Mainland Chinese companies are pushing up demand for upscale shared office space in Hong Kong’s central business district.

The Executive Centre, the biggest flexible workspace landlord in the district’s grade-A buildings, last month saw a fivefold increase in new leases from January.

About 70 percent of the new tenants were Chinese companies, it said.

Photo: Bloomberg

The removal of COVID-19 pandemic restrictions in China has led to an increase of client interest in the territory.

“During COVID, the businesses in mainland China had time to reflect and organize themselves,” Executive Centre CEO Paul Salnikow said. “Now we are absolutely seeing a concerted flow of companies coming in tours of five, 10 people” to take up offices in Hong Kong.

The Executive Centre, owned by KKR & Co and TIGA Investments Pte, holds about 70 percent of the premium shared offices in the district.

While multinational companies make up the majority of its tenant base, Chinese firms are growing.

It recently signed Tongcheng Travel Holdings Ltd (同程旅行), an online travel agency, as a new tenant among other mainland Chinese financial operations.

Hong Kong has seen an inflow of businesses from a diverse range of sectors.

“There are more companies from emerging industries like technology, media and gaming setting up in Hong Kong,” CBRE Group Inc CEO Ada Fung (馮慧詩) said. “They tend to rent in flexible space, unlike banks which want traditional offices.”

Meanwhile, Chinese tech giant ByteDance Ltd (字節跳動) is moving to a bigger office in the district’s International Finance Centre as the company expands its presence in the territory, a company spokesperson said.

TikTok’s owner previously set up a temporary base in a Hong Kong coworking space to house dozens of employees in legal and finance.

ByteDance’s lease would cover about 1,900m2, valued at about HK$130 (US$16.56) per square meter, the Hong Kong Economic Times reported, citing unidentified people in the market.

Firms including BNP Paribas SA and Julius Baer Group Ltd have given up space in the International Finance Centre in the past few years.

Dwindling demand from multinationals and growing supply have weighed on commercial property, potentially causing rents for premium offices to fall as much as 5 percent this year, CBRE said.

Real estate agent and property developer JSL Construction & Development Co (愛山林) led the average compensation rankings among companies listed on the Taiwan Stock Exchange (TWSE) last year, while contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) finished 14th. JSL Construction paid its employees total average compensation of NT$4.78 million (US$159,701), down 13.5 percent from a year earlier, but still ahead of the most profitable listed tech giants, including TSMC, TWSE data showed. Last year, the average compensation (which includes salary, overtime, bonuses and allowances) paid by TSMC rose 21.6 percent to reach about NT$3.33 million, lifting its ranking by 10 notches

SEASONAL WEAKNESS: The combined revenue of the top 10 foundries fell 5.4%, but rush orders and China’s subsidies partially offset slowing demand Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) further solidified its dominance in the global wafer foundry business in the first quarter of this year, remaining far ahead of its closest rival, Samsung Electronics Co, TrendForce Corp (集邦科技) said yesterday. TSMC posted US$25.52 billion in sales in the January-to-March period, down 5 percent from the previous quarter, but its market share rose from 67.1 percent the previous quarter to 67.6 percent, TrendForce said in a report. While smartphone-related wafer shipments declined in the first quarter due to seasonal factors, solid demand for artificial intelligence (AI) and high-performance computing (HPC) devices and urgent TV-related orders

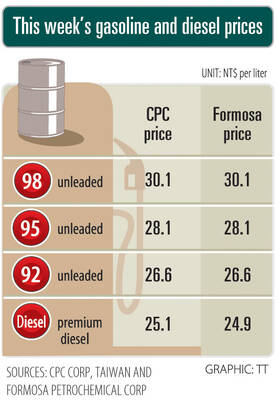

Prices of gasoline and diesel products at domestic fuel stations are this week to rise NT$0.2 and NT$0.3 per liter respectively, after international crude oil prices increased last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week snapped a two-week losing streak as the geopolitical situation between Russia and Ukraine turned increasingly tense, CPC said in a statement. News that some oil production facilities in Alberta, Canada, were shut down due to wildfires and that US-Iran nuclear talks made no progress also helped push oil prices to a significant weekly gain, Formosa said

MINERAL DIPLOMACY: The Chinese commerce ministry said it approved applications for the export of rare earths in a move that could help ease US-China trade tensions Chinese Vice Premier He Lifeng (何立峰) is today to meet a US delegation for talks in the UK, Beijing announced on Saturday amid a fragile truce in the trade dispute between the two powers. He is to visit the UK from yesterday to Friday at the invitation of the British government, the Chinese Ministry of Foreign Affairs said in a statement. He and US representatives are to cochair the first meeting of the US-China economic and trade consultation mechanism, it said. US President Donald Trump on Friday announced that a new round of trade talks with China would start in London beginning today,