Softbank Group Corp is moving to sell the majority of its stake in Chinese Internet giant Alibaba Group Holding Ltd (阿里巴巴), the Financial Times reported, the latest sign of long-time China investors lowering their exposure.

The Japanese technology investor has sold more than US$7 billion in Alibaba shares this year through prepaid forward contracts, after selling US$29 billion last year, the newspaper said.

The contracts give Softbank the option to buy the shares back, but the group has settled previous deals by handing over the stock, the Times reported.

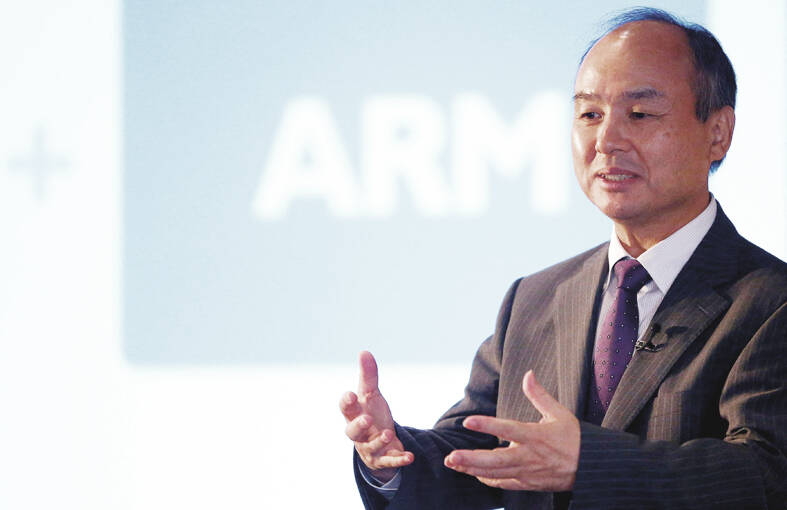

Photo: Reuters

Pummeled by losses on its start-up bets, Softbank has said it would prioritize financial discipline before seeking the right time to go on the offensive with investments.

Investors are also speculating if the company might launch another buyback program.

Alibaba shares fell as much as 5.2 percent in Hong Kong yesterday, erasing about US$13 billion of market value. Softbank shares were little changed in Tokyo after dropping about 8 percent this year.

The sales are likely to reduce the Japanese conglomerate’s ownership of Alibaba to less than 4 percent, the paper said, citing its analysis of regulatory filings.

That is down from about a 14.6 percent stake the company said it was slated to hold as of the end of September last year. Softbank once owned about one-third of the company spanning from an early US$20 million investment in one of venture capital’s most famous bets.

“We think progress in the monetization of asset holdings would boost the chances of a buyback announcement,” Citibank analyst Mitsunobu Tsuruo said.

Alibaba, along with other technology companies, has come under intense scrutiny from the Chinese government in recent years, and its shares have tumbled.

The online commerce leader last month said it plans to split its US$240 billion empire into six units to raise funds individually and explore initial public offerings.

Softbank, once one of Silicon Valley’s largest investors, has shouldered billions of US dollars of losses on its Vision Fund, which had lifted valuations in start-ups worldwide with its large bets on hundreds of fledgling companies.

The Vision Fund unit last year cut staff as it stopped chasing new investments.

Softbank this week said it plans to sell early-stage venture capital arm Softbank Ventures Asia Corp, one of the avenues by which it scouted promising start-ups.

Softbank founder and CEO Masayoshi Son has said he wants to focus on a planned listing of chip design unit Arm Ltd later this year and make the debut “the biggest” in the history of the chip industry.

The relisting of Arm, which had traded on the London exchange prior to Softbank’s US$32 billion acquisition in 2016, is expected to be a windfall for the world’s biggest technology investor.

With an approval rating of just two percent, Peruvian President Dina Boluarte might be the world’s most unpopular leader, according to pollsters. Protests greeted her rise to power 29 months ago, and have marked her entire term — joined by assorted scandals, investigations, controversies and a surge in gang violence. The 63-year-old is the target of a dozen probes, including for her alleged failure to declare gifts of luxury jewels and watches, a scandal inevitably dubbed “Rolexgate.” She is also under the microscope for a two-week undeclared absence for nose surgery — which she insists was medical, not cosmetic — and is

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

CHIP DUTIES: TSMC said it voiced its concerns to Washington about tariffs, telling the US commerce department that it wants ‘fair treatment’ to protect its competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reiterated robust business prospects for this year as strong artificial intelligence (AI) chip demand from Nvidia Corp and other customers would absorb the impacts of US tariffs. “The impact of tariffs would be indirect, as the custom tax is the importers’ responsibility, not the exporters,” TSMC chairman and chief executive officer C.C. Wei (魏哲家) said at the chipmaker’s annual shareholders’ meeting in Hsinchu City. TSMC’s business could be affected if people become reluctant to buy electronics due to inflated prices, Wei said. In addition, the chipmaker has voiced its concern to the US Department of Commerce