Exchange-traded funds (ETFs) in Taiwan last month reached a new milestone last month as the total assets exceeded NT$4 trillion (US$126.76 billion) and attracted more than 9 million investors, the Securities Investment Trust and Consulting Association (投信投顧公會) said last week.

An ETF, which operates like a mutual fund, typically tracks a particular index, sector, commodity or other assets, with underlying targets including stocks, bonds and futures. However, an ETF can also be bought or sold on a stock exchange as regular stock, the association said.

Total assets of ETFs issued in Taiwan spiked from NT$3.8 trillion late last year to NT$4.04 trillion last month, while the number of beneficiaries grew by 498,100 people, or 5.7 percent, to 9.2 million, meaning that 75 percent of 12 million Taiwanese investors used them as investment tool.

Photo: CNA

The fast-growing popularity of ETFs is enabling the nation’s major fund managers Yuanta Securities Investment Trust Co (元大投信), Cathay Securities Investment Trust Co (國泰投信), Fubon Asset Management Co (富邦投信), Capital Investment Trust Corp (群益投信) and Fuh Hwa Securities Investment Trust Co (復華投信) to benefit from a windfall in sales and clients, the association said.

Yuanta and Capital, the issuers of popular high-dividend funds 00056 and 00713, as well as 00919 and 00937B, gained more than 100,000 clients each last month, it said.

While Cathay’s 00878 ETF drew the largest beneficiaries, its chairman Jeff Chang (張錫) said the boom in ETFs is thanks to their simple design and stable wealth creation effect, which appeal to young and old investors alike.

Passive high-dividend ETF products have highlighted annual dividend yields of at least 5 percent, better than regular incomes generated by time deposits and unit-linked insurance policies.

Further, share prices in several high-dividend ETFs last year soared more than 40 percent, thanks to underlying targets such as Quanta Computer Inc (廣達電腦), Wistron Corp (緯創) and Inventec Corp (英業達), which supply artificial intelligence (AI) servers.

Chang said he is hopeful that the TAIEX could rally another 10 percent this year, as more local firms participate in global AI supply chains and are expected to benefit from a business upturn and fund inflows.

The benchmark index on Friday rose 36.41 points, or 0.19 percent, to close at an all-time high of 18,889.19, with the bulk of the gains coming from Taiwan Semiconductor Manufacturing Co (台積電), a key provider of foundry services for AI-chip designer Nvidia Corp, as well as IC designer MediaTek Inc (聯發科) and several electrical equipment stocks, including Chung-Hsin Electric and Machinery Manufacturing Corp (中興電工) and Fortune Electric Co (華城電機).

The TAIEX has risen 5.34 percent so far this year.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

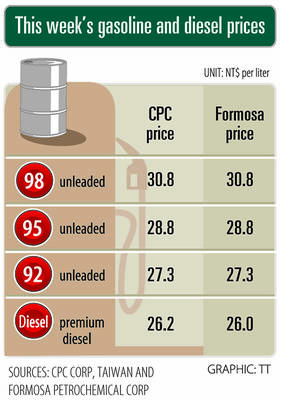

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

A German company is putting used electric vehicle batteries to new use by stacking them into fridge-size units that homes and businesses can use to store their excess solar and wind energy. This week, the company Voltfang — which means “catching volts” — opened its first industrial site in Aachen, Germany, near the Belgian and Dutch borders. With about 100 staff, Voltfang says it is the biggest facility of its kind in Europe in the budding sector of refurbishing lithium-ion batteries. Its CEO David Oudsandji hopes it would help Europe’s biggest economy ween itself off fossil fuels and increasingly rely on climate-friendly renewables. While

SinoPac Financial Holdings Co (永豐金控) is weighing whether to add a life insurance business to its portfolio, but would tread cautiously after completing three acquisitions in quick succession, president Stanley Chu (朱士廷) said yesterday. “We are carefully considering whether life insurance should play a role in SinoPac’s business map,” Chu told reporters ahead of an earnings conference. “Our priority is to ensure the success of the deals we have already made, even though we are tracking some possible targets.” Local media have reported that Mercuries Life Insurance Co (三商美邦人壽), which is seeking buyers amid financial strains, has invited three financial