The industrial production index last month expanded 13.65 percent annually to 106.1, reaching a three-month high, while also increasing 11.95 percent annually in the first quarter, as demand for artificial intelligence (AI) and high-performance computing (HPC) applications remained robust, the Ministry of Economic Affairs said yesterday.

The manufacturing production

index, the major pillar of the industrial production index, last month climbed 14.71 percent year-on-year to 106.89, marking a 13th consecutive month of expansion, and grew 12.79 percent annually in the first quarter, the ministry said.

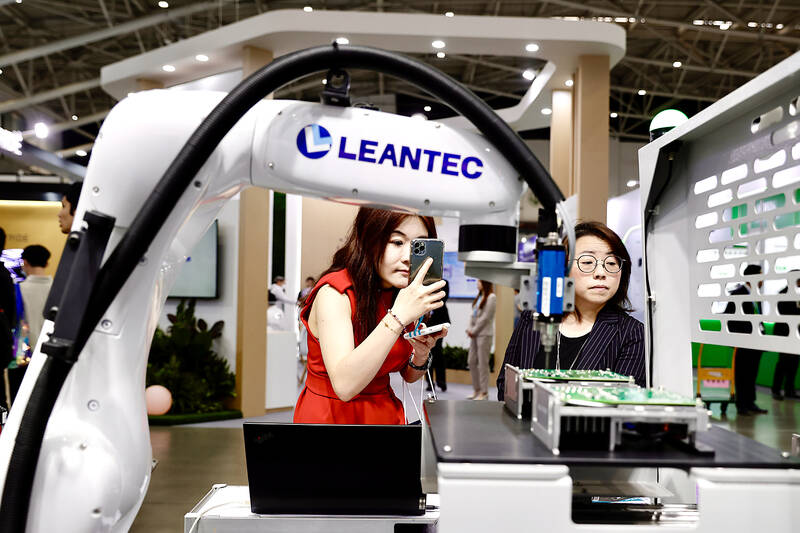

Photo: RITCHIE B. TONGO, EPA-EFE

The manufacturing production index next month is expected to rise between 14.4 percent and 19 percent annually, Department of Statistics Deputy Director-General Huang Wei-jie (黃偉傑) told a news conference in Taipei.

“Although we’re still unsure how the US tariffs on Taiwanese goods will be in the future, the growth in the AI sector has yet to slow down. Our forecast for the industry is still highly positive,” Huang said.

Production of electronic components grew 20.39 percent in the first quarter from a year earlier, as the AI and HPC businesses remained strong, the ministry said.

Semiconductor production in the first quarter expanded 24.19 percent from a year earlier, thanks to steady demand for 12-inch wafers, chip designing, testing and packaging services, and flat panels, the ministry added.

The sharp increase in semiconductor production was partially related to front-loading demand by US clients ahead of US President Donald Trump’s tariffs on Taiwanese semiconductors, Huang said.

Production of computers, electronic goods and optical components in the first quarter surged 27.08 percent on the back of strong demand for AI applications, cloud services, servers, semiconductor equipment and phone lenses, the ministry said.

Machinery equipment production rose 10.59 percent in the first quarter, due to plans to expand production capacity by leading chip companies, which boosted the need for related equipment, it said.

In contrast, production of automotive products decreased 11.18 percent in the first quarter due to a decline in orders.

“When domestic vehicle inventory declines, the demand for related auto components also tends to decrease,” Huang said. “Competition from foreign automakers also played a significant role in the output decline.”

Production of base metals, including steel, sank 7.11 percent in the first quarter from the same period last year due to disruptions in the global steel recovery, with some manufacturers suspending operations to repair and maintain production equipment, the ministry said.

Output in chemical materials and fertilizers dropped 2.63 percent during the period, as some production lines were also temporarily shut down for maintenance or cut due to to weak demand, it said.

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

With an approval rating of just two percent, Peruvian President Dina Boluarte might be the world’s most unpopular leader, according to pollsters. Protests greeted her rise to power 29 months ago, and have marked her entire term — joined by assorted scandals, investigations, controversies and a surge in gang violence. The 63-year-old is the target of a dozen probes, including for her alleged failure to declare gifts of luxury jewels and watches, a scandal inevitably dubbed “Rolexgate.” She is also under the microscope for a two-week undeclared absence for nose surgery — which she insists was medical, not cosmetic — and is

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

Alchip Technologies Ltd (世芯), an application-specific integrated circuit (ASIC) designer specializing in artificial-intelligence (AI) chips, yesterday said that small-volume production of 3-nanometer (nm) chips for a key customer is on track to start by the end of this year, dismissing speculation about delays in producing advanced chips. As Alchip is transitioning from 7-nanometer and 5-nanometer process technology to 3 nanometers, investors and shareholders have been closely monitoring whether the company is navigating through such transition smoothly. “We are proceeding well in [building] this generation [of chips]. It appears to me that no revision will be required. We have achieved success in designing