US officials have discussed capping sales of advanced artificial intelligence (AI) chips from Nvidia Corp and other American companies on a country-specific basis, people familiar with the matter said, a move that would limit some nations’ AI capabilities.

The new approach would set a ceiling on export licenses for some countries in the interest of national security, according to the people, who described the private discussions on condition of anonymity.

Officials in the administration of US President Joe Biden focused on Persian Gulf countries that have a growing appetite for AI data centers and the deep pockets to fund them, the people said, adding that deliberations are in early stages and remain fluid.

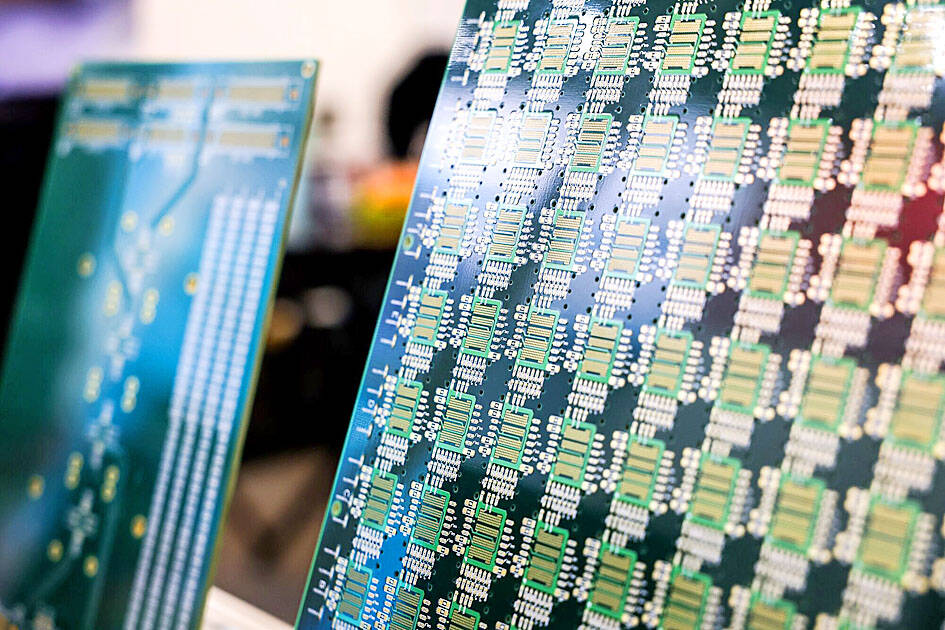

Photo: Cheng I-hwa, Bloomberg

The policy would build on a new framework to ease the licensing process for AI chip shipments to data centers in places such as the United Arab Emirates (UAE) and Saudi Arabia.

US Department of Commerce officials unveiled those regulations last month and said there are more rules coming.

The agency’s Bureau of Industry and Security, which oversees export controls, declined to comment.

Nvidia, the market leader for AI chips, also declined to comment, as did Advanced Micro Devices Inc (AMD).

A representative for Intel Corp, which also makes such processors, did not respond to a request for comment.

A spokesperson for the White House National Security Council declined to comment on the talks, but pointed to a recent joint statement by the US and the UAE on AI.

In it, the two countries acknowledged the “tremendous potential of AI for good,” as well as the “challenges and risks of this emerging technology and the vital importance of safeguards.”

Setting country-based caps would tighten restrictions that originally targeted China’s ambitions in AI, as Washington considers the security risks of AI development around the world.

Already, the Biden administration has restricted AI chip shipments by companies like Nvidia and AMD to more than 40 countries across the Middle East, Africa and Asia over fears their products could be diverted to China.

At the same time, some US officials have come to view semiconductor export licenses, particularly for Nvidia chips, as a point of leverage to achieve broader diplomatic goals. That could include asking key companies to reduce ties with China to gain access to US technology — but the concerns extend beyond Beijing.

It is unclear how leading AI chipmakers would react to additional US restrictions. When the Biden administration first issued sweeping chip regulations for China, Nvidia redesigned its AI offerings to ensure it can keep selling into that market.

If the administration moves forward with country-based caps, it might prove difficult to deliver a comprehensive new policy in the final months of Biden’s term. Such rules could be challenging to enforce and would be a major test of US diplomatic relationships.

Governments around the world are in a quest for so-called sovereign AI — the ability to build and run their own AI systems — and that pursuit has become a key driver of demand for advanced processors, Nvidia chief executive officer Jensen Huang (黃仁勳) has said.

Meanwhile, China is working to develop its own advanced semiconductors, although they still trail the best chips made in the US.

Still, there is concern among US officials that if Huawei Technologies Co (華為) or another foreign maker one day offers a viable alternative to Nvidia chips — presumably with fewer strings attached — that could weaken the US’ ability to shape the global AI landscape.

Some US officials argue that is only a distant possibility and that Washington should adopt a more restrictive approach to global AI chip exports given its current negotiating position. Others warn against making it too difficult for other countries to buy American technology, in the event that China gains ground and captures those customers.

While officials have debated the best approach, they have slowed high-volume AI chip license approvals to the Middle East and elsewhere.

However, there are signs things could get moving soon: Under the new rules for shipments to data centers, US officials would vet and preapprove specific customers based on security commitments from the companies and their national governments, paving the way for easier licensing down the road.

BIG BUCKS: Chairman Wei is expected to receive NT$34.12 million on a proposed NT$5 cash dividend plan, while the National Development Fund would get NT$8.27 billion Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday announced that its board of directors approved US$15.25 billion in capital appropriations for long-term expansion to meet growing demand. The funds are to be used for installing advanced technology and packaging capacity, expanding mature and specialty technology, and constructing fabs with facility systems, TSMC said in a statement. The board also approved a proposal to distribute a NT$5 cash dividend per share, based on first-quarter earnings per share of NT$13.94, it said. That surpasses the NT$4.50 dividend for the fourth quarter of last year. TSMC has said that while it is eager

‘IMMENSE SWAY’: The top 50 companies, based on market cap, shape everything from technology to consumer trends, advisory firm Visual Capitalist said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) was ranked the 10th-most valuable company globally this year, market information advisory firm Visual Capitalist said. TSMC sat on a market cap of about US$915 billion as of Monday last week, making it the 10th-most valuable company in the world and No. 1 in Asia, the publisher said in its “50 Most Valuable Companies in the World” list. Visual Capitalist described TSMC as the world’s largest dedicated semiconductor foundry operator that rolls out chips for major tech names such as US consumer electronics brand Apple Inc, and artificial intelligence (AI) chip designers Nvidia Corp and Advanced

Saudi Arabian Oil Co (Aramco), the Saudi state-owned oil giant, yesterday posted first-quarter profits of US$26 billion, down 4.6 percent from the prior year as falling global oil prices undermine the kingdom’s multitrillion-dollar development plans. Aramco had revenues of US$108.1 billion over the quarter, the company reported in a filing on Riyadh’s Tadawul stock exchange. The company saw US$107.2 billion in revenues and profits of US$27.2 billion for the same period last year. Saudi Arabia has promised to invest US$600 billion in the US over the course of US President Donald Trump’s second term. Trump, who is set to touch

SKEPTICAL: An economist said it is possible US and Chinese officials would walk away from the meeting saying talks were productive, without reducing tariffs at all US President Donald Trump hailed a “total reset” in US-China trade relations, ahead of a second day of talks yesterday between top officials from Washington and Beijing aimed at de-escalating trade tensions sparked by his aggressive tariff rollout. In a Truth Social post early yesterday, Trump praised the “very good” discussions and deemed them “a total reset negotiated in a friendly, but constructive, manner.” The second day of closed-door meetings between US Secretary of the Treasury Scott Bessent, US Trade Representative Jamieson Greer and Chinese Vice Premier He Lifeng (何立峰) were due to restart yesterday morning, said a person familiar