Smartphone chip designer MediaTek Inc (聯發科) yesterday said it estimates that revenue would expand at an annual rate of about 15 percent this year, as a proliferation of generative artificial intelligence (AI) applications for premium smartphones are fueling demand for its flagship smartphone chips.

It expects its smartphone chip revenue to outgrow the company’s average growth rate this year, benefiting primarily from the higher average selling price of its flagship smartphone chips and market share gains.

The flagship chip revenue is to soar 50 percent year-on-year this year, MediaTek told an investor conference yesterday.

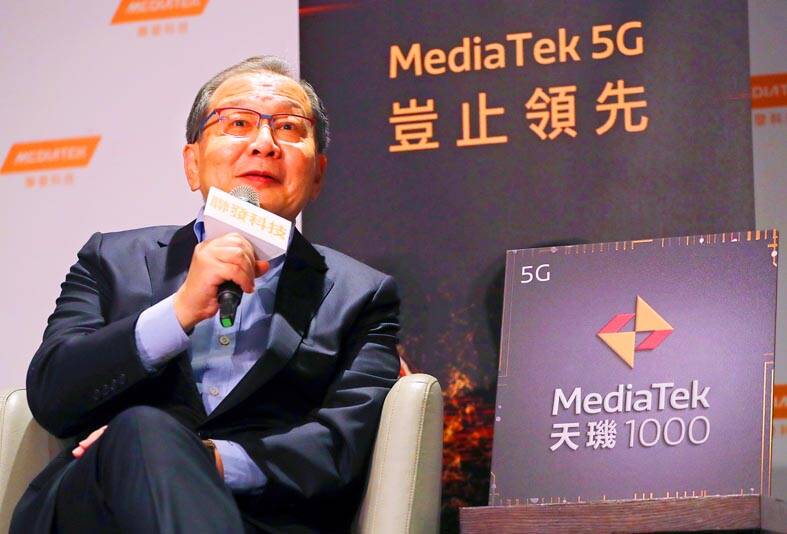

Photo: CNA

As a whole, this year’s gross margin is expected to be between 46 percent and 49 percent, compared with 47.8 percent last year, MediaTek said.

“We think mid-teens percentage growth is a very achievable number,” MediaTek CEO Rick Tsai (蔡力行) said during the conference, referring to the company’s revenue growth target for this year.

“The driving force really is the move toward high-end phones — flagship or premium phones. The trend provides the driving force for us to expand our total addressable market,” he added.

In China, MediaTek aims to seize a 30 percent share of the premium smartphones running on Android this year, Tsai said, referring to the company’s strong product portfolio.

The global top three smartphones ranked by AI performance are all powered by Mediatek’s new flagship smartphone chip, Dimensity 9300, he said.

The company expects more smartphones powered by Dimensity 9300 and Dimensity 8300 chips to hit the market later this quarter, MediaTek said.

Its next-generation flagship chip, Dimensity 9400, is on track to launch in the second half of this year, MediaTek added.

MediaTek yesterday also showed its ambition to build a presence in the market of rapidly growing AI accelerators used in data centers.

It would be reasonable for the company to vie for a 10 percent share of the market valued at US$40 billion by 2028, as it intends to be a major player, MediaTek said.

The total addressable market for AI accelerators used in data centers would total US$12 billion this year, it added.

As the smartphone chip restocking cycle is drawing to an end this quarter, MediaTek expects revenue this quarter to be flat or to decline by 9 percent sequentially to NT$121.4 billion to NT$133.5 billion (US$3.73 billion to US$4.10 billion), compared with NT$133.46 billion in the first quarter.

Smartphone chips are the biggest revenue contributor to MediaTek, accounting for 61 percent last quarter.

Gross margin this quarter is expected to be in the range of 45.5 percent to 48.5 percent, from 47.9 percent last quarter, excluding a one-time item, the company said.

MediaTek yesterday reported quarterly net profit of NT$31.6 billion during the January-to-March period, surging 87.4 percent year-on-year from NT$16.89 billion. On a quarterly basis, net profit jumped 23.1 percent from NT$25.71 billion.

Earnings per share rose to NT$19.85 last quarter from NT$10.64 in the first quarter of last year and NT$16.15 in the fourth quarter last year.

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co. (TSMC), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co. (better known as Foxconn) ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose 60 places to reach No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc. at 348th, Pegatron Corp. at 461st, CPC Corp., Taiwan at 494th and Wistron Corp. at 496th. According to Fortune, the world’s

NEW PRODUCTS: MediaTek plans to roll out new products this quarter, including a flagship mobile phone chip and a GB10 chip that it is codeveloping with Nvidia Corp MediaTek Inc (聯發科) yesterday projected that revenue this quarter would dip by 7 to 13 percent to between NT$130.1 billion and NT$140 billion (US$4.38 billion and US$4.71 billion), compared with NT$150.37 billion last quarter, which it attributed to subdued front-loading demand and unfavorable foreign exchange rates. The Hsinchu-based chip designer said that the forecast factored in the negative effects of an estimated 6 percent appreciation of the New Taiwan dollar against the greenback. “As some demand has been pulled into the first half of the year and resulted in a different quarterly pattern, we expect the third quarter revenue to decline sequentially,”

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

DIVERSIFYING: Taiwanese investors are reassessing their preference for US dollar assets and moving toward Europe amid a global shift away from the greenback Taiwanese investors are reassessing their long-held preference for US-dollar assets, shifting their bets to Europe in the latest move by global investors away from the greenback. Taiwanese funds holding European assets have seen an influx of investments recently, pushing their combined value to NT$13.7 billion (US$461 million) as of the end of last month, the highest since 2019, according to data compiled by Bloomberg. Over the first half of this year, Taiwanese investors have also poured NT$14.1 billion into Europe-focused funds based overseas, bringing total assets up to NT$134.8 billion, according to data from the Securities Investment Trust and Consulting Association (SITCA),