Prices of gasoline and diesel at domestic fuel stations are to rise NT$0.2 and NT$0.3 per liter respectively this week after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday.

International crude oil prices last week snapped a two-week losing streak as US President Donald Trump’s administration announced agreements with the EU and a number of other trading partners over the week, boosting market optimism that an economic slowdown could be avoided and raising hopes for oil demand, CPC said.

As Trump stepped up pressure on Russia to reach a ceasefire agreement with Ukraine — threatening to impose “secondary tariffs” on countries that buy Russian oil — market concerns grew over potential disruptions to Russian supply, pushing up international crude oil prices last week, Formosa said.

Front-month Brent crude oil futures — the international oil benchmark — last week rose 2.97 percent to settle at US$69.67 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — gained 3.33 percent to US$67.33 per barrel on the New York Mercantile Exchange.

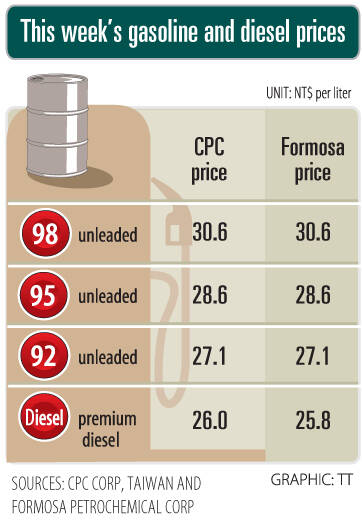

Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.1, NT$28.6 and NT$30.6 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements.

Premium diesel is to cost NT$26 per liter at CPC stations and NT$25.8 at Formosa pumps, they added.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”

ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip assembly and testing service provider, yesterday said it would boost equipment capital expenditure by up to 16 percent for this year to cope with strong customer demand for artificial intelligence (AI) applications. Aside from AI, a growing demand for semiconductors used in the automotive and industrial sectors is to drive ASE’s capacity next year, the Kaohsiung-based company said. “We do see the disparity between AI and other general sectors, and that pretty much aligns the scenario in the first half of this year,” ASE chief operating officer Tien Wu (吳田玉) told an