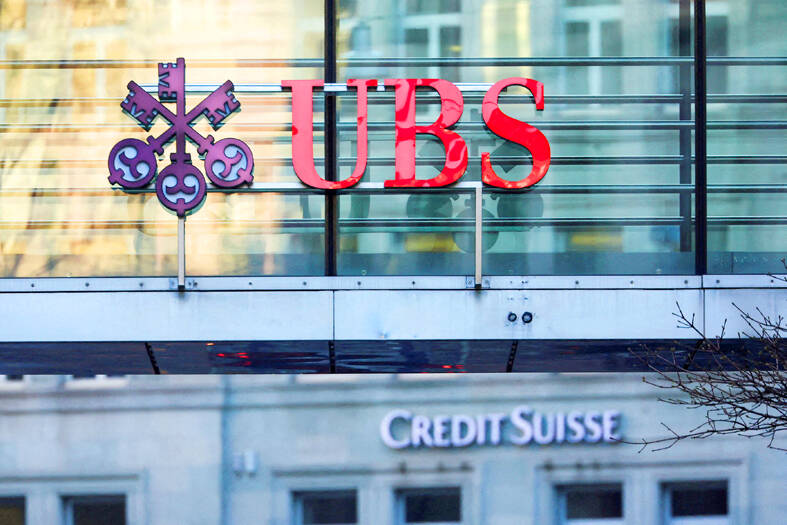

UBS Group AG is weighing a plan to cut about two-thirds of Credit Suisse Group’s investment bankers in the Asia-Pacific region as part of the first major job reductions following the merger of the two Swiss lenders, people familiar with the matter said.

That would cost about 200 jobs at its global banking division in Asia over the next couple of months, the people said, asking not to be identified because the matter is confidential.

The Zurich-based bank might announce global leadership changes internally, without details on the cuts, one of the people said.

Photo: Reuters

Reuters reported earlier that UBS is letting go of about 80 percent of Credit Suisse investment bankers in Hong Kong starting this week. A Hong Kong-based spokesperson at UBS declined to comment.

UBS is still looking to retain more than 100 Credit Suisse investment bankers across Asia, with many of them focusing on markets outside of Hong Kong, the people said.

The headcount at Credit Suisse’s domestic securities venture in China would be largely unaffected by the latest round as the firm is in process of selling its stake, one of the people said.

UBS has shown little appetite for Credit Suisse’s investment bank since the government-brokered deal was announced in March. The bank said it would continue its own strategy of a smaller capital-lite securities unit and would only use Credit Suisse’s investment bank to reinforce its global business while managing the rest down.

The Credit Suisse acquisition has increased UBS’ workforce to about 120,000, which the bank intends to ultimately reduce by about 30 percent, Bloomberg has reported.

UBS aims to reduce staff costs by about US$6 billion over the next several years.

The move also reflects plummeting revenue at investment banking divisions across the globe due to a slowdown in dealmaking.

Deal values have fallen more than 40 percent this year which has led to Wall Street banks going into retrenchment mode, planning job cuts and freezing hiring.

PATENTS: MediaTek Inc said it would not comment on ongoing legal cases, but does not expect the legal action by Huawei to affect its business operations Smartphone integrated chips designer MediaTek Inc (聯發科) on Friday said that a lawsuit filed by Chinese smartphone brand Huawei Technologies Co (華為) over alleged patent infringements would have little impact on its operations. In an announcement posted on the Taiwan Stock Exchange, MediaTek said that it would not comment on an ongoing legal case. However, the company said that Huawei’s legal action would have little impact on its operations. MediaTek’s statement came after China-based PRIP Research said on Thursday that Huawei filed a lawsuit with a Chinese district court claiming that MediaTek infringed on its patents. The infringement mentioned in the lawsuit likely involved

Taipei is today suspending work, classes and its US$2.4 trillion stock market as Typhoon Gaemi approaches Taiwan with strong winds and heavy rain. The nation is not conducting securities, currency or fixed income trading, statements from its stock and currency exchanges said. Authorities had yesterday issued a warning that the storm could affect people on land and canceled some ship crossings and domestic flights. Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) expects its local chipmaking fabs to maintain normal production, the company said in an e-mailed statement. The main chipmaker for Apple Inc and Nvidia Corp said it has activated routine typhoon alert

GROWTH: TSMC increased its projected revenue growth for this year to more than 25 percent, citing stronger-than-expected demand for AI devices and smartphones The Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) yesterday raised its forecast for Taiwan’s GDP growth this year from 3.29 percent to 3.85 percent, as exports and private investment recovered faster than it predicted three months ago. The Taipei-based think tank also expects that Taiwan would see a 8.19 percent increase in exports this year, better than the 7.55 percent it projected in April, as US technology giants spent more money on artificial intelligence (AI) infrastructure and development. “There will be more AI servers going forward, but it remains to be seen if the momentum would extend to personal computers, smartphones and

Catastrophic computer outages caused by a software update from one company have once again exposed the dangers of global technological dependence on a handful of players, experts said on Friday. A flawed update sent out by the little-known security firm CrowdStrike Holdings Inc brought airlines, TV stations and myriad other aspects of daily life to a standstill. The outages affected companies or individuals that use CrowdStrike on the Microsoft Inc’s Windows platform. When they applied the update, the incompatible software crashed computers into a frozen state known as the “blue screen of death.” “Today CrowdStrike has become a household name, but not in