The world’s most advanced and delicately fine-tuned semiconductors would not be possible without the aid of giant steel storage tanks built by a little-known Tokyo company founded in 1927.

Valqua Ltd makes specialized, super clean containers for storing essential chipmaking chemicals and it expects to hit its highest sales ever this fiscal year.

It is by far the world’s largest supplier of such tanks, dwarfing a clutch of smaller competitors in places such as Taiwan, and providing almost every tank used by the world’s biggest contract chipmaker, Taiwan Semiconductor Manufacturing Co (台積電), Ichiyoshi Research Institute analyst Mitsuhiro Osawa said.

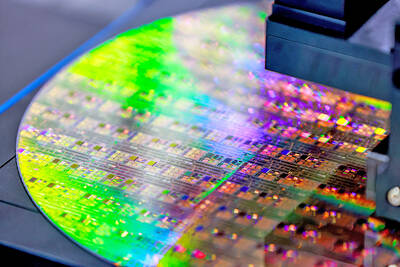

Photo: Yimou Lee, Reuters

Valqua is part of a loose network of Japanese manufacturers that dominate a niche, but indispensable segment of the global chip supply chain. Disco Corp, for instance, is the industry’s go-to supplier of silicon wafer cutters, while JSR Corp provides the high-purity chemicals that Valqua stores at chip plants.

“A molecular-level impurity would make the whole chemical solution in a tank useless, as it would drastically degrade the production yields of cutting-edge chipmaking,” Valqua president Yoshihiro Hombo said in an interview. “We and chemical makers support the complete supply chain by making, transporting and storing these solutions under ultra-clean conditions, and that is not something that can be easily replicated.”

Valqua gets more than half its sales from semiconductor makers and its close-knit relationship with the chip sector helps it stand out among industry peers.

Chipmaking customers are not showing signs of slowing spending even as demand has fallen dramatically from its COVID-19 pandemic highs, Hombo said.

“Sentiment actually remains intact, as top players of the industry tend to accelerate their investment to distance themselves from rivals,” the 66-year-old said.

The various chemicals and acids used in semiconductor fabrication processes have to be free of contaminants. The required purity for the ones used in cleaning wafers is equivalent to taking a trip around the Earth without finding a dust speck wider than a 10th of a human hair.

Those extreme specifications make it a tough business for a small company to enter and an unattractive one for bigger players, Hombo said.

There’s no standardized tank shape or size, so each chip plant’s containers — which usually number in the hundreds per facility — have to be made to order.

These tanks can be as large as 4 meters in diameter and 9 meters in height, and Valqua lines their interiors with fluororesin sheets.

Applying the inflexible, non-adhesive sheets to curved surfaces perfectly requires the hands of skilled workers. Pipes connecting tanks to machinery must also be lined, and the whole tank production process is carried out in a clean environment.

Customers return to Valqua because of that bespoke manufacturing and the difficulty of replacing a tank, which might last for a decade or more.

Valqua might spend to accelerate its growth push as it moves toward its 100th birthday.

“Our balance sheet is healthy right now, and we may eye some acquisitions and expansions,” Hombo said.

One step on that path is a new factory for storage tanks in Japan’s Aichi, which Valqua announced last month. It is the company’s first new plant in Japan since 2008, underscoring the growing value placed on shoring up potential weak points in the chip supply chain.

The move was driven in part by requests from customers wary of geopolitical risks surrounding Taiwan.

“The cost of making tanks is higher in Japan, but some top chipmakers still favor Japan as the best place to source supplies from,” Hombo said.

The nation is rich on good providers of materials and machinery, and is seen as a safe haven for a sector that “has become a big cluster of various geopolitical risks.”

Valqua’s new factory, expected to start operations in January 2025, is to be funded in part by the Japanese government.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional