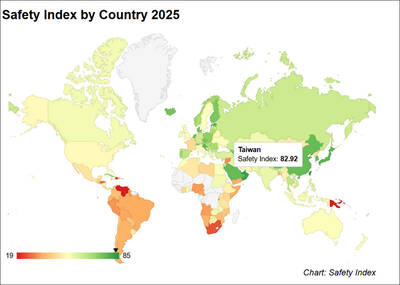

Taiwan was ranked the fourth-safest country in the world with a score of 82.9, trailing only Andorra, the United Arab Emirates and Qatar in Numbeo’s Safety Index by Country report. Taiwan’s score improved by 0.1 points compared with last year’s mid-year report, which had Taiwan fourth with a score of 82.8. However, both scores were lower than in last year’s first review, when Taiwan scored 83.3, and are a long way from when Taiwan was named the second-safest country in the world in 2021, scoring 84.8. Taiwan ranked higher than Singapore in ninth with a score of 77.4 and Japan in 10th with

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary