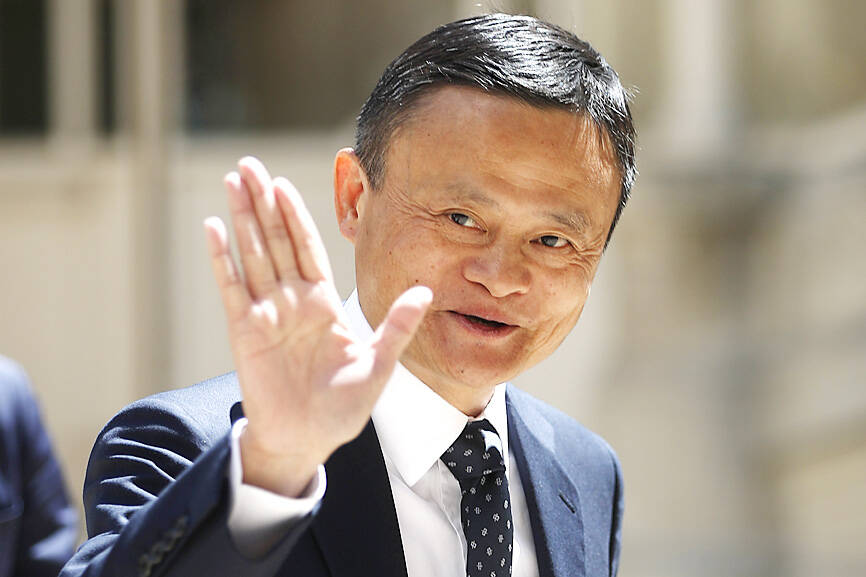

Alibaba Group Holding Ltd (阿里巴巴) cofounder Jack Ma (馬雲) has returned to China, ending a more than year-long stay overseas that was viewed by industry as reflecting the sober mood of China’s private businesses and troubled policymakers trying to spur the economy.

The return of China’s best-known entrepreneur might help quell the concerns of the country’s private-sector businesses after a bruising two-year regulatory crackdown.

His public re-emergence provides support for the government’s softening tone toward the private sector as leaders try to shore up an economy battered by three years of COVID-19 curbs.

Photo: AP

Online discussion saying that Ma was in China began emerging on Chinese social media early yesterday and his return was confirmed by a school he had visited and the Alibaba-owned South China Morning Post newspaper.

Ma discussed topics such as artificial intelligence-powered chatbot ChatGPT and also said he hoped to return to teaching one day during his visit, the Yungu School said on its official WeChat account.

The school was founded by Ma and other Alibaba founders in the e-commerce giant’s home city of Hangzhou in 2017.

Ma returned to China last week, two sources with knowledge of the matter said. A speech he gave in 2020 criticizing China’s regulatory system is commonly accepted as the spark for the tighter government scrutiny and triggered his public retreat. In late 2021 he left China and has been seen in photographs in Japan, Spain, Australia and Thailand.

While Chinese authorities have recently said they are easing the crackdown and would support the private sector, Chinese entrepreneurs and investors said they saw Ma’s decision to stay overseas as a factor hindering confidence.

Recognizing this, Chinese Premier Li Qiang (李強) had since late last year asked Ma to return home, hoping that this would boost business confidence among entrepreneurs, five sources with knowledge of the matter told Reuters.

Some of these efforts involved asking people close to Ma such as his business associates to persuade the Alibaba cofounder in person while he was living in Japan, two of the sources said.

Alibaba and the Chinese State Council did not immediately respond to a request for comment.

Li, a close ally of Chinese President Xi Jinping (習近平), has been at the forefront of government’s effort to bolster the private sector, saying earlier this month that the country’s environment for entrepreneurial businesses would improve and that Beijing would treat all firms equally.

However, companies are hesitant, privately pointing to a lack of new supportive policies and the new regulatory framework the crackdown had brought.

That view is shared by longtime Asia analyst Fraser Howie, who has written several books on China’s financial system.

“I can see how this sort of signals a relaxation, but none of the laws and institutions set up to control the private sector have changed,” he said. “It doesn’t matter at all to private business because he is already beaten. The state won, Jack has lost control, power, wealth and its not coming back.”

PATENTS: MediaTek Inc said it would not comment on ongoing legal cases, but does not expect the legal action by Huawei to affect its business operations Smartphone integrated chips designer MediaTek Inc (聯發科) on Friday said that a lawsuit filed by Chinese smartphone brand Huawei Technologies Co (華為) over alleged patent infringements would have little impact on its operations. In an announcement posted on the Taiwan Stock Exchange, MediaTek said that it would not comment on an ongoing legal case. However, the company said that Huawei’s legal action would have little impact on its operations. MediaTek’s statement came after China-based PRIP Research said on Thursday that Huawei filed a lawsuit with a Chinese district court claiming that MediaTek infringed on its patents. The infringement mentioned in the lawsuit likely involved

Taipei is today suspending work, classes and its US$2.4 trillion stock market as Typhoon Gaemi approaches Taiwan with strong winds and heavy rain. The nation is not conducting securities, currency or fixed income trading, statements from its stock and currency exchanges said. Authorities had yesterday issued a warning that the storm could affect people on land and canceled some ship crossings and domestic flights. Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) expects its local chipmaking fabs to maintain normal production, the company said in an e-mailed statement. The main chipmaker for Apple Inc and Nvidia Corp said it has activated routine typhoon alert

GROWTH: TSMC increased its projected revenue growth for this year to more than 25 percent, citing stronger-than-expected demand for AI devices and smartphones The Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) yesterday raised its forecast for Taiwan’s GDP growth this year from 3.29 percent to 3.85 percent, as exports and private investment recovered faster than it predicted three months ago. The Taipei-based think tank also expects that Taiwan would see a 8.19 percent increase in exports this year, better than the 7.55 percent it projected in April, as US technology giants spent more money on artificial intelligence (AI) infrastructure and development. “There will be more AI servers going forward, but it remains to be seen if the momentum would extend to personal computers, smartphones and

Catastrophic computer outages caused by a software update from one company have once again exposed the dangers of global technological dependence on a handful of players, experts said on Friday. A flawed update sent out by the little-known security firm CrowdStrike Holdings Inc brought airlines, TV stations and myriad other aspects of daily life to a standstill. The outages affected companies or individuals that use CrowdStrike on the Microsoft Inc’s Windows platform. When they applied the update, the incompatible software crashed computers into a frozen state known as the “blue screen of death.” “Today CrowdStrike has become a household name, but not in