Citigroup Inc, DBS Group Holdings Ltd and other banks caught up in Singapore’s biggest money-laundering scandal are ramping up scrutiny of their wealthy customers and potential clients to avoid exposure to illicit flows, people familiar with the matter said.

Private bankers at several institutions are also receiving additional training to help them spot tricks used by criminals to mask their backgrounds and sources of funds, the people said.

The moves, which are voluntary, show how lenders are trying to close loopholes that enabled a group of criminals from China to launder more than S$3 billion (US$2.22 billion) in proceeds from online gambling through at least 16 financial institutions in the island nation.

Photo: Edgar Su, Reuters

The scandal has tarnished Singapore’s image and exposed weaknesses in how local and foreign banks and brokerages screen their clients.

The Monetary Authority of Singapore (MAS) recently completed on-site inspections of some banks that were involved in the case.

Lenders that had the most dealings with the criminals — through deposit accounts, loans and other financial services — are expected to face fines and other punitive measures from the financial regulator after its review concludes, some of the people said.

The MAS would assess if the financial institutions have implemented adequate and appropriate controls against money laundering and terrorism financing, and would take action if they have fallen short of requirements, as it has done in past cases, a MAS spokesperson said in response to questions from Bloomberg News.

Supervisory engagements are ongoing, the spokesperson said.

After the laundering case became public in August last year, Singapore’s government set up an inter-ministerial committee to review its anti-money laundering regime and strengthen defenses in sectors including financial institutions, property agents and precious metals dealers.

The assets seized by authorities included cash, gold bars, jewelry, cars, and residential and commercial properties.

The 10 accused have pleaded guilty, and have been sentenced to prison for 13 to 17 months. Another 17 people are under investigation and remain at large.

The 10 convicted individuals were linked to accounts across 16 financial institutions operating in Singapore that held more than S$370 million in deposits and investments.

The banks that held the most assets include Credit Suisse Group AG, Citigroup’s local unit and United Overseas Bank Ltd.

DBS is also among banks tightening their processes for vetting major transactions by clients, the people said.

The country’s largest bank had about S$100 million in exposure, mainly from financing property purchases.

Anti-money laundering processes are evolving to keep up with changes in how criminals act, as well as regulatory and industry developments, a DBS spokesperson said.

“Criminals will adapt their behavior now that there has been discovery of their methods, so we will need to continue thinking about how to stay one step ahead,” the DBS spokesperson added.

Real estate agent and property developer JSL Construction & Development Co (愛山林) led the average compensation rankings among companies listed on the Taiwan Stock Exchange (TWSE) last year, while contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) finished 14th. JSL Construction paid its employees total average compensation of NT$4.78 million (US$159,701), down 13.5 percent from a year earlier, but still ahead of the most profitable listed tech giants, including TSMC, TWSE data showed. Last year, the average compensation (which includes salary, overtime, bonuses and allowances) paid by TSMC rose 21.6 percent to reach about NT$3.33 million, lifting its ranking by 10 notches

SEASONAL WEAKNESS: The combined revenue of the top 10 foundries fell 5.4%, but rush orders and China’s subsidies partially offset slowing demand Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) further solidified its dominance in the global wafer foundry business in the first quarter of this year, remaining far ahead of its closest rival, Samsung Electronics Co, TrendForce Corp (集邦科技) said yesterday. TSMC posted US$25.52 billion in sales in the January-to-March period, down 5 percent from the previous quarter, but its market share rose from 67.1 percent the previous quarter to 67.6 percent, TrendForce said in a report. While smartphone-related wafer shipments declined in the first quarter due to seasonal factors, solid demand for artificial intelligence (AI) and high-performance computing (HPC) devices and urgent TV-related orders

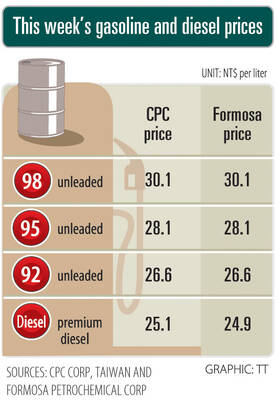

Prices of gasoline and diesel products at domestic fuel stations are this week to rise NT$0.2 and NT$0.3 per liter respectively, after international crude oil prices increased last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week snapped a two-week losing streak as the geopolitical situation between Russia and Ukraine turned increasingly tense, CPC said in a statement. News that some oil production facilities in Alberta, Canada, were shut down due to wildfires and that US-Iran nuclear talks made no progress also helped push oil prices to a significant weekly gain, Formosa said

MINERAL DIPLOMACY: The Chinese commerce ministry said it approved applications for the export of rare earths in a move that could help ease US-China trade tensions Chinese Vice Premier He Lifeng (何立峰) is today to meet a US delegation for talks in the UK, Beijing announced on Saturday amid a fragile truce in the trade dispute between the two powers. He is to visit the UK from yesterday to Friday at the invitation of the British government, the Chinese Ministry of Foreign Affairs said in a statement. He and US representatives are to cochair the first meeting of the US-China economic and trade consultation mechanism, it said. US President Donald Trump on Friday announced that a new round of trade talks with China would start in London beginning today,