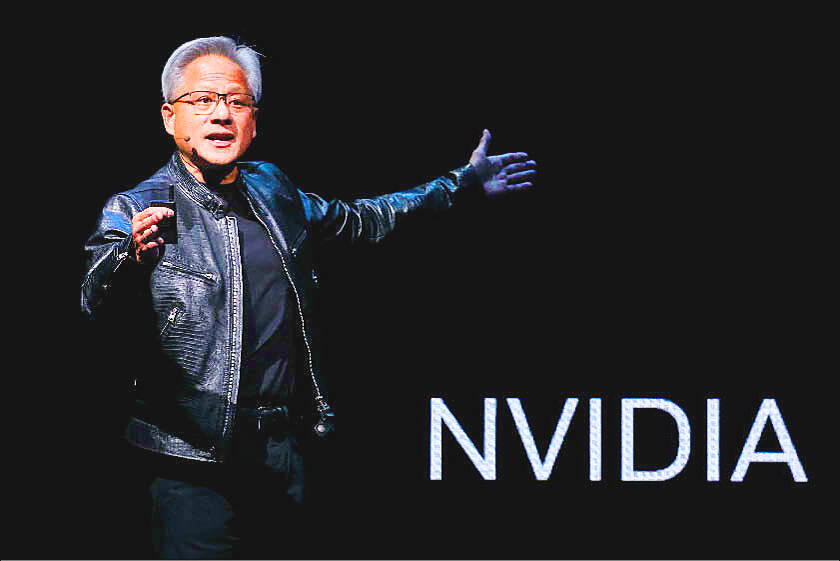

Nvidia Corp CEO Jensen Huang (黃仁勳) unloaded shares worth nearly US$169 million last month, the most he has netted in a single month, as insatiable demand for the chips used to power artificial intelligence (AI) drove the stock to fresh peaks.

The sale of 1.3 million shares, his first of the year, came during a month when Nvidia’s market value rose above US$3 trillion for the first time. That briefly made it the world’s most valuable company and pushed Huang, 61, into the rarefied group of ultra-rich with fortunes above US$100 billion.

The series of transactions were executed under a 10b5-1 trading plan adopted in March, the company’s regulatory filings showed.

Photo: Ann Wang, Reuters

Nvidia declined to comment.

Nvidia’s dominant share of the market for high-end accelerators has made it one of the biggest beneficiaries of the AI craze.

Due to the stock’s more than 150 percent gain since the start of the year, Huang’s net worth has more than doubled — rising by US$63.7 billion — in the past six months. The cofounder of the company is now ranked 13th on the Bloomberg Billionaires Index, with a US$107.7 billion fortune.

Huang is not the only insider selling. Nvidia executives and directors unloaded more than US$700 million of shares in the first half of this year, a dollar amount that dwarfs any other period in company history.

Huang has cashed out nearly US$1.1 billion in shares since the start of 2020, including last month’s sales.

Additional filings showed that Huang plans to continue selling in this month.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new

SK Hynix Inc warned of increased volatility in the second half of this year despite resilient demand for artificial intelligence (AI) memory chips from big tech providers, reflecting the uncertainty surrounding US tariffs. The company reported a better-than-projected 158 percent jump in March-quarter operating income, propelled in part by stockpiling ahead of US President Donald Trump’s tariffs. SK Hynix stuck with a forecast for a doubling in demand for the high-bandwidth memory (HBM) essential to Nvidia Corp’s AI accelerators, which in turn drive giant data centers built by the likes of Microsoft Corp and Amazon.com Inc. That SK Hynix is maintaining its