The struggles of China’s chip industry predate US sanctions, and “people” are the country’s “biggest hurdle,” former Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) co-chief operating officer Chiang Shang-yi (蔣尚義) said in an interview.

Speaking on Era TV’s Taiwan Insights on Sunday, Chiang, who worked in China for several years after leaving TSMC in 2013, said that while Chinese firms might be capable of solving the technical aspects of research and development, he found during his time there that “the biggest hurdle was always people.”

Regarding his dealings with “political leaders” when serving as vice chairman of Shanghai-based Semiconductor Manufacturing International Corp (SMIC, 中芯國際), Chiang said he felt that he was “not trusted.”

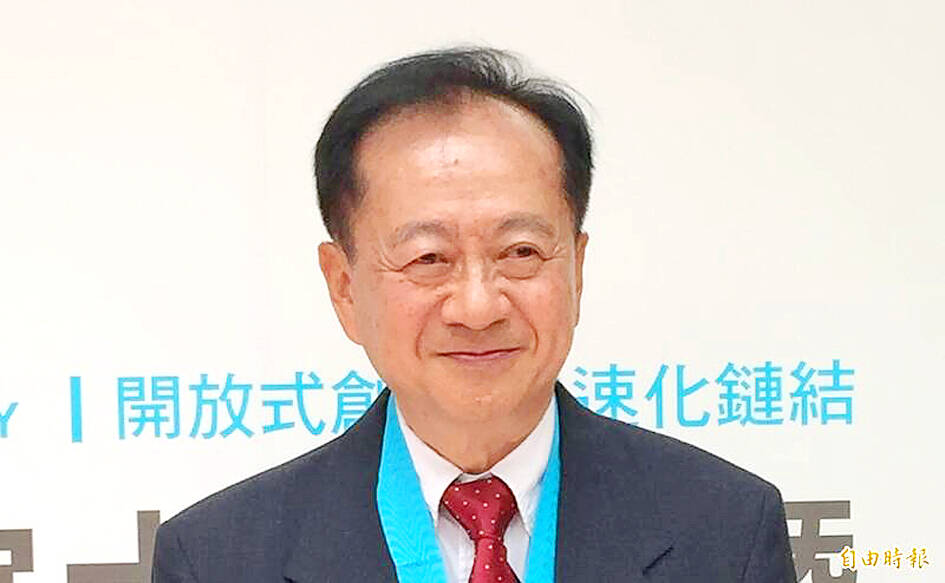

Photo: Grace Hung, Taipei Times

“SMIC is headquartered in Shanghai, but has factories in Beijing. I was asked by then-SMIC chairman Zhou Zixue (周子學) to fly to Beijing when a high-ranking official wished to visit the factories, but twice I was shut out of the meetings because they only allowed People’s Republic of China citizens to attend,” Chiang said.

Zhou had tried to iron out the issue by setting up personal meetings with the Beijing official for Chiang, but “it was not a pleasant feeling,” he said.

With regards to US sanctions against Beijing, Chiang said they would slow down the development of China’s chip industry, but it remained to be seen if the pressure would end up forcing chipmakers to stand on their own feet.

“We do not know whether self-reliance could be achieved [in China’s semiconductor industry], but one also has to note that China has been developing the industry for more than 10 years and the US sanctions are actually very recent,” Chiang said.

China’s chip industry was “not that successful either when it was not restricted,” he added.

Chiang was first recruited by SMIC, China’s top foundry, as an independent director in 2016, before leaving to take up the position of CEO at Wuhan Hongxin Semiconductor Corp (HSMC, 武漢弘芯) in 2019.

He left HSMC in July 2020 and returned to SMIC in mid-December 2020 to take over as vice chairman, but left China a year later.

After leaving SMIC in 2021, he told local media in Taiwan that he would not work in China again.

Chiang in November last year joined Hon Hai Precision Industry Co (鴻海精密) as its chief strategy officer to integrate the resources of its semiconductor subsidiaries. In June, he was appointed to chair ShunSin Technology Holdings Ltd (訊芯科技), a semiconductor arm of Hon Hai that specializes in offering system-in-a-package modules and optical transceivers.

Additional reporting by Lisa Wang

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

Enhanced tax credits that have helped reduce the cost of health insurance for the vast majority of US Affordable Care Act enrollees expired on Jan.1, cementing higher health costs for millions of Americans at the start of the new year. Democrats forced a 43-day US government shutdown over the issue. Moderate Republicans called for a solution to save their political aspirations this year. US President Donald Trump floated a way out, only to back off after conservative backlash. In the end, no one’s efforts were enough to save the subsidies before their expiration date. A US House of Representatives vote

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This