US President Joe Biden’s administration plans to raise tariffs on solar wafers, polysilicon and some tungsten products from China to protect US clean energy businesses.

The notice from the Office of US Trade Representative (USTR) said tariffs on Chinese-made solar wafers and polysilicon would rise to 50 percent from 25 percent and duties on certain tungsten products would increase from zero to 25 percent, effective on Jan. 1, following a review of Chinese trade practices under Section 301 of the US Trade Act of 1974.

The decision followed a public comment period after the USTR said in September that it was considering such actions.

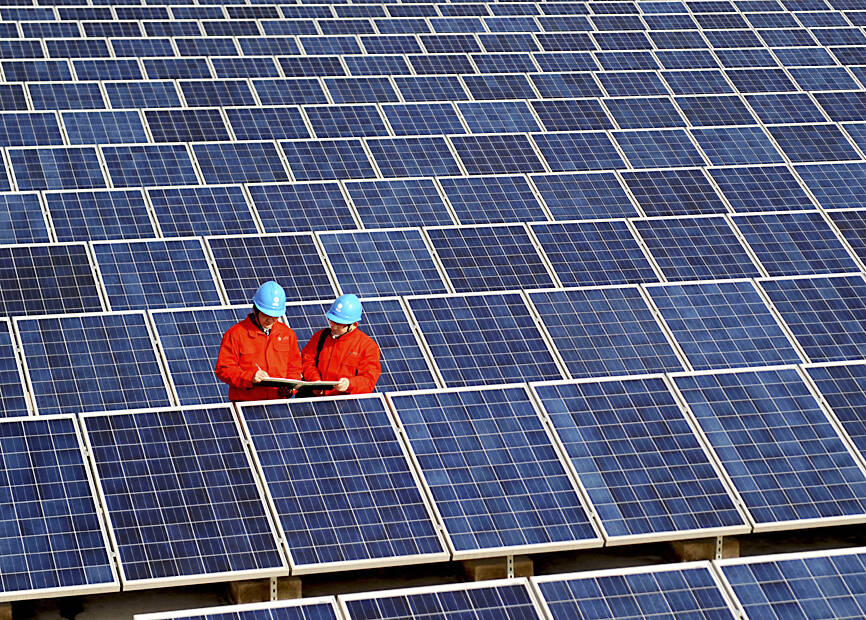

Photo: AP

“The tariff increases announced today will further blunt the harmful policies and practices by the People’s Republic of China,” US Trade Representative Katharine Tai (戴琪) said in a statement. “These actions will complement the domestic investments made under the Biden-Harris Administration to promote a clean energy economy, while increasing the resilience of critical supply chains.”

Last week, Washington tightened restrictions on Chinese access to advanced semiconductor technology. Beijing responded by banning exports to the US of certain critical minerals needed to make computer chips, such as gallium, germanium and antimony. It also stepped up its controls on graphite exports to the US.

China provides a very large share of most of those materials, and the US has been working to secure alternative sources in Africa and other parts of the world.

Tungsten is another strategically vital metal whose production is dominated by China. The US does not produce it, but South Korea is a potential big supplier. It is used to make armaments and is also used in X-ray tubes and light bulb filaments, among other industrial applications.

US imports of the metal from China fell to US$10.9 million last year from US$19.5 million the year before.

Trade frictions have been escalating ahead of the inauguration of US president-elect Donald Trump, who has vowed to impose 60 percent tariffs on Chinese goods, among other threats. Biden’s administration has kept in place tariffs that Trump imposed during his first term in office, but says it has a more targeted approach.

China has sharply ramped up production of cheap electric vehicles (EVs), solar panels and batteries at a time when the Biden administration has championed moves to support those industries in the US.

The US and other trading partners say China improperly subsidizes exports, giving exporters of solar panels and other products an unfair advantage in overseas markets, where its manufacturers charge lower prices thanks to government support.

China accounts for more than 80 percent of the market for solar panels at all stages of production, according to the International Energy Agency, which is more than double its domestic demand for those products. Its huge economies of scale have made solar power more affordable, but also concentrated the supply chain inside China.

The agency has urged other countries to assess their solar panel supply chains and develop strategies to address any risks.

BYPASSING CHINA TARIFFS: In the first five months of this year, Foxconn sent US$4.4bn of iPhones to the US from India, compared with US$3.7bn in the whole of last year Nearly all the iPhones exported by Foxconn Technology Group (富士康科技集團) from India went to the US between March and last month, customs data showed, far above last year’s average of 50 percent and a clear sign of Apple Inc’s efforts to bypass high US tariffs imposed on China. The numbers, being reported by Reuters for the first time, show that Apple has realigned its India exports to almost exclusively serve the US market, when previously the devices were more widely distributed to nations including the Netherlands and the Czech Republic. During March to last month, Foxconn, known as Hon Hai Precision Industry

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and the University of Tokyo (UTokyo) yesterday announced the launch of the TSMC-UTokyo Lab to promote advanced semiconductor research, education and talent development. The lab is TSMC’s first laboratory collaboration with a university outside Taiwan, the company said in a statement. The lab would leverage “the extensive knowledge, experience, and creativity” of both institutions, the company said. It is located in the Asano Section of UTokyo’s Hongo, Tokyo, campus and would be managed by UTokyo faculty, guided by directors from UTokyo and TSMC, the company said. TSMC began working with UTokyo in 2019, resulting in 21 research projects,

Taiwan’s property market is entering a freeze, with mortgage activity across the nation’s six largest cities plummeting in the first quarter, H&B Realty Co (住商不動產) said yesterday, citing mounting pressure on housing demand amid tighter lending rules and regulatory curbs. Mortgage applications in Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung totaled 28,078 from January to March, a sharp 36.3 percent decline from 44,082 in the same period last year, the nation’s largest real-estate brokerage by franchise said, citing data from the Joint Credit Information Center (JCIC, 聯徵中心). “The simultaneous decline across all six cities reflects just how drastically the market

Ashton Hall’s morning routine involves dunking his head in iced Saratoga Spring Water. For the company that sells the bottled water — Hall’s brand of choice for drinking, brushing his teeth and submerging himself — that is fantastic news. “We’re so thankful to this incredible fitness influencer called Ashton Hall,” Saratoga owner Primo Brands Corp’s CEO Robbert Rietbroek said on an earnings call after Hall’s morning routine video went viral. “He really helped put our brand on the map.” Primo Brands, which was not affiliated with Hall when he made his video, is among the increasing number of companies benefiting from influencer