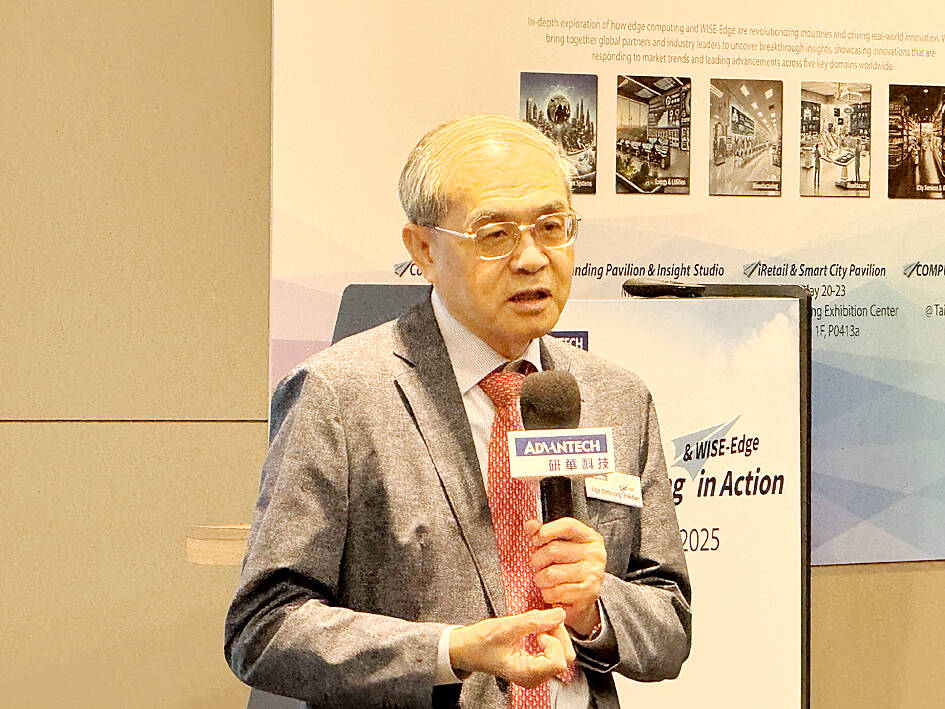

Advantech Co (研華) chairman K.C. Liu (劉克振) yesterday said that a surge in the New Taiwan dollar would affect the embedded computer module and industrial motherboard maker’s revenue and earnings per share.

“The company’s revenue would see a bearable decrease, and as we would calculate it by the NT dollar, our earnings per share and share price might fall a bit as well, but we will earn that loss back from other sectors,” Liu said at a news conference in Taoyuan.

Advantech mainly conducts transactions with US dollars in overseas markets but uses the NT dollar as the reporting currency in its financial statements. Therefore, an appreciation of about 3 to 5 percent in the NT dollar would definitely result in foreign exchange losses and affect the company's profits, but the outcome is bearable, he said.

Photo: CNA

The NT dollar traded at NT$30.145 against the US dollar yesterday, gaining 2.96 percent. It has risen 5.85 percent against the greenback over the past two sessions.

Asked about the potential impact of US tariffs, he said the company would share the costs with clients and partly absorb them.

The US tariff rate for Taiwanese goods might not be as high as 32 percent, and it might be 15 to 20 percent instead, so it would not be a crisis for the company, he added.

Taiwan-made industrial computers are difficult to replace, and the tariff uncertainty would eventually pass, so the situation is not critical, Liu said.

However, to cope with the predictable revenue decline, Advantech would continue to work on the application of cutting-edge artificial intelligence (AI) and software systems to provide higher value for clients, he said.

Advantech is building new factories in southern California, where half the land has been reserved for future expansion, he said.

The company has set up plants in northern California for 20 years to assemble large system products, he added.

Some of the company’s board members have urged Advantech to set up surface mount technology (SMT) plants in the US to avoid high import levies, Liu said.

However, setting up SMT plants in the US would require taking labor, cost and flexibility into consideration, while the complex, low-volume and diverse nature of SMT production would also require sending experienced supervisors abroad, inevitably increasing expenses, he added.

Looking ahead, amid rising demand for edge AI computing and artificial intelligence of things, Advantech could expand its presence in the smart factories and energy as well as retail and hospitality sectors, he said.

The company is to showcase edge AI applications at the Computex Taipei trade show from May 20 to 23, including autonomous robots, robotic arms and service robots developed with partners, he added.

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Taiwan’s property market is entering a freeze, with mortgage activity across the nation’s six largest cities plummeting in the first quarter, H&B Realty Co (住商不動產) said yesterday, citing mounting pressure on housing demand amid tighter lending rules and regulatory curbs. Mortgage applications in Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung totaled 28,078 from January to March, a sharp 36.3 percent decline from 44,082 in the same period last year, the nation’s largest real-estate brokerage by franchise said, citing data from the Joint Credit Information Center (JCIC, 聯徵中心). “The simultaneous decline across all six cities reflects just how drastically the market

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer