Hong Kong and Singapore are the front-runners in a push by Asian governments to become cryptocurrency hubs as they look to capitalize on the global resurgence of the sector thanks to the support of US President Donald Trump.

Bitcoin recently hit a record of close to US$110,000 while others have also rallied on the back of Trump’s pro-crypto promises. With forecasts that they could rise further, governments are keen to get a piece of the action.

Hong Kong regulators said on Wednesday that the city needed to tap “global liquidity” and laid out plans including the possibility of offering riskier crypto products such as derivative trading and margin financing. “The one word that we need to think about always is liquidity,” Hong Kong Securities and Futures Commission (SFC) executive director Eric Yip (葉志衡) said at an industry conference in the financial hub.

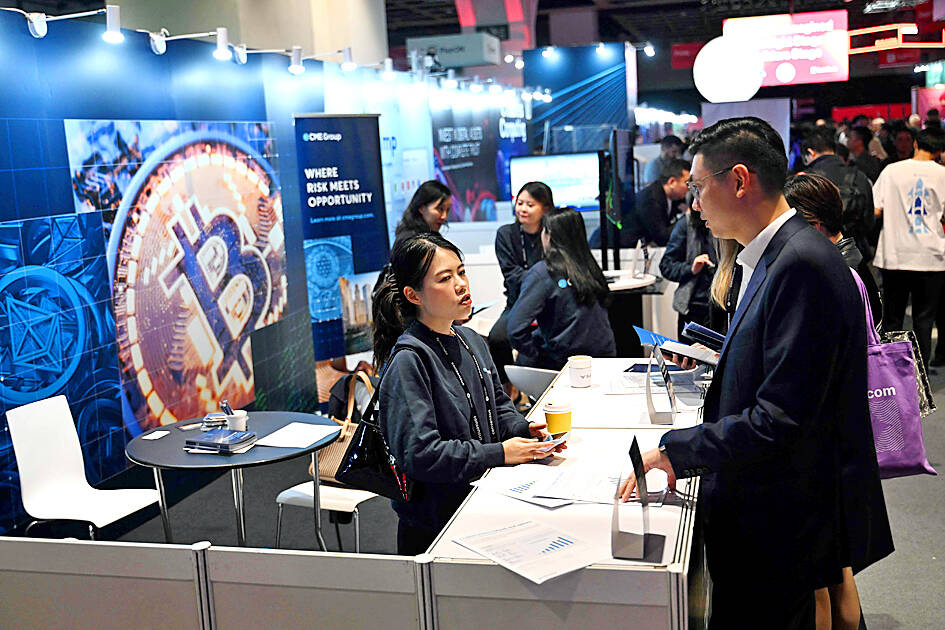

Photo: Peter Parks, AFP

“How do you bring liquidity to this market, hence commercial value, hence ecosystem?”

The collapse of exchange FTX in 2022 took along with it around US$8 billion from customers who used it to buy, sell and store cryptocurrencies.

The funds were later recovered, but regulators around the world are anxious to avoid a repeat, and the sector has since moved away from its freewheeling, anti-establishment origins to embrace regulation.

Officials stress the need for investor protection while still hoping their rules will be business-friendly.

“There was a lot more scrutiny two or three years (ago), right after FTX... (Regulators) want to make sure that they do the proper due diligence,” cryptocurrency exchange OKX (歐易) president Hong Fang (洪方) said.

Officials in Malaysia and Thailand are mulling crypto-related policy shifts, while Japan, South Korea and Cambodia have made incremental moves, according to Bloomberg News.

But Hong Kong and Singapore, along with Middle East standout Dubai, cemented their front-runner status during a period when US regulators under form president Joe Biden’s administration were sceptical toward crypto.

In an executive order last month, Trump — who has pledged to make the US the “crypto capital of the planet” — said he will instead provide “regulatory clarity and certainty” to support blockchain and digital asset innovation.

Animoca Brands group (安擬集團) president Evan Auyang (歐陽杞浚) said the anticipation surrounding a new US playbook is a game changer and will influence regulators worldwide.

The Monetary Authority of Singapore (MAS) has issued “Major Payment Institution” licenses in relation to digital payment tokens to 30 companies, including OKX, which it added last year.

The city-state has had a head start in regulating digital assets, including efforts such as the 2022 Project Guardian that brought regulators together with major global banks to explore asset tokenization.

That project showed Singapore “engaged early on central banks, regulatory bodies, international standards-setting bodies,” MAS deputy managing director Leong Sing Chiong (梁新松) said in November last year.

Hong Kong, which uses a different approach, has granted “Virtual Asset Trading Platform” licenses to 10 companies.

The Chinese finance hub is “number two... behind Singapore” when it comes to crypto regulation, Auyang said.

While Hong Kong has fewer exchanges, they saw a spike last year in terms of value received, according to blockchain research platform Chainalysis.

In the first half of last year, Hong Kong’s centralized exchanges collectively received US$26.6 billion, almost triple the year before and almost double Singapore’s US$13.5 billion.

Hong Kong overhauled its legal framework for crypto exchanges in mid-2023, with the SFC put in charge of vetting and licensing.

China has banned crypto since 2021 and exchanges in the semi-autonomous enclave cannot serve mainland Chinese clients.

But Animoca Brands executive chairperson Yat Siu (蕭逸) said pro-crypto policies have Beijing’s “blessing” and that Hong Kong benefits from being China’s financial gateway.

Aside from exchanges, the SFC on Wednesday said it would explore a range of regulations, including for custody services, staking and over-the-counter trading.

“Hong Kong isn’t sitting back and saying, ‘Look at the US, we’re just going to sort of kick back’,” Siu said. “It actually spurs it more into action.”

However, the city’s regulators have learned that the devil is in the details.

Hong Kong regulatory lawyer Jonathan Crompton said: “Anybody who engages in (exchange licensing) is going to have to commit to a very serious governance regime... It’s not for the faint-hearted.”

Over the past two years, some companies have reportedly found it challenging to hire specialized compliance personnel. The SFC vetting team, too, is understaffed.

The regulator’s Web site lists eight pending candidates, while 13 have withdrawn their applications.

“The SFC has been stuck between a rock and a hard place,” Crompton told AFP. “People have complained that, on one hand, it’s not quick enough to introduce a regulatory regime, and on the other hand, they have not provided enough protection.”

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,