China has set up its third planned state-backed investment fund to boost its semiconductor industry, with a registered capital of 344 billion yuan (US$47.5 billion), a filing with a government-run companies’ registry showed.

Chinese chip shares rose, with the CES CN Semiconductor Index rallying more than 3 percent and set to log the biggest one-day gain in more than a month.

The third phase of the fund, also known as the “Big Fund,” was officially established on Friday and registered under the Beijing Municipal Administration for Market Regulation, National Enterprise Credit Information Publicity System, a government-run credit information agency, data showed.

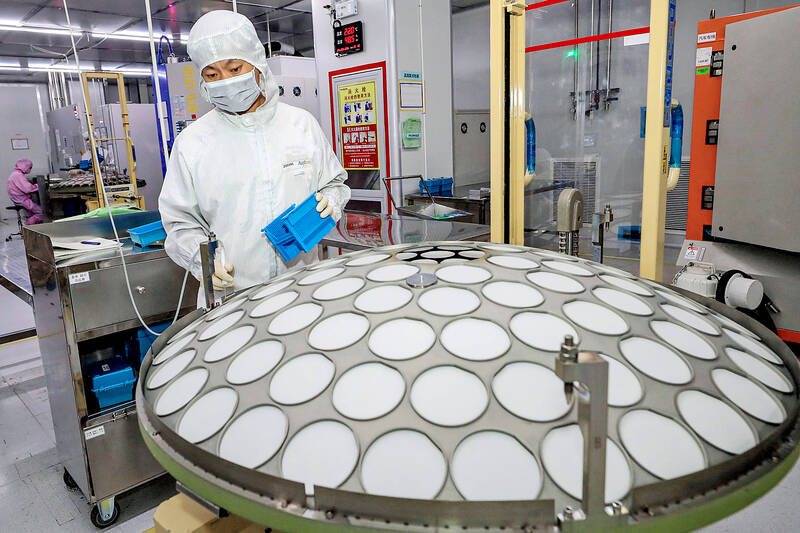

Photo: AFP

It was also the largest of the three funds launched by the China Integrated Circuit Industry Investment Fund.

Its biggest shareholder is the Chinese Ministry of Finance, with a 17 percent stake and paid-in capital of 60 billion yuan, followed by China Development Bank Capital, with a 10.5 percent stake, said Tianyancha (天眼查), a Chinese companies’ information database company.

Seventeen other entities are listed as investors, including five major Chinese banks: Industrial and Commercial Bank of China (中國工商銀行), China Construction Bank (中國建設銀行), Agricultural Bank of China (中國農業銀行), Bank of China (中國銀行) and Bank of Communications (交通銀行), with each contributing about 6 percent of the total capital.

The first phase of the fund was established in 2014, with registered capital of 138.7 billion yuan, and the second phase was in 2019, with 204 billion yuan.

The Big Fund has provided financing to China’s two biggest chip foundries, Semiconductor Manufacturing International Corp (中芯國際) and Hua Hong Semiconductor Ltd (華虹半導體), as well as to Yangtze Memory Technologies Co (長江儲存), a maker of flash memory, and a number of smaller companies and funds.

One of the major areas the third phase of the fund would focus on is equipment for chip manufacturing, Reuters reported in September last year.

The Big Fund is also considering hiring at least two institutions to invest the capital from the third phase.

AI SERVER DEMAND: ‘Overall industry demand continues to outpace supply and we are expanding capacity to meet it,’ the company’s chief executive officer said Hon Hai Precision Industry Co (鴻海精密) yesterday reported that net profit last quarter rose 27 percent from the same quarter last year on the back of demand for cloud services and high-performance computing products. Net profit surged to NT$44.36 billion (US$1.48 billion) from NT$35.04 billion a year earlier. On a quarterly basis, net profit grew 5 percent from NT$42.1 billion. Earnings per share expanded to NT$3.19 from NT$2.53 a year earlier and NT$3.03 in the first quarter. However, a sharp appreciation of the New Taiwan dollar since early May has weighed on the company’s performance, Hon Hai chief financial officer David Huang (黃德才)

The Taiwan Automation Intelligence and Robot Show, which is to be held from Wednesday to Saturday at the Taipei Nangang Exhibition Center, would showcase the latest in artificial intelligence (AI)-driven robotics and automation technologies, the organizer said yesterday. The event would highlight applications in smart manufacturing, as well as information and communications technology, the Taiwan Automation Intelligence and Robotics Association said. More than 1,000 companies are to display innovations in semiconductors, electromechanics, industrial automation and intelligent manufacturing, it said in a news release. Visitors can explore automated guided vehicles, 3D machine vision systems and AI-powered applications at the show, along

FORECAST: The greater computing power needed for emerging AI applications has driven higher demand for advanced semiconductors worldwide, TSMC said The government-supported Industrial Technology Research Institute (ITRI) has raised its forecast for this year’s growth in the output value of Taiwan’s semiconductor industry to above 22 percent on strong global demand for artificial intelligence (AI) applications. In its latest IEK Current Quarterly Model report, the institute said the local semiconductor industry would have output of NT$6.5 trillion (US$216.6 billion) this year, up 22.2 percent from a year earlier, an upward revision from a 19.1 percent increase estimate made in May. The strong showing of the local semiconductor industry largely reflected the stronger-than-expected performance of the integrated circuit (IC) manufacturing segment,

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data