The US Department of Commerce’s announcement that it would impose a fresh round of sanctions on exports to China by major US artificial intelligence (AI) chip designers is expected to harm suppliers, including those in Taiwan, analysts said on Wednesday.

The department this week announced new export licensing requirements for Nvidia Corp’s H20 and Advanced Micro Devices Inc’s (AMD) MI308 chips, which are critical to AI development.

The new US licensing requirements would further hamper Nvidia and AMD, while Taiwanese suppliers to the two companies would also be affected, Taiwan Industry Economics Services researcher Arisa Liu (劉佩真) said.

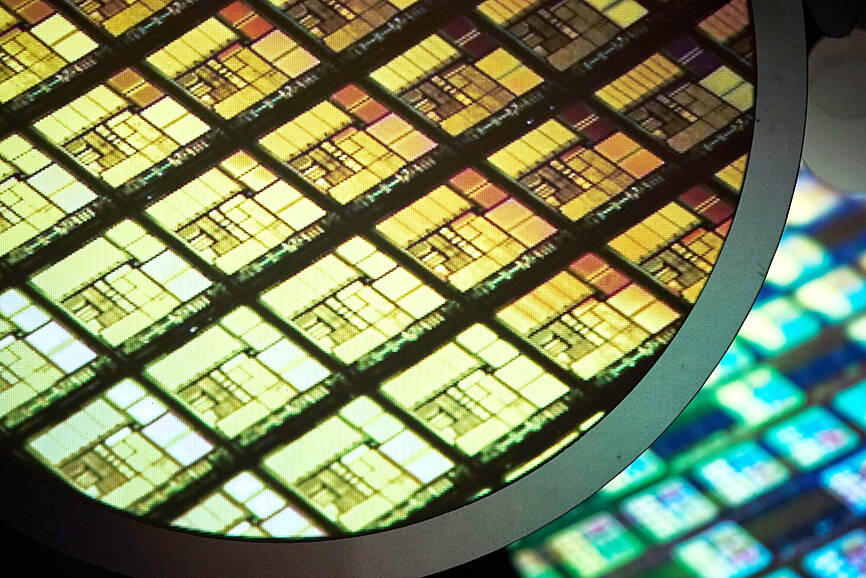

Photo: An Rong Xu, Bloomberg

The Taiwanese companies most likely to be affected include AI server makers such as Inventec Corp (英業達) and Mitac Holdings Corp (神達控股), which supply Chinese cloud service providers such as Baidu Inc (百度), Alibaba Group Holding Ltd (阿里巴巴) and Tencent Holdings Ltd (騰訊), local news reports said yesterday.

An industry expert, speaking on condition of anonymity, on Wednesday called the latest sanctions “ridiculous,” as the H20 and MI308 chips were designed to comply with US restrictions on exports to China.

China is unlikely to be heavily affected by the sanctions in the short term, as many Chinese buyers have reportedly built up large inventories of H20 and MI308 chips, the expert said.

The US’ move to further restrict chip exports to China would prompt Chinese chipmakers to speed up production of chips similar to those made in the US, they added.

Citing the example of Huawei Technologies Co’s (華為) Ascend 910B processor, which is close to Nvidia’s H20 in terms of efficiency, the expert said that such efforts could accelerate China’s progress toward semiconductor self-sufficiency.

Therefore, the sanctions are likely to bolster China’s chip industry, which would not only harm Nvidia and AMD, but also their Taiwanese suppliers, they said.

On Tuesday, Nvidia said it would book a quarterly charge of about US$5.5 billion tied to restrictions on exports of its H20 graphics processing units to China and other destinations, while AMD on Wednesday said it would see charges of about US$800 million related to the sales restrictions imposed on its MI308 units.

Nvidia CEO Jensen Huang (黃仁勳) yesterday said that China is an important market for Nvidia.

“We hope to continue to cooperate with China,” Huang said in a meeting with Ren Hongbin (任鴻斌), head of the China Council for the Promotion of International Trade, state broadcaster China Central Television reported.

Huang arrived in Beijing earlier in the day at the invitation of the trade organization.

Additional reporting by Reuters

With an approval rating of just two percent, Peruvian President Dina Boluarte might be the world’s most unpopular leader, according to pollsters. Protests greeted her rise to power 29 months ago, and have marked her entire term — joined by assorted scandals, investigations, controversies and a surge in gang violence. The 63-year-old is the target of a dozen probes, including for her alleged failure to declare gifts of luxury jewels and watches, a scandal inevitably dubbed “Rolexgate.” She is also under the microscope for a two-week undeclared absence for nose surgery — which she insists was medical, not cosmetic — and is

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

CHIP DUTIES: TSMC said it voiced its concerns to Washington about tariffs, telling the US commerce department that it wants ‘fair treatment’ to protect its competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reiterated robust business prospects for this year as strong artificial intelligence (AI) chip demand from Nvidia Corp and other customers would absorb the impacts of US tariffs. “The impact of tariffs would be indirect, as the custom tax is the importers’ responsibility, not the exporters,” TSMC chairman and chief executive officer C.C. Wei (魏哲家) said at the chipmaker’s annual shareholders’ meeting in Hsinchu City. TSMC’s business could be affected if people become reluctant to buy electronics due to inflated prices, Wei said. In addition, the chipmaker has voiced its concern to the US Department of Commerce