CTBC Financial Holding Co (中信金控) yesterday said that its bid to acquire Shin Kong Financial Holding Co (新光金控) on the open market would enable it to become a serious regional player larger by assets than the UK’s Standard Chartered Bank, Singapore’s United Overseas Bank and Japan’s Nomura Holdings Inc by assets.

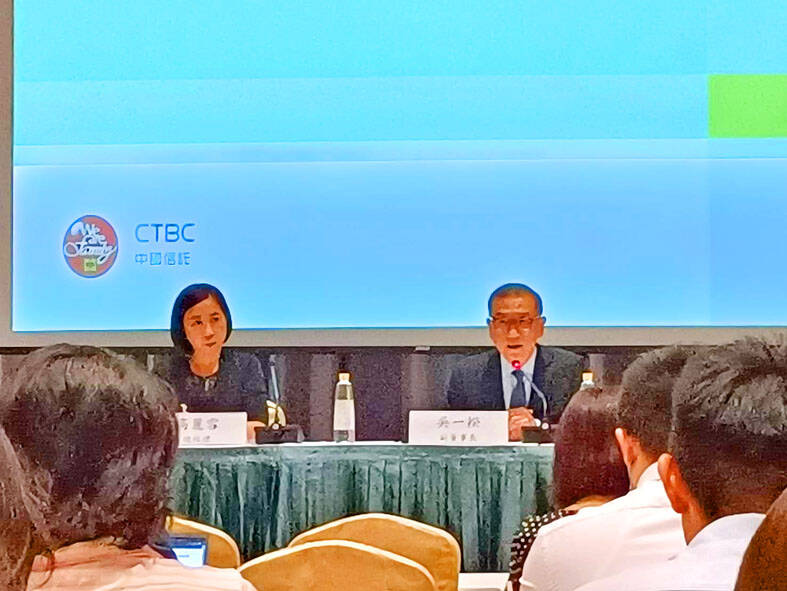

In Taiwan, CTBC Financial would grow into the largest financial conglomerate like Taiwan Semiconductor Manufacturing Co (台積電) in the technology field, CTBC Financial vice chairman Daniel Wu (吳一揆) told a media briefing in Taipei.

Wu rejected Taishin Financial Holding Co’s (台新金控) charge that the planned hostile takeover would throw the financial market into disarray and thwart future merger efforts, saying that former Shin Kong Financial chairman Eugene Wu (吳東進) raised the issue with CTBC Financial chairman Yen Wen-long (顏文隆).

Photo: Lee Chin-hui, Taipei Times

Eugene Wu, the older brother of Taishin Financial chairman Thomas Wu (吳東亮), and Yen are in-laws, Daniel Wu said, adding that CTBC Financial arrived at the buyout and tender prices after lengthy evaluations.

The company has demonstrated its ability and competence in integrating Grand Commercial Bank (萬通銀行) and Taiwan Life Insurance Co (台灣人壽), and has steeply raised overall profitability, making it a better choice for life insurance-focused Shin Kong, its employees and shareholders, Daniel Wu said.

CTBC Financial has offered to buy Shin Kong Financial in a cash and share swap deal of NT$14.55 per share and has pioneered the practice of retaining employees at acquired entities for three years, he said.

Taishin Financial intends to finance the merger fully through share swaps of NT$11.32 per share.

Taishin Financial on Tuesday said it would consider raising its offer, if necessary, to secure the deal.

Fitch Ratings yesterday gave Taishin Financial and its securities arm a negative credit outlook on concern that Shin Kong Financial would prove a cumbersome integration target for the company.

Taishin Financial would need a long time to see synergy benefits as Shin Kong Financial’s assets constitute 158 percent of bank-focused Taishin Financial’s scale and Shin Kong Financial’s businesses are subject to larger volatility, Fitch said.

A day earlier, Taiwan Ratings Corp (中華信評) placed Taishin Financial under credit watch for similar reasons, saying that both Taishin Financial and Shin Kong Financial have comparable subsidiaries and their integration would take quite a while even if financial regulators and their respective shareholders approve the merger.

Kaohsiung-based steelmaker Prosperity Tieh Enterprise Co (裕鐵) and other firms have expressed their interest in selling their stakes in Shin Kong Financial to CTBC Financial, Daniel Wu said.

Taiwan Ratings, the local subsidiary of S&P Global Ratings, yesterday affirmed the credit profile of CTBC Financial and key subsidiaries with a stable credit outlook, saying that the nation’s third-largest financial conglomerate has a scale advantage and sufficient resources to carry out the investment plan without undermining the group’s financial health.

CTBC Financial reported a net income of NT$37.21 billion (US$1.16 billion) for the first half, or earnings per share of NT$1.85, marking a 29 percent increase from a year earlier.

Taishin Financial posted a net profit of NT$10.6 billion for the same period, or earnings per share of NT$0.74, representing an increase of 21.3 percent.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new