Four Taiwanese companies which are alleged to be helping Chinese telecom firm Huawei Technologies Co (華為) build “infrastructure for an under-the- radar network of chip plants” are not supplying critical technologies to the Chinese client, which has been sanctioned by the US, Minister of Economic Affairs Wang Mei-hua (王美花) said yesterday.

Speaking with reporters, Wang said Taiwan’s law bars local companies from providing key technologies to China, while investing in the Chinese market, and to her knowledge, the four companies named in a Bloomberg report earlier in the day are not supplying any key technologies or equipment to Huawei.

According to an investigation by Bloomberg, the four Taiwanese companies, which have engaged in “unusual” cooperation with US-sanctioned Huawei were a subsidiary of chip material reseller Topco Scientific Co (崇越), a subsidiary of cleanroom equipment supplier L&K Engineering Co (亞翔), a subsidiary of construction specialist United Integrated Services Co (漢唐) and chemical supply system provider Cica-Huntek Chemical Technology Taiwan Co (矽科宏晟).

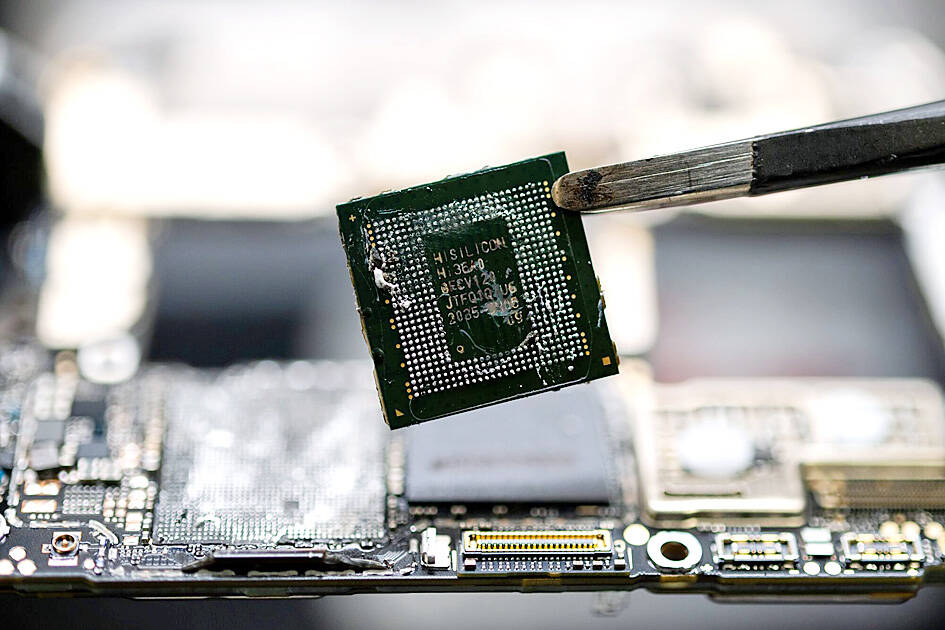

Photo: Bloomberg

“At a time when China threatens Taiwan regularly with military action for even contemplating independence, it’s unusual that members of the island’s most important industry may be helping US-sanctioned Huawei develop semiconductors to effectively break an American blockade,” the report said.

Bloomberg said the US sanctions against Huawei were called into question after the Chinese firm unveiled a smartphone in late August with an advanced made-in-China chip, which set off alarm bells in Washington with the US government urged by the US Congress to completely cut off Huawei and Shanghai-based contract chipmaker Semiconductor Manufacturing International Corp (中芯).

The report cited the Semiconductor Industry Association as saying Huawei has set up “its own shadow network of chipmakers” with the support of the Chinese government. In addition, Huawei has been relying on three little-known firms in Shenzhen -- Pengxinwei IC Manufacturing Co (鵬芯微), Pensun Technology Co (鵬新旭) and SwaySure Technology Co (昇維旭) -- to roll out chips based on its designs.

Wang said all Taiwanese investors in China should abide by not only Taiwan’s national security law but also keep a close eye on whether they violate US export control measures if the equipment they use is restricted by American rules.

Other officials said the ministry will continue to watch closely how Taiwanese firms do business with Huawei in a bid to protect their interests.

The officials reminded Taiwanese companies about the possible risks of doing business in China, adding that firms should observe US foreign direct product rules, or FDPR, which were first introduced in 1959 to control sales of US technologies.

In response to the Bloomberg report, United Integrated Services and Topco Scientific said they did not violate any laws when doing business in China.

United Integrated Services said since it was founded in 1982, all of its business and investments in China have adhered to Taiwan’s national policy.

While its subsidiary based in China’s Jiangxi Province was contracted by SwaySure Technology for construction projects in Shenzhen, United Integrated Services said the contracts were executed in accordance with law.

Topco Scientific said while it secured orders from Pensun Technology to provide environmental protection services in early last year, the project did not involve any critical technologies.

Topco Scientific emphasized that it did not provide any semiconductor raw materials or equipment to Pensun Technology, adding that the Chinese company had not been placed on the US sanctions list at the time the contracts were signed.

Topco Scientific said the contract with Pensun Technology will continue and undertook to prudently consider future cooperation with the Chinese firm.

L&K Engineering and Cica-Huntek Chemical Technology were not immediately available to comment on the Bloomberg report.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth