Prices of gasoline and diesel products at domestic fuel stations are this week to rise NT$0.4 per liter, even though international crude oil prices posted a weekly decline following a ceasefire agreement between Israel and Iran, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday.

The companies’ moves were against market trends, as international crude oil prices fell sharply last week, ending three straight weeks of gains, with market attention shifting back to economic fundamentals from the geopolitical risk premium.

Front-month Brent crude oil futures — the international oil benchmark — last week plunged 12 percent to settle at US$67.77 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — lost 11.27 percent to US$65.52 per barrel on the New York Mercantile Exchange.

CPC said it calculates its weekly fuel prices based on a weighted oil price formula that comprises 70 percent Dubai crude and 30 percent Brent.

Based on that mechanism, CPC’s gasoline and diesel prices should have increased by NT$0.8 and NT$0.5 per liter respectively this week.

However, CPC stated said it would absorb the cost changes to comply with a government policy of keeping domestic fuel prices lower than those in major neighboring markets, while Formosa followed CPC’s lead, taking into account global oil market trends, the exchange rate for the New Taiwan dollar and intense competition in the domestic market.

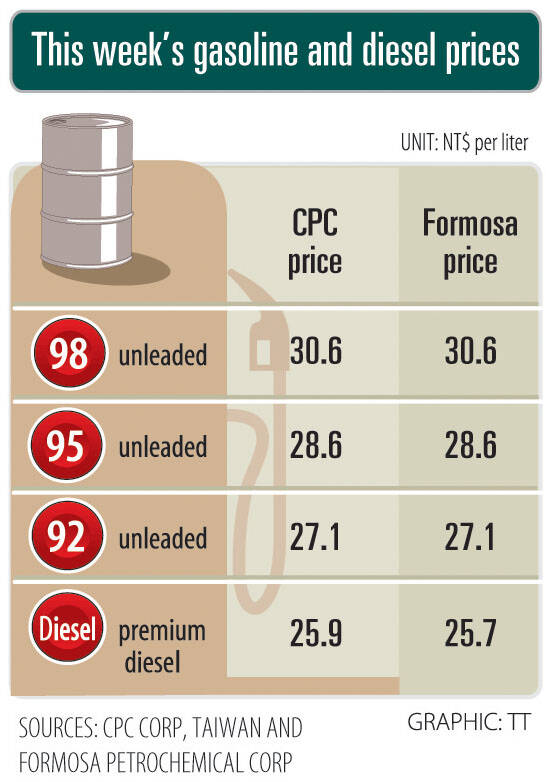

Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.1, NT$28.6 and NT$30.6 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$25.9 per liter at CPC stations and NT$25.7 at Formosa pumps, the companies said.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

RESHAPING COMMERCE: Major industrialized economies accepted 15 percent duties on their products, while charges on items from Mexico, Canada and China are even bigger US President Donald Trump has unveiled a slew of new tariffs that boosted the average US rate on goods from across the world, forging ahead with his turbulent effort to reshape international commerce. The baseline rates for many trading partners remain unchanged at 10 percent from the duties Trump imposed in April, easing the worst fears of investors after the president had previously said they could double. Yet his move to raise tariffs on some Canadian goods to 35 percent threatens to inject fresh tensions into an already strained relationship, while nations such as Switzerland and New Zealand also saw increased