Qualcomm Inc has approached Intel Corp to discuss a potential acquisition of the struggling chipmaker, people with knowledge of the matter said, raising the prospect of one of the biggest-ever merger and acquisition deals.

California-based Qualcomm proposed a friendly takeover for Intel in recent days, said the sources, who asked not to be identified discussing confidential information.

The proposal is for all of the chipmaker, although Qualcomm has not ruled out buying some parts of Intel and selling off others.

Photo:REUTERS

It is uncertain whether the initial approach would lead to an agreement and any deal is likely to come under close antitrust scrutiny and take time to complete, the sources said.

Qualcomm has been speaking with US regulators and believes an all-US combination could allay any concerns, they said.

Qualcomm is looking at Intel at a time when its smaller rival is in the midst of the most difficult period in the company’s 56-year history.

Intel’s shares have fallen about 37 percent over the past 12 months, giving it a market value of about US$93 billion.

Qualcomm’s stock has risen more than 50 percent during the same period to a market capitalization of about US$188 billion. At such values, any deal between Qualcomm and all of Intel would rank among the largest on record.

The Wall Street Journal reported Qualcomm’s interest on Friday, driving Intel’s shares up by more than 3 percent. Representatives for Qualcomm and Intel declined to comment.

Intel chief executive officer Pat Gelsinger still believes his turnaround plan could be sufficient for the company to remain independent, but he is open to considering the merits of different potential transactions, the sources said.

Both companies would now assess various options with advisers, they said.

While Qualcomm’s approach raises the prospect of others entering the fray, at least one large rival is opting to sit on the sidelines for now.

Broadcom Inc is not currently evaluating an offer for Intel, the sources said.

The company had previously been assessing whether to pursue a deal, they added.

Advisers continue to pitch ideas to Broadcom, the sources said. A representative for Broadcom declined to comment.

Intel is headed toward its third consecutive year of shrinking sales, estimated to make US$52 billion in revenue this year, just 70 percent of its 2021 revenue.

The stock did receive a bounce last week after the company made a raft of announcements that spurred optimism in Gelsinger’s turnaround plan.

In the most notable move, Intel struck a multibillion-dollar deal with Amazon.com Inc’s Amazon Web Services cloud unit to coinvest in a custom artificial intelligence semiconductor and outlined a plan to turn its ailing manufacturing business, or foundry, into a wholly owned subsidiary.

The decision to separate Intel’s foundry operations from the rest of the tech company is aimed in part at convincing prospective customers — some of which compete with Intel — that they are dealing with an independent supplier.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

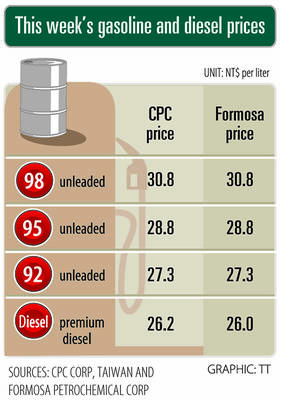

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

DOLLAR SIGNS: The central bank rejected claims that the NT dollar had appreciated 10 percentage points more than the yen or the won against the greenback The New Taiwan dollar yesterday fell for a sixth day to its weakest level in three months, driven by equity-related outflows and reactions to an economics official’s exchange rate remarks. The NT dollar slid NT$0.197, or 0.65 percent, to close at NT$30.505 per US dollar, central bank data showed. The local currency has depreciated 1.97 percent so far this month, ranking as the weakest performer among Asian currencies. Dealers attributed the retreat to foreign investors wiring capital gains and dividends abroad after taking profit in local shares. They also pointed to reports that Washington might consider taking equity stakes in chipmakers, including Taiwan Semiconductor

A German company is putting used electric vehicle batteries to new use by stacking them into fridge-size units that homes and businesses can use to store their excess solar and wind energy. This week, the company Voltfang — which means “catching volts” — opened its first industrial site in Aachen, Germany, near the Belgian and Dutch borders. With about 100 staff, Voltfang says it is the biggest facility of its kind in Europe in the budding sector of refurbishing lithium-ion batteries. Its CEO David Oudsandji hopes it would help Europe’s biggest economy ween itself off fossil fuels and increasingly rely on climate-friendly renewables. While