Prices of gasoline and diesel products at domestic fuel stations are to rise by NT$0.1 per liter this week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday, despite international crude oil prices posting a weekly decline due to trade tensions that have raised concerns over global oil demand.

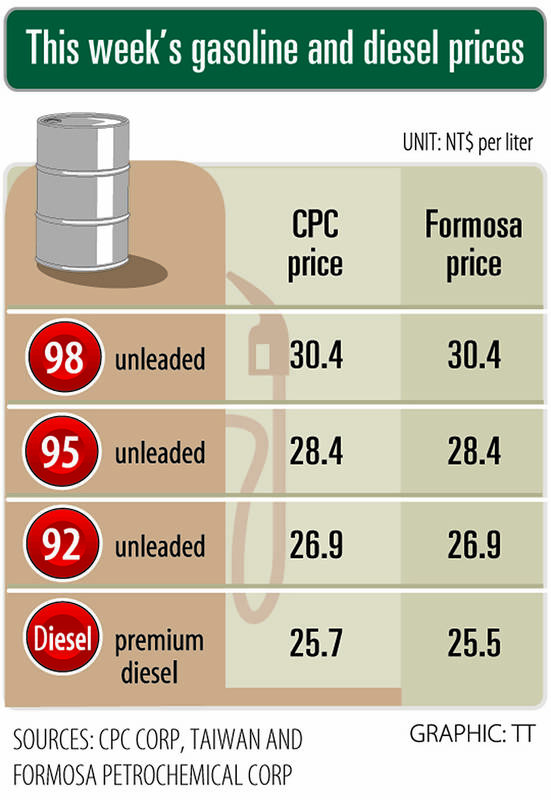

Gasoline prices at CPC and Formosa stations are to rise to NT$26.9, NT$28.4 and NT$30.4 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements.

Premium diesel is to cost NT$25.7 per liter at CPC stations and NT$25.5 at Formosa pumps, they added.

The companies’ price adjustments were against market trends, as international crude oil prices fell for a second consecutive week last week after the market reacted to a mixed bag of factors.

While developments such as a bigger-than-expected decline in US crude oil inventories in the week ending on July 18, the continued escalation of US-EU trade tensions, and Russian plans to reduce gasoline exports had brightened market sentiment slightly, this optimism was largely dented by traders’ expectation that the EU’s new round of sanctions against Moscow would be unable to effectively restrict the country’s crude oil supply.

Front-month Brent crude oil futures — the international oil benchmark — last week fell 1.21 percent to settle at US$68.44 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — lost 1.35 percent to US$65.16 per barrel on the New York Mercantile Exchange.

ELECTRONICS BOOST: A predicted surge in exports would likely be driven by ICT products, exports of which have soared 84.7 percent from a year earlier, DBS said DBS Bank Ltd (星展銀行) yesterday raised its GDP growth forecast for Taiwan this year to 4 percent from 3 percent, citing robust demand for artificial intelligence (AI)-related exports and accelerated shipment activity, which are expected to offset potential headwinds from US tariffs. “Our GDP growth forecast for 2025 is revised up to 4 percent from 3 percent to reflect front-loaded exports and strong AI demand,” Singapore-based DBS senior economist Ma Tieying (馬鐵英) said in an online briefing. Taiwan’s second-quarter performance beat expectations, with GDP growth likely surpassing 5 percent, driven by a 34.1 percent year-on-year increase in exports, Ma said, citing government

‘REMARKABLE SHOWING’: The economy likely grew 5 percent in the first half of the year, although it would likely taper off significantly, TIER economist Gordon Sun said The Taiwan Institute of Economic Research (TIER) yesterday raised Taiwan’s GDP growth forecast for this year to 3.02 percent, citing robust export-driven expansion in the first half that is likely to give way to a notable slowdown later in the year as the front-loading of global shipments fades. The revised projection marks an upward adjustment of 0.11 percentage points from April’s estimate, driven by a surge in exports and corporate inventory buildup ahead of possible US tariff hikes, TIER economist Gordon Sun (孫明德) told a news conference in Taipei. Taiwan’s economy likely grew more than 5 percent in the first six months

SMART MANUFACTURING: The company aims to have its production close to the market end, but attracting investment is still a challenge, the firm’s president said Delta Electronics Inc (台達電) yesterday said its long-term global production plan would stay unchanged amid geopolitical and tariff policy uncertainties, citing its diversified global deployment. With operations in Taiwan, Thailand, China, India, Europe and the US, Delta follows a “produce at the market end” strategy and bases its production on customer demand, with major site plans unchanged, Delta president Simon Chang (張訓海) said on the sidelines of a company event yesterday. Thailand would remain Delta’s second headquarters, as stated in its first-quarter earnings conference, with its plant there adopting a full smart manufacturing system, Chang said. Thailand is the firm’s second-largest overseas

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market value closed above US$1 trillion for the first time in Taipei last week, with a raised sales forecast driven by robust artificial intelligence (AI) demand. TSMC saw its Taiwanese shares climb to a record high on Friday, a near 50 percent rise from an April low. That has made it the first Asian stock worth more than US$1 trillion, since PetroChina Co (中國石油天然氣) briefly reached the milestone in 2007. As investors turned calm after their aggressive buying on Friday, amid optimism over the chipmaker’s business outlook, TSMC lost 0.43 percent to close at NT$1,150