Aspeed Technology Inc (信驊), which supplies baseboard management controls (BMC) for servers powered by Nvidia Corp chips, gave a positive outlook for this year, expecting revenue to expand annually by a double-digit percentage on the back of relentless growth in server demand.

The upbeat forecast comes amid concern about the sustainability of the artificial intelligence (AI) boom, which is usually gauged by capital expenditure plans by the world’s major cloud service providers (CSP), including Amazon.com Inc, Microsoft Corp and Google.

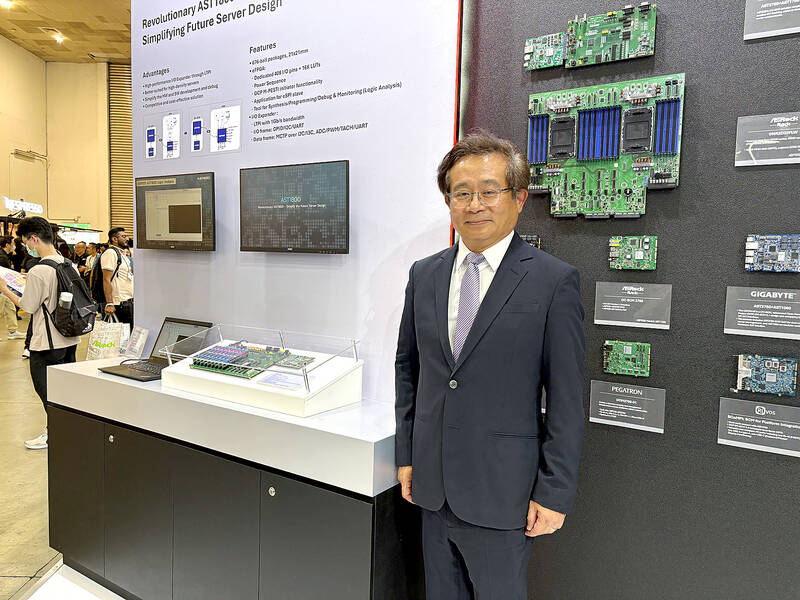

“The world’s major CSPs are spending [on server deployment] as normal in the third quarter,” Aspeed chairman Chris Lin (林鴻明) told reporters at the company’s booth at the Computex trade show in Taipei on Wednesday.

Photo: Lisa Wang, Taipei Times

“The tariffs issue apparently did not slow down their progress,” Lin said, referring to trade policies introduced by US President Donald Trump.

“Aside from AI servers, they are also adding general-purpose servers this year to help share workloads on cost consideration,” he said.

“This is quite different from what they did before,” he added.

Server deployments are boosting demand for Aspeed’s BMCs, Lin said.

An AI server powered by Nvidia’s latest GB300 NVL72 typically has 71 BMCs, similar to the server racks powered by previous-generation GB200 chips, but a dramatic increase from 15 BMCs used in server racks powered by H100 chips, which are two generations prior to the GB300, Aspeed said.

“A lot of rush orders have poured in over the past four months, significantly lifting the company’s book-to-bill ratio last month and this month,” Lin said. “Customers seem to have gained control over tariff issues and marketplace uncertainty.”

Greater demand prompted Aspeed to hike its revenue forecast for this quarter to NT$2 billion (US$66.51 million), up from its earlier estimate of at least NT$1.7 billion.

The company has factored in the 6 percent that the New Taiwan dollar gained against the US dollar.

“The third quarter is also shaping up well, although visibility in the fourth quarter is low,” Lin said.

For the whole year of this year, Aspeed expects revenue to grow by at least a double-digit percentage to an all-time high.

The company generated NT$6.46 billion in revenue last year, more than double from 2023.

BMCs would make up 80 percent of the company’s total revenue this year, Lin said.

Gross margin this year would be 65 or 66 percent, up from 64.3 percent last year, Lin said.

Aspeed posted net profit of NT$887 million last quarter, more than double the NT$391 million in the first quarter last year, but down 5.95 percent from NT$943 million a quarter earlier.

Earnings per share rose to NT$23.46 last quarter from NT$10.36 percent a year earlier and down from NT$24.95 a quarter earlier.

Aspeed at Computex is showcasing its new AST1800 chip, a versatile I/O expander chip designed to complement its AST2700 series BMCs.

The new chip enhances system capabilities by providing additional I/O expansion options, the firm said.

Its AST2700 BMC, which was unveiled at Computex last year, would enter volume production in the first quarter of next year.

The chip would be made using Taiwan Semiconductor Manufacturing Co’s (台積電) 12-nanometer technology, Aspeed said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the