A Nobel Prize-winning labor market economist has cautioned young people against piling into science, technology, engineering and mathematics (STEM) subjects, saying “empathetic” and creative skills might thrive in a world dominated by artificial intelligence (AI).

Christopher Pissarides, professor of economics at the London School of Economics, said that workers in certain information technology (IT) jobs risk sowing their “own seeds of self-destruction” by advancing AI that would eventually take the same jobs.

While Pissarides said he is an optimist on AI’s overall effect on the jobs market, he raised concerns for those taking STEM subjects hoping to ride the coattails of the technological advances.

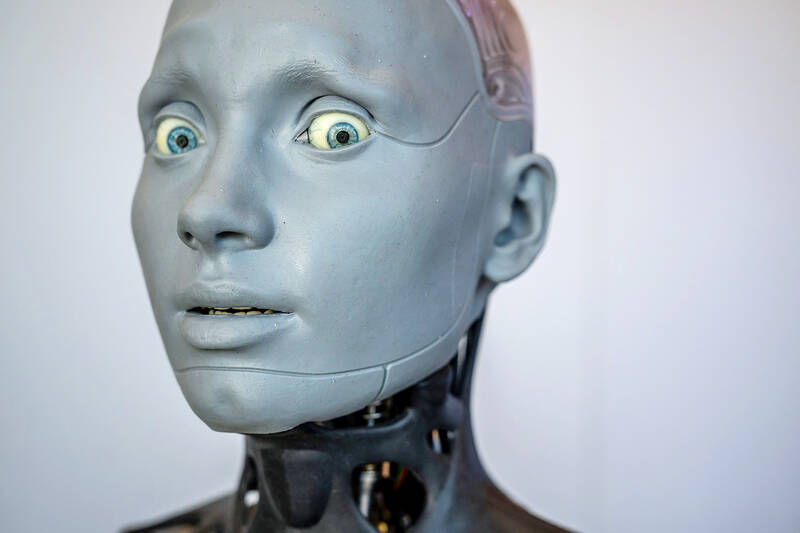

Photo: AFP

Despite rapid growth in the demand for STEM proficiency, jobs requiring more traditional face-to-face skills, such as in hospitality and healthcare, would still dominate the jobs market, he said.

“The skills that are needed now — to collect the data, collate it, develop it and use it to develop the next phase of AI, or, more to the point, make AI more applicable for jobs — will make the skills that are needed now obsolete because it will be doing the job,” he said in an interview. “Despite the fact that you see growth, they’re still not as numerous as might be required to have jobs for all those graduates coming out with STEM because that’s what they want to do.”

“This demand for these new IT skills, they contain their own seeds of self destruction,” he added.

The popularity of STEM subjects has boomed in the past few years as students seek to make themselves more employable, but The rapid rise of AI could transform the labor market, making some tasks and roles obsolete.

However, in the long-term, managerial, creative and empathetic skills, including communications, customer services and healthcare, would likely remain high in demand as they are less replaceable by technology, particularly AI.

“When you say the majority of jobs will be jobs that will involve personal care, communication, good social relationships, people might say: ‘Oh, God, is that what we have to look forward to in the future?’” Pissarides said. “We shouldn’t be looking down at these jobs. They’re better than the jobs that school leavers used to do.”

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.