Hewlett-Packard Co Chief Executive Carly Fiorina may be facing the beginning of the end of her tenure, investors said, as the family of co-founder William Hewlett promised to vote against the acquisition that is the cornerstone of her turnaround plans.

After a 27 percent stock slide since Fiorina unveiled plans to buy Compaq Computer Corp for US$21.4 billion, the Hewlett family and a related foundation, which own about 5 percent of the company's shares, Tuesday said they opposed the deal. The stock rose 17 percent on the news, its biggest jump in at least 20 years.

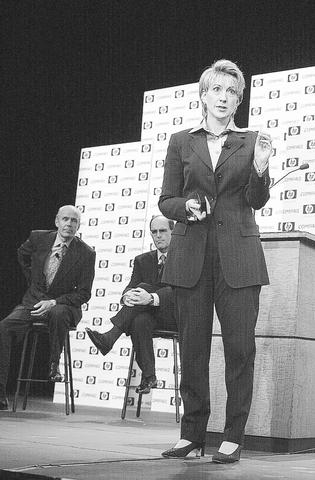

PHOTO: BLOOMBERG

Fiorina, 47, already stood on shaky ground with investors, who have complained for a year about missed sales targets and a lack of focus. Many say she hasn't done a good job selling the acquisition. If the emotional weight of the Hewlett family's decision sways other wary shareholders, the purchase may fall apart. If that happens, investors don't expect Fiorina to last much longer.

"If it doesn't go through, I think there is a new CEO," said David Katz, chief investment officer of Matrix Asset Advisors, who opposes the deal and last month urged the companies to drop the acquisition. "It really opens the door for the boards to re-review the transaction."

On Tuesday, company director Walter Hewlett, his sisters Eleanor Hewlett Gimon and Mary Hewlett Jaffe, and the William Hewlett Revocable Trust said they intend to vote their stake against the acquisition. Together with the William and Flora Hewlett Foundation, they own more than 100 million Hewlett-Packard shares.

Buying Compaq would boost Hewlett-Packard's position in the personal-computer market, where annual sales are forecast to fall for the first time in more than 15 years. The Palo Alto company is worth more on its own, Walter Hewlett said.

Fiorina, who built her reputation as a star saleswoman at Lucent Technologies Inc, has had a mixed track record at Hewlett-Packard since arriving in July 1999. She won kudos early on for rejuvenating the sales force and forging closer ties between divisions. Lately, she's been criticized for not cutting costs fast enough or introducing new products quickly.

Her credibility has been questioned. In last year's fiscal fourth quarter, she missed her earnings targets by US$0.10 a share, and then chopped her profit estimates mid-quarter for three straight periods.

For the quarter that just ended, she didn't even give a formal forecast.

Last year, she considered buying PricewaterhouseCoopers LLC's consulting arm for as much as US$18 billion, then abandoned those plans, leaving investors wondering about her strategy.

"It's difficult for Carly to point to anything in her career as CEO as an accomplishment," said Bob Sutherland, an analyst at Technology Business Research Inc who doesn't own the stock.

Then came Compaq. After the acquisition was announced Sept. 3, Fiorina touted new services capabilities, broader product offerings in server computers and a well-rounded company that could mount a bigger challenge to International Business Machines Corp.

Investors quickly made their feelings known. The stock slid 19 percent the following day -- the biggest drop since 1987 -- and still hasn't fully recovered, even with Tuesday's jump. Compaq shares fell 5.5 percent Tuesday and are trading at their lowest levels since 1996.

"Shareholders are getting restless," said Bruce Raabe, chief investment officer of Collins & Co, which oversees US$500 million, including 150,000 Hewlett-Packard shares. "H-P leadership has not convinced the public."

Shareholders say they're not convinced Hewlett-Packard will get enough out of this purchase to make it worth the risk. With Compaq, they'd be absorbing a company that tried to reorganize three times in two years while losing its lead in the global PC and US server markets to Dell Computer Corp.

Hewlett-Packard would lose a lot of time trying to figure out how to combine with Compaq, and is worth more on its own, said Walter Hewlett.

"The extensive integration associated with this transaction is not worth taking," he said. "The merger would distract Hewlett-Packard management and employees."

It gets worse for Fiorina. Investors said that even if the purchase is completed, they're not sure she's up to the challenge of running such a big company.

"I haven't seen enough out of H-P to give me confidence in Carly," said Chris Ely, a fund manager with Loomis Sayles & Co, which manages about US$65 billion. "She's taken a couple of steps where she's stumbled." Hewlett-Packard has reiterated several times that the board supports Fiorina and this purchase. Fiorina has been adamant that she will submit the deal for shareholders to decide, regardless of how low the stock slipped.

"We're not going to back off this deal prior to a shareowner vote," Fiorina said in an October interview. "Period." Still, her support appears to be cracking now.

Walter Hewlett said he's planning to call each of the eight other board members and discuss his feelings. If he wins them over -- or convinces the Packard family foundation to join him -- it would be tough for Fiorina to recover.

The two families account for 15 percent of the outstanding stock and still command the respect of other investors. The foundation started by David Packard, who founded the company with William Hewlett in a Palo Alto garage in 1939, is the company's largest shareholder. A spokeswoman said yesterday the foundation hasn't decided how it will vote.

"They carry a lot of weight with their opinion," Collins & Co's Raabe said. "This will change the way the vote shakes out, absolutely."

LONG FLIGHT: The jets would be flown by US pilots, with Taiwanese copilots in the two-seat F-16D variant to help familiarize them with the aircraft, the source said The US is expected to fly 10 Lockheed Martin F-16C/D Block 70/72 jets to Taiwan over the coming months to fulfill a long-awaited order of 66 aircraft, a defense official said yesterday. Word that the first batch of the jets would be delivered soon was welcome news to Taiwan, which has become concerned about delays in the delivery of US arms amid rising military tensions with China. Speaking on condition of anonymity, the official said the initial tranche of the nation’s F-16s are rolling off assembly lines in the US and would be flown under their own power to Taiwan by way

CHIP WAR: The new restrictions are expected to cut off China’s access to Taiwan’s technologies, materials and equipment essential to building AI semiconductors Taiwan has blacklisted Huawei Technologies Co (華為) and Semiconductor Manufacturing International Corp (SMIC, 中芯), dealing another major blow to the two companies spearheading China’s efforts to develop cutting-edge artificial intelligence (AI) chip technologies. The Ministry of Economic Affairs’ International Trade Administration has included Huawei, SMIC and several of their subsidiaries in an update of its so-called strategic high-tech commodities entity list, the latest version on its Web site showed on Saturday. It did not publicly announce the change. Other entities on the list include organizations such as the Taliban and al-Qaeda, as well as companies in China, Iran and elsewhere. Local companies need

CRITICISM: It is generally accepted that the Straits Forum is a CCP ‘united front’ platform, and anyone attending should maintain Taiwan’s dignity, the council said The Mainland Affairs Council (MAC) yesterday said it deeply regrets that former president Ma Ying-jeou (馬英九) echoed the Chinese Communist Party’s (CCP) “one China” principle and “united front” tactics by telling the Straits Forum that Taiwanese yearn for both sides of the Taiwan Strait to move toward “peace” and “integration.” The 17th annual Straits Forum yesterday opened in Xiamen, China, and while the Chinese Nationalist Party’s (KMT) local government heads were absent for the first time in 17 years, Ma attended the forum as “former KMT chairperson” and met with Chinese People’s Political Consultative Conference Chairman Wang Huning (王滬寧). Wang

OBJECTS AT SEA: Satellites with synthetic-aperture radar could aid in the detection of small Chinese boats attempting to illegally enter Taiwan, the space agency head said Taiwan aims to send the nation’s first low Earth orbit (LEO) satellite into space in 2027, while the first Formosat-8 and Formosat-9 spacecraft are to be launched in October and 2028 respectively, the National Science and Technology Council said yesterday. The council laid out its space development plan in a report reviewed by members of the legislature’s Education and Culture Committee. Six LEO satellites would be produced in the initial phase, with the first one, the B5G-1A, scheduled to be launched in 2027, the council said in the report. Regarding the second satellite, the B5G-1B, the government plans to work with private contractors