JPMorgan Chase Bank NA is to take over all deposits and most of the assets of troubled First Republic Bank, the US Federal Deposit Insurance Corp (FDIC) said early yesterday.

California regulators closed First Republic and appointed the FDIC as receiver, it said in a statement.

JPMorgan Chase is to assume “all of the deposits and substantially all of the assets of First Republic Bank,” it said.

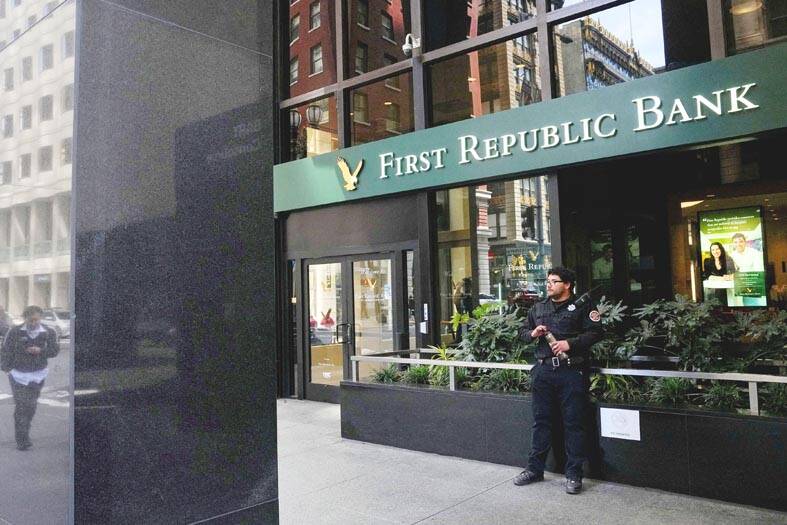

Photo: Reuters

First Republic Bank’s 84 branches in eight states were yesterday to reopen as branches of JPMorgan Chase Bank.

Regulators had been working to find a way forward before US stock markets opened yesterday.

San Francisco-based First Republic has struggled since the collapses of Silicon Valley Bank and Signature Bank in early March. They added to worries that the bank might not survive as an independent entity for much longer.

Shares in First Republic closed at US$3.51 on Friday, a fraction of the about US$170 a share it traded for a year earlier. It fell further in afterhours trading.

The bank reported total assets of US$233 billion as of March 31. At the end of last year, the US Federal Reserve ranked First Republic 14th in size among US commercial banks.

Before Silicon Valley Bank failed, First Republic had a banking franchise that was the envy of most of the industry.

Its clients — mostly the rich and powerful — rarely defaulted on their loans. The bank has made much of its money making low-cost loans to the rich, which reportedly included Meta Platforms Inc CEO Mark Zuckerberg.

Flush with deposits from the well-heeled, First Republic saw total assets more than double from US$102 billion at the end of first quarter in 2019, when its full-time workforce was 4,600.

The vast majority of First Republic’s deposits, like those in Silicon Valley and Signature Bank, were uninsured — that is, above the US$250,000 limit set by the FDIC.

That made analysts and investors worried. If First Republic were to fail, its depositors might not get all their money back.

Those fears were crystalized in the bank’s recent quarterly results.

It said that depositors pulled more than US$100 billion out of the bank during last month’s crisis.

First Republic said that it was only able to stanch the bleeding after a group of large banks stepped in to save it with US$30 billion in uninsured deposits.

Now First Republic is in need of a bigger fix.

“Getting the bank in the hands of a larger one is the best possible economic outcome,” said Steven Kelly, a researcher at the Yale School of Management Program on Financial Stability. “First Republic has lots of knowledge about its customers and has been a profitable bank for its entire history — but its business model is not stable. It needs a big bank balance sheet behind it.”

Kelly said that other options, such as government control or continuing to try to survive on its own, would see its value continue to disappear, along with credit and economic growth.

“A successful absorption into a big bank would provide a proper, stable home for the firm to continue to provide its value proposition to the economy,” Kelly said.

PATENTS: MediaTek Inc said it would not comment on ongoing legal cases, but does not expect the legal action by Huawei to affect its business operations Smartphone integrated chips designer MediaTek Inc (聯發科) on Friday said that a lawsuit filed by Chinese smartphone brand Huawei Technologies Co (華為) over alleged patent infringements would have little impact on its operations. In an announcement posted on the Taiwan Stock Exchange, MediaTek said that it would not comment on an ongoing legal case. However, the company said that Huawei’s legal action would have little impact on its operations. MediaTek’s statement came after China-based PRIP Research said on Thursday that Huawei filed a lawsuit with a Chinese district court claiming that MediaTek infringed on its patents. The infringement mentioned in the lawsuit likely involved

Taipei is today suspending work, classes and its US$2.4 trillion stock market as Typhoon Gaemi approaches Taiwan with strong winds and heavy rain. The nation is not conducting securities, currency or fixed income trading, statements from its stock and currency exchanges said. Authorities had yesterday issued a warning that the storm could affect people on land and canceled some ship crossings and domestic flights. Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) expects its local chipmaking fabs to maintain normal production, the company said in an e-mailed statement. The main chipmaker for Apple Inc and Nvidia Corp said it has activated routine typhoon alert

GROWTH: TSMC increased its projected revenue growth for this year to more than 25 percent, citing stronger-than-expected demand for AI devices and smartphones The Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) yesterday raised its forecast for Taiwan’s GDP growth this year from 3.29 percent to 3.85 percent, as exports and private investment recovered faster than it predicted three months ago. The Taipei-based think tank also expects that Taiwan would see a 8.19 percent increase in exports this year, better than the 7.55 percent it projected in April, as US technology giants spent more money on artificial intelligence (AI) infrastructure and development. “There will be more AI servers going forward, but it remains to be seen if the momentum would extend to personal computers, smartphones and

Catastrophic computer outages caused by a software update from one company have once again exposed the dangers of global technological dependence on a handful of players, experts said on Friday. A flawed update sent out by the little-known security firm CrowdStrike Holdings Inc brought airlines, TV stations and myriad other aspects of daily life to a standstill. The outages affected companies or individuals that use CrowdStrike on the Microsoft Inc’s Windows platform. When they applied the update, the incompatible software crashed computers into a frozen state known as the “blue screen of death.” “Today CrowdStrike has become a household name, but not in