The Japanese owner of 7-Eleven said Wednesday its founding family had offered a counter-bid to a takeover attempt by Canadian convenience store rival Alimentation Couche-Tard Inc (ACT).

With about 85,000 outlets, 7-Eleven is the world’s biggest convenience chain. If realized, ACT’s 7 trillion yen (US$45 billion) takeover would be the largest foreign buyout of a Japanese firm.

Bloomberg News said up to 9 trillion yen could be spent on taking the retail group private instead.

Photo: Reuters

Seven & i Holdings Co said on Wednesday it had received a non-legally binding acquisition proposal from its vice president Junro Ito, the founder’s son, and his company Ito-Kogyo Co.

A special committee “has been reviewing the proposal carefully and thoroughly with its financial and legal advisors,” its statement said.

“No determination has been made at this time to pursue a transaction with either Mr Ito and Ito-Kogyo, ACT, or any other party, and there can be no assurance that any such transaction will be entered into or consummated,” it said.

Ito-Kogyo holds a stake of around 8 percent in the Japanese retail giant.

“Mr Ito has been excluded from all discussions within the company ... relating to any proposal,” the statement said.

Seven & i stocks closed more than 11 percent higher, having soared as much as 17 percent following the news.

The 7-Eleven franchise began in the US, but it has been wholly owned by Seven & i since 2005.

Around a quarter of 7-Eleven stores are in Japan, where the stores are a cherished one-stop shop for everything from rice balls to concert tickets.

ACT, which began with one store in Canada’s city of Laval in 1980, now runs nearly 17,000 convenience outlets worldwide.

The Nikkei, citing sources close to Seven & i, said the company had begun talks with financial institutions to procure the necessary resources to go private.

However, it said potential obstacles could include whether the banks would agree to the huge loans required.

Seven & i is Japan’s biggest retailer, with a current market cap of 6.5 trillion yen.

In September, it rejected an initial takeover offer from ACT, saying the proposal “grossly” undervalued its business and could face regulatory hurdles.

The group said last month it had received a revised offer that reportedly totaled around 7 trillion yen.

To boost its share price and fend off ACT, Seven & i has also announced a major restructuring, including plans to spin off its non-core businesses.

To allow it to focus on 7-Eleven, its new holding company would comprise its supermarket food business, specialty stores and other businesses.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

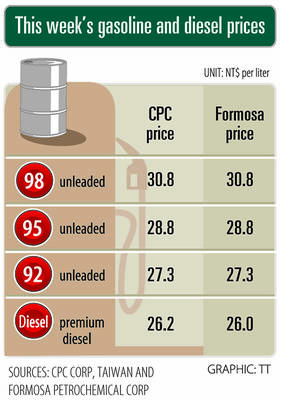

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

SinoPac Financial Holdings Co (永豐金控) is weighing whether to add a life insurance business to its portfolio, but would tread cautiously after completing three acquisitions in quick succession, president Stanley Chu (朱士廷) said yesterday. “We are carefully considering whether life insurance should play a role in SinoPac’s business map,” Chu told reporters ahead of an earnings conference. “Our priority is to ensure the success of the deals we have already made, even though we are tracking some possible targets.” Local media have reported that Mercuries Life Insurance Co (三商美邦人壽), which is seeking buyers amid financial strains, has invited three financial

CAUTION: Right now, artificial intelligence runs on faith, not productivity and eventually, the risk of a bubble will emerge,’ TIER economist Gordon Sun said Taiwanese manufacturers turned more optimistic last month, ending a five-month streak of declining sentiment as concerns over US tariffs, currency volatility and China’s overcapacity began to ease, the Taiwan Institute of Economic Research (TIER) said yesterday. The manufacturing business confidence index rose 1.17 points from June to 86.8, its first rebound since February. TIER economist Gordon Sun (孫明德) attributed the uptick to fading trade uncertainties, a steadier New Taiwan dollar and reduced competitive pressure from Chinese producers. Taiwan’s semiconductor industry is unlikely to face significant damage from Washington’s ongoing probe into semiconductors, given the US’ reliance on Taiwanese chips to power artificial