Beijing is stepping up pressure on Chinese companies to buy locally produced artificial intelligence (AI) chips instead of Nvidia Corp products, part of the nation’s effort to expand its semiconductor industry and counter US sanctions.

Chinese regulators have been discouraging companies from purchasing Nvidia’s H20 chips, which are used to develop and run AI models, sources familiar with the matter said.

The policy has taken the form of guidance rather than an outright ban, as Beijing wants to avoid handicapping its own AI start-ups and escalating tensions with the US, said the sources, who asked not to be identified because the matter is private.

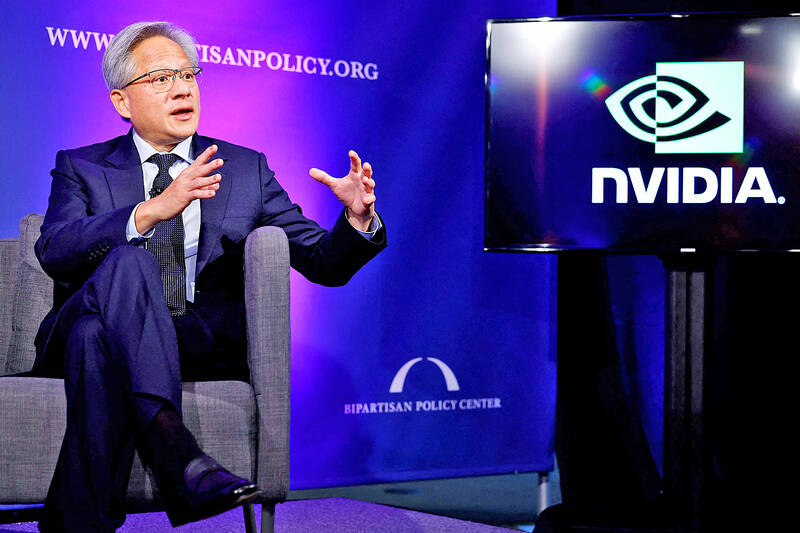

Photo: AFP

The move is designed to help domestic Chinese AI chipmakers gain more market share while preparing local tech companies for any potential additional US restrictions, the sources said.

The country’s leading makers of AI processors include Cambricon Technologies Corp (寒武紀) and Huawei Technologies Co (華為).

The US government banned Nvidia from selling its most advanced AI processors to Chinese customers in 2022, part of an attempt to limit Beijing’s technological advances. Nvidia, based in Santa Clara, California, modified subsequent versions of the chips so they could be sold under US Department of Commerce regulations. The H20 line fits that criteria.

In recent months, several Chinese regulators, including the powerful Ministry of Industry and Information Technology, issued so-called window guidance — instructions without the force of law — to reduce the use of Nvidia, the sources said.

The notice was aimed at encouraging companies to rely on domestic vendors like Huawei and Cambricon, they added.

Beijing also amplified the message via a local trade group, according to another.

At the same time, Chinese officials want local companies to build the best AI systems possible. If that means they need to buy some foreign semiconductors over domestic alternatives, Beijing would still tolerate that, sources familiar with China’s AI policy said.

Nvidia declined to comment. China’s Ministry of Commerce, Ministry of Information and Technology, and Cyberspace Administration did not respond to faxed requests for comment.

Separately, Nvidia chief executive officer Jensen Huang (黃仁勳) on Friday said that he is doing his best to serve customers in China and stay within the requirements of US government restrictions.

“The first thing we have to do is comply with whatever policies and regulations that are being imposed,” he said. “And, meanwhile, do the best we can to compete in the markets that we serve. We have a lot of customers there that depend on us, and we’ll do our best to support them.”

Nvidia, the world’s most valuable chipmaker, has seen sales soar as data center operators across the globe scramble to buy more of its processors. China continues to be part of that growth, although trade restrictions have taken a toll. In the July quarter, the firm got 12 percent of its revenue, or about US$3.7 billion, from the country, including Hong Kong. That was up more than 30 percent from a year earlier.

“Our data center revenue in China grew sequentially in Q2 and is a significant contributor to our data center revenue,” Nvidia chief financial officer Colette Kress said during an earnings call last month.

“As a percentage of total data center revenue, it remains below levels seen prior to the imposition of export controls. We continue to expect the China market to be very competitive going forward,” she said.

Meanwhile, Chinese chip designers and manufacturers are working to introduce alternatives to Nvidia. Beijing has offered billions in subsidies to the semiconductor sector, but local AI chips remain well behind Nvidia’s fare.

China does have a burgeoning AI sector, despite the US restrictions. ByteDance Ltd (字節跳動) and Alibaba Group Holding Ltd (阿里巴巴) have been investing aggressively, while a flock of start-ups are vying for leadership. There are six so-called tigers in developing large language models, the key technology behind generative AI: 01.AI (零一萬物), Baichuan (百川智能), Moonshot (月之暗面), MiniMax (稀宇科技), Stepfun (階躍星辰) and Zhipu (智譜).

Some of the companies are turning a blind eye to the Chinese decree to avoid H20 chips and rushing to buy more before an anticipated sanction from the US by the end of this year, while also buying homemade Huawei chips to please Beijing, one of the sources said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.