A boom in artificial intelligence (AI) would increase banks’ dependence on big US tech firms, creating new risks for the industry, European banking executives said.

Excitement around using AI in financial services — widely used already for detecting fraud and money-laundering — has soared since the launch of OpenAI’s viral chatbot ChatGPT in late 2022 as banks examine ways to deploy generative AI.

However, at a gathering of fintech executives in Amsterdam last week, some expressed concerns that the amount of computing power needed to develop AI capabilities would make banks rely even more on small number of tech providers.

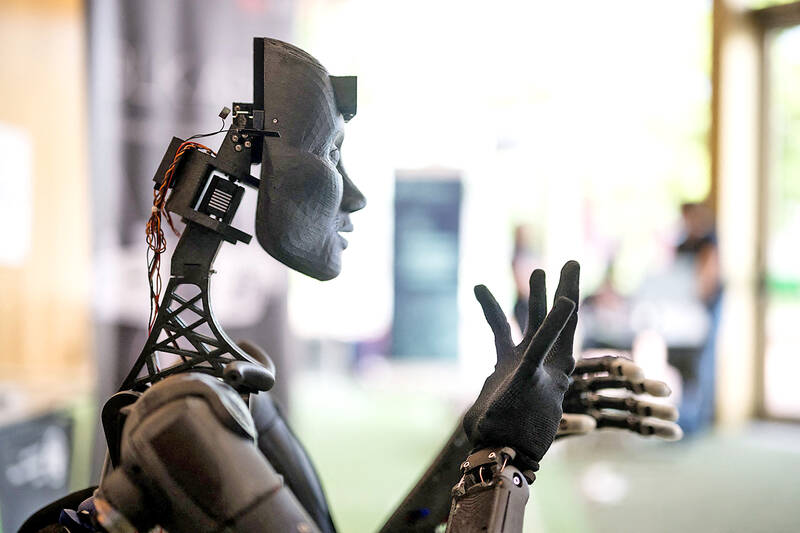

Photo: AFP

ING Groep NV chief analytics officer Bahadir Yilmaz, who is in charge of the Dutch bank’s AI work, said he expected to rely on Big Tech companies “more and more going forward” for infrastructure and machinery.

“You will always need them because sometimes the machine power that is needed for these technologies is huge. It’s also not really feasible for a bank to build this tech,” he said.

Banks’ dependency on a small number of tech companies was “one of the biggest risks,” Yilmaz said, emphasizing that European banks in particular needed to ensure they could move between different tech providers and avoid what he called “vendor lock-in.”

Britain last year proposed rules to regulate financial firms’ heavy reliance on external technology companies, such as Microsoft Corp, Google, IBM Corp and Amazon.com Inc.

Regulators say they are worried that problems at a single cloud computing company could potentially bring down services across many financial institutions.

“AI requires huge amounts of compute [computing power] and really the only way that you’re going to be able to access that compute sensibly is from Big Tech,” Joanne Hannaford, who leads technology strategy at Deutsche Bank AG’s corporate bank, told an audience at the Money20/20 conference earlier last week.

Hannaford said that there are requirements for the bank to notify regulators when they move data into the cloud, which could become much more complicated as the use of cloud computing increases.

Banks also need to communicate to regulators the risk of not leveraging cloud computing’s power, which would be an opportunity cost, she added.

AI was top of the agenda at the Amsterdam conference.

The CEO of French AI start-up Mistral AI, seen as France’s answer to OpenAI, told attendees there were “synergies” between its generative AI products and financial services.

“We see a lot of opportunities in creating analysis and monitoring information ... which is really something that bankers like to do,” Arthur Mensch said.

ING is testing an AI chatbot currently used for 2.5 percent of incoming customer service chats. Asked how long it would be until the chatbot could handle half or more of customer service conversations, Yilmaz said within a year.

In its first statement on AI, the EU’s securities watchdog last week said that banks and investment firms cannot shirk boardroom responsibility and have a legal obligation to protect customers when using AI.

It warned that the technology is likely to have significant impact on retail investor protection.

PATENTS: MediaTek Inc said it would not comment on ongoing legal cases, but does not expect the legal action by Huawei to affect its business operations Smartphone integrated chips designer MediaTek Inc (聯發科) on Friday said that a lawsuit filed by Chinese smartphone brand Huawei Technologies Co (華為) over alleged patent infringements would have little impact on its operations. In an announcement posted on the Taiwan Stock Exchange, MediaTek said that it would not comment on an ongoing legal case. However, the company said that Huawei’s legal action would have little impact on its operations. MediaTek’s statement came after China-based PRIP Research said on Thursday that Huawei filed a lawsuit with a Chinese district court claiming that MediaTek infringed on its patents. The infringement mentioned in the lawsuit likely involved

Taipei is today suspending work, classes and its US$2.4 trillion stock market as Typhoon Gaemi approaches Taiwan with strong winds and heavy rain. The nation is not conducting securities, currency or fixed income trading, statements from its stock and currency exchanges said. Authorities had yesterday issued a warning that the storm could affect people on land and canceled some ship crossings and domestic flights. Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) expects its local chipmaking fabs to maintain normal production, the company said in an e-mailed statement. The main chipmaker for Apple Inc and Nvidia Corp said it has activated routine typhoon alert

GROWTH: TSMC increased its projected revenue growth for this year to more than 25 percent, citing stronger-than-expected demand for AI devices and smartphones The Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) yesterday raised its forecast for Taiwan’s GDP growth this year from 3.29 percent to 3.85 percent, as exports and private investment recovered faster than it predicted three months ago. The Taipei-based think tank also expects that Taiwan would see a 8.19 percent increase in exports this year, better than the 7.55 percent it projected in April, as US technology giants spent more money on artificial intelligence (AI) infrastructure and development. “There will be more AI servers going forward, but it remains to be seen if the momentum would extend to personal computers, smartphones and

Catastrophic computer outages caused by a software update from one company have once again exposed the dangers of global technological dependence on a handful of players, experts said on Friday. A flawed update sent out by the little-known security firm CrowdStrike Holdings Inc brought airlines, TV stations and myriad other aspects of daily life to a standstill. The outages affected companies or individuals that use CrowdStrike on the Microsoft Inc’s Windows platform. When they applied the update, the incompatible software crashed computers into a frozen state known as the “blue screen of death.” “Today CrowdStrike has become a household name, but not in