The US Department of the Treasury has kept Taiwan on a watchlist of currency manipulators in its semiannual Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the US report.

The report, presented to the US Congress on Friday, reviewed and assessed the policies of major US trading partners, which accounted for about 80 percent of US foreign trade in goods and services, during the four quarters through December last year.

In addition to Taiwan, China, Germany, Malaysia, Singapore, South Korea and Switzerland have also been placed on the currency manipulation watchlist, the US Treasury said.

Photo: CNA

None of Washington’s major trading partners were named as a currency manipulator, it said.

The report uses three criteria to determine which of its trading partners would be named as currency manipulator nations: a significant bilateral trade surplus with the US; a material current account surplus; and involvement in persistent one-sided intervention in the foreign exchange market.

When an economy meets just one of the three criteria for two US currency reports in a row, it is removed from the monitoring list.

The central bank on Saturday said that although Taipei has stayed on Washington’s monitoring list for currency manipulation, both sides have channels to maintain smooth communications.

Taiwan remained on the watchlist because it has a trade surplus of US$51 billion in merchandise and services, and its current account surplus made up 13.3 percent of its GDP during the four quarters through the end of last year, the central bank said.

However, the central bank sold a net US$13 billion from its US dollar reserves, which made up about 1.7 percent of Taiwan’s GDP, and the number of months that the central bank was a net buyer of US dollars was fewer than eight, which did not meet the third criterium of persistent one-sided intervention in the foreign exchange market.

The central bank said it would continue to interact with the US Treasury.

It is unnecessary for Taiwan to worry about bilateral ties with the US just because Taipei was kept on the currency manipulation monitoring list, Taiwan Institute of Economic Research economist Wu Meng-tao (吳孟道) said.

As Taipei and Washington signed their first agreement under the US-Taiwan Initiative on 21st-Century Trade on June 1, which covered customs and border procedures, regulatory practices and small business in a bid to make trade and investment between the two sides easier, Wu said the US Treasury’s move to keep Taiwan on the currency manipulation watchlist is not expected to affect bilateral trade ties.

However, as the US Federal Reserve last week signaled more interest rate hikes before the end of the year, which could continue to boost the US dollar, influence fund flows and affect global financial markets, it is likely to prompt intervention from Taiwan’s central bank in the currency market, Wu said.

SETBACK: Apple’s India iPhone push has been disrupted after Foxconn recalled hundreds of Chinese engineers, amid Beijing’s attempts to curb tech transfers Apple Inc assembly partner Hon Hai Precision Industry Co (鴻海精密), also known internationally as Foxconn Technology Group (富士康科技集團), has recalled about 300 Chinese engineers from a factory in India, the latest setback for the iPhone maker’s push to rapidly expand in the country. The extraction of Chinese workers from the factory of Yuzhan Technology (India) Private Ltd, a Hon Hai component unit, in southern Tamil Nadu state, is the second such move in a few months. The company has started flying in Taiwanese engineers to replace staff leaving, people familiar with the matter said, asking not to be named, as the

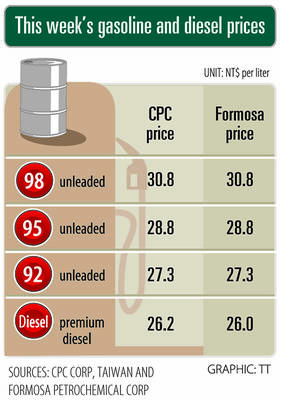

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices

DOLLAR SIGNS: The central bank rejected claims that the NT dollar had appreciated 10 percentage points more than the yen or the won against the greenback The New Taiwan dollar yesterday fell for a sixth day to its weakest level in three months, driven by equity-related outflows and reactions to an economics official’s exchange rate remarks. The NT dollar slid NT$0.197, or 0.65 percent, to close at NT$30.505 per US dollar, central bank data showed. The local currency has depreciated 1.97 percent so far this month, ranking as the weakest performer among Asian currencies. Dealers attributed the retreat to foreign investors wiring capital gains and dividends abroad after taking profit in local shares. They also pointed to reports that Washington might consider taking equity stakes in chipmakers, including Taiwan Semiconductor

A German company is putting used electric vehicle batteries to new use by stacking them into fridge-size units that homes and businesses can use to store their excess solar and wind energy. This week, the company Voltfang — which means “catching volts” — opened its first industrial site in Aachen, Germany, near the Belgian and Dutch borders. With about 100 staff, Voltfang says it is the biggest facility of its kind in Europe in the budding sector of refurbishing lithium-ion batteries. Its CEO David Oudsandji hopes it would help Europe’s biggest economy ween itself off fossil fuels and increasingly rely on climate-friendly renewables. While