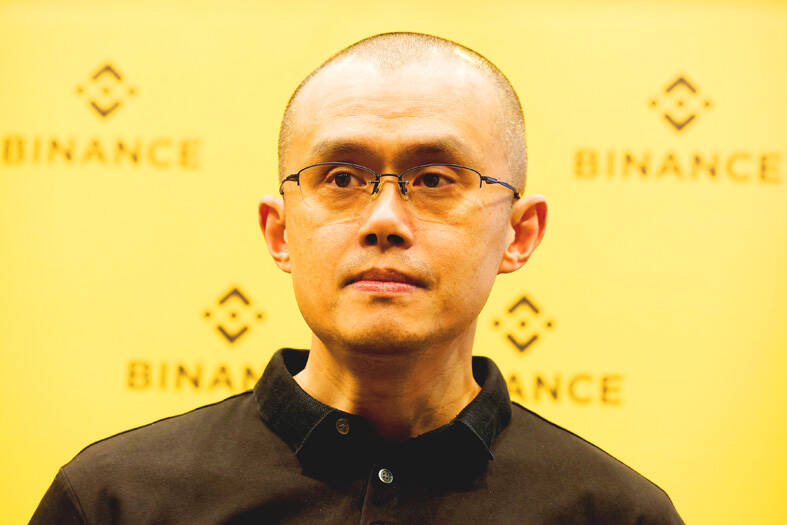

Changpeng Zhao (趙長鵬), the billionaire founder of Binance Holdings Ltd (幣安), which operates a cryptocurrency exchange, arrived at the Coca-Cola Arena in Dubai to rapturous applause and a long line of fans eager for a selfie with him. Deep in the pulsating crowd, a man yelled: “He is a martyr,” while in another part of the room a promoter of a start-up boldly declared: “The king is back.”

Back, that is, from a US prison halfway around the world. Yet the crypto billionaire known as CZ is not back at the helm of the largest crypto exchange, as his plea deal with the US Department of Justice forbids him from leading the company. He said he is OK with that.

Following his appearance in Dubai, Zhao spoke with Bloomberg a day before former US president-elect Donald Trump’s victory in the US presidential election sent crypto prices soaring and CZ’s estimated net worth to almost US$53 billion. He reflected on his forced separation from Binance and four months of incarceration during which he passed the time by working out, writing a book and talking crypto with fellow inmates.

Photo: Reuters

“I don’t think I want to go back” to being Binance’s chief executive officer, Zhao said in the interview, his first comments to the press since his release. “I’ve been leading the company for seven years. I enjoyed it. It’s a lot of work, but I think that chapter is that chapter.”

Zhao said he has even received offers to sell his controlling stake in the exchange — equity that makes up the bulk of his net worth — yet he would not disclose from whom or for how much.

“I’m not saying that I’m going to hold onto the equity forever or not,” he said. “I’m happy to review every offer, but so far I haven’t done anything. But, you know, I’m just a regular shareholder at this point.”

Still, the feverish reception to Zhao’s re-entry into crypto society at Binance’s razzle-dazzle event was indicative of how intertwined the exchange and its founder are, despite attempts to create distance and satisfy deals with the US Department of Justice. When Binance agreed to pay US$4.3 billion for contravening US sanctions and allowing Americans to trade on an unlicensed exchange, Zhao’s resignation as CEO was a key part of the fine print.

Now a self-described passive investor in crypto, Zhao, who has the Binance logo tattooed on his arm, claims his “felon status” has not deterred people from doing business with him.

Before the justice department deal was carved out and Zhao was still CEO, Binance invested US$500 million in Elon Musk’s takeover of Twitter, now X. Since then, the value of the social media platform has taken a beating. At the same time, Musk became one of Trump’s top donors, using the platform to champion the presidential candidate and welcoming back right-wing influencers previously banned for breaking hate-speech rules.

Now that the crypto-supporter Trump has won a second term in the White House, the prospects for the industry are much brighter than they have been under US President Joe Biden’s administration, which embarked on a massive regulatory crackdown on digital-asset companies including Binance.

Trump’s victory pushed Zhao’s estimated net worth up by US$12.1 billion in a single day, the Bloomberg Billionaires Index showed.

Just a month before his return to the crypto conference circuit, Zhao had been sharing a cell at the US Federal Correctional Institution Lompoc II, a minimum-security prison in California’s Santa Barbara County, after cutting a deal with US authorities to end an investigation that had hung over him and the company he built for years. He pleaded guilty to failing to implement an adequate anti-money laundering program at Binance, a crime that allowed groups from Hamas to al-Qaeda and other bad actors to trade on the platform.

He was sentenced to prison in April, becoming the richest-ever US inmate and the first executive to do time for a US Bank Secrecy Act contravention — an offense usually seen as a reporting infraction that, in his case, was amplified by unusually egregious facts. Federal prosecutors had sought a three-year sentence, seeking to make an example of a leader in an industry that has had more than its fair share of scams and scandals.

Armed with advice from a prison consultant to keep a low profile and no more than US$50 in his commissary account, CZ checked in to what is known as “Lowpoc low,” a facility with an adjacent camp that is often home to white-collar defendants and once housed Richard Nixon’s chief of staff after the Watergate scandal.

Strip-searched and placed in a group designated by race — segregation that Zhao said helped provide protection from violence and extortion — his days were a mix of pushups, book-writing and awful prison food: heavy on starch and sugars, low on protein save for what he described as Spam-like meat and some occasional fried fish.

“I usually stick to a paleo diet, just proteins and veggies. That’s not possible there,” said Zhao, whose frugality is well known among friends and family.

Not many of the inmates recognized Zhao at first, although word eventually spread that he was a “big Bitcoin guy” and “not poor,” he said.

“Many of them asked, like, which coins should they buy?” he said during the interview on Monday. Even some of the guards were plying him for tips. “I’m like, look, I’ve been here, you know, I don’t have access to any information. I don’t even know what the market looks like.”

He made friends with an inmate well-read on the subjects of crypto and blockchain who was serving a 25-year sentence for robbing a bank. They became workout buddies, spending 90 minutes a day in the open-air gym.

Since his release, Zhao said he had been trying to connect the inmate with pro-bono lawyers in hopes of shaving a few years off his sentence.

The other founder to match Zhao’s meteoric rise was his fiercest rival and social-media sparring partner, FTX Trading Ltd’s Sam Bankman-Fried. Bankman-Fried, who is serving 25 years in prison for fraud, partially blamed Zhao for accelerating the bank run that led to FTX’s blow up in late 2022.

Both ended up in prison, but Zhao said the common comparison between their cases is misplaced.

“That’s like comparing somebody who’s stealing money versus somebody who failed to register a company,” he said.

Zhao is adamant he is no longer involved in Binance’s decisions and has no desire to return. He is exploring investments in artificial intelligence and biotech and launching Giggle Academy, a nonprofit educational app.

Of course, his controlling stake means his presence still looms large at Binance. CZ’s shareholder rights were spared in the prosecution, and buoyant crypto prices have left him as the 25th-richest person on the Bloomberg Billionaires Index.

The Binance leadership asks his advice “very rarely,” and he obliges only with “historical context,” he said.

He is also a codefendant in a number of civil actions, including one filed by the US Securities and Exchange Commission, alongside Binance.

Yi He (易赫), Binance’s cofounder with whom Zhao has children, is still an important figure at the company.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the