Semiconductor Manufacturing International Corp (SMIC, 中芯) warned that a hoped-for smartphone market recovery is another year out, and that geopolitical tensions are fomenting a serious glut in global chipmaking capacity.

That outlook clashes with more upbeat comments from Samsung Electronics Co and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) about mobile demand bottoming soon. China’s largest chipmaker on Thursday reported its third consecutive fall in quarterly revenue, reflecting the depth of the downturn as well as Washington’s broadening campaign to curb China’s tech sector. That result disappointed investors who had hoped the surprise popularity of Huawei Technologies Co’s (華為) latest smartphones would help offset lost sales.

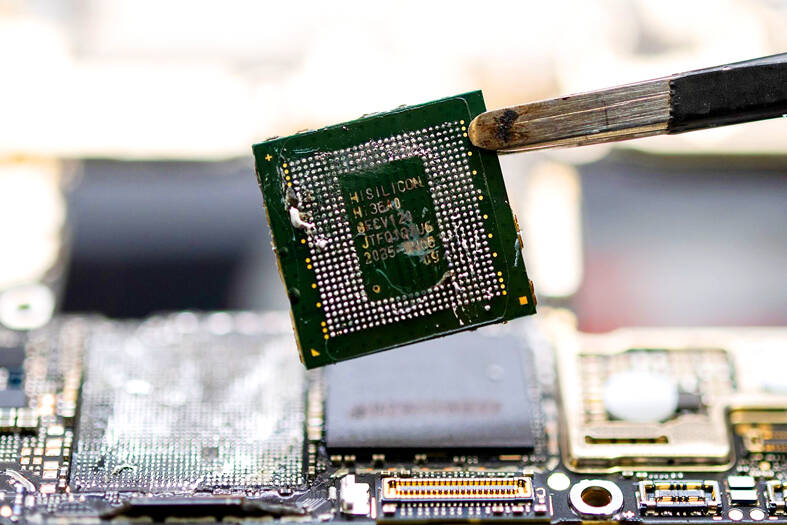

SMIC is one of the highest-profile companies at the heart of Beijing’s ambitions to build a world-class tech sector that is less reliant on US innovations. It helped Huawei build the 7-nanometer processor for the Mate 60 Pro, regarded as a breakthrough for two companies the US blacklisted years ago over national security concerns. Riding nationalist fervor, the device sold out rapidly, taking business away from Apple Inc’s iPhone.

Photo: Bloomberg

SMIC executives spoke about how political tensions had spurred a global build-up of domestic chipmaking capacity. They did not name any countries, but the US, China, Japan and Europe are among those shelling out incentives to attract local manufacturers.

“From a global perspective, capacity will be excessive. It will take a lot of time to digest the new capacities built in recent years,” SMIC co-CEO Zhao Haijun (趙海軍) told analysts in a conference call.

SMIC’s shares slid as much as 6.6 percent on Friday, their most in two months, after reporting a larger-than-projected 15 percent fall in revenue to US$1.62 billion in the September quarter. Net income plunged 80 percent, also missing estimates.

Meanwhile, executives said SMIC continues to grapple with uncertainty in China’s smartphone market. Smartphone shipments fell 5 percent in the third quarter and none of the top five players sold more phones than a year ago, research firm Canalys said. Major Chinese smartphone makers rely on chips from Qualcomm Inc and MediaTek Inc (聯發科), but those two firms also outsource manufacturing to overseas contractors such as TSMC and Globalfoundries Inc.

“The current smartphone replacement cycle wasn’t because of new innovations,” Zhao told analysts. “The overall smartphone shipment for next year should be on par with this year.”

Longer-term, it remains to be seen whether Beijing’s overt support for SMIC and chip-related firms would prop up the bottom line.

SMIC is raising its full-year capital expenditure to US$7.5 billion from an earlier guidance of roughly US$6.35 billion, suggesting that it too is ramping up capacity. The company expects to take delivery of some machinery earlier than scheduled after suppliers were quicker to secure shipping licenses, Zhao said.

“China’s drive toward semiconductor self-sufficiency appears to buffer SMIC against anticipated 3Q headwinds in sales and profit margins, despite broader market challenges from stagnant smartphone and consumer-electronics recoveries,” Bloomberg Intelligence analyst Charles Shum (沈明) wrote in a note ahead of the results release.

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan

CUSTOMERS’ BURDEN: TSMC already has operations in the US and is a foundry, so any tariff increase would mostly affect US customers, not the company, the minister said Taiwanese manufacturers are “not afraid” of US tariffs, but are concerned about being affected more heavily than regional economic competitors Japan and South Korea, Minister of Economic Affairs J.W. Kuo (郭智輝) said. “Taiwan has many advantages that other countries do not have, the most notable of which is its semiconductor ecosystem,” Kuo said. The US “must rely on Taiwan” to boost its microchip manufacturing capacities, Kuo said in an interview ahead of his one-year anniversary in office tomorrow. Taiwan has submitted a position paper under Section 232 of the US Trade Expansion Act to explain the “complementary relationship” between Taiwan and the US