A top executive of Chinese property giant Evergrande Group’s (恆大集團) electric vehicle company has been detained by police in the latest sign of trouble for the world’s most heavily indebted property developer.

Evergrande New Energy Vehicle Group Ltd (恆大新能源汽車) announced the detention of Liu Yongzhuo (劉永灼), its vice chairman and an executive director, in a notice yesterday to the Hong Kong Stock Exchange.

Its shares plunged nearly 11 percent after they resumed trading later in the day.

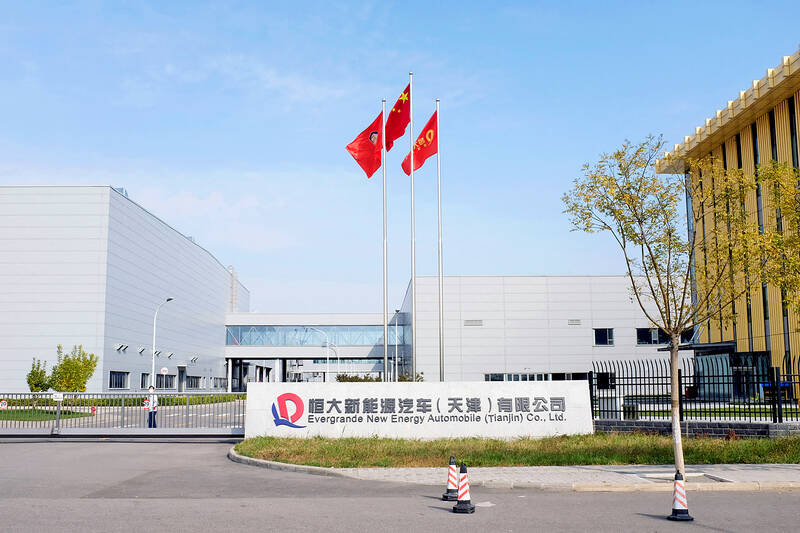

Photo: Reuters

That followed news over the weekend that Zhongzhi Enterprise Group Co (中植企業), a major shadow bank in China that has lent billions in yuan to property developers, filed for bankruptcy liquidation after it was unable to pay its debts.

Zhongzhi, one of China’s largest private asset management companies, said in November last year that its debts of up to 460 billion yuan (US$64.74 billion) were more than twice its assets of 200 billion yuan.

Soon afterwards, Beijing police said they were investigating the suspected crimes of a Chinese wealth company owned by Zhongzhi.

Evergrande has been in crisis since it defaulted on its debt obligations two years ago.

It is in the midst of a restructuring that includes selling off assets to avoid defaulting on US$340 billion in debt.

The firm confirmed in September last year that its chairman, Hui Ka Yan (許家印), had been subjected to “mandatory measures in accordance with the law due to suspicion of illegal crimes.” His status is unclear.

Evergrande New Energy Vehicle’s shares tumbled nearly 20 percent last week after it said a deal to sell shares to Dubai-based NWTN Motors had lapsed.

The brief announcement of Liu’s detention on “suspicion of illegal crimes” made no mention of that or other details.

The company has delayed its plans for beginning manufacturing after running into difficulties in attracting enough funding.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52