The White House on Tuesday launched a partnership with India that US President Joe Biden said he hopes would help the countries compete against China on military equipment, semiconductors and artificial intelligence (AI).

Washington wants to deploy more Western mobile phone networks in the subcontinent to counter China’s Huawei Technologies Co (華為), to welcome more Indian computer chip specialists to the US and to encourage companies from both countries to collaborate on military equipment such as artillery systems.

The White House faces an uphill battle on each front, including US restrictions on military technology transfer and visas for immigrant workers, along with India’s longstanding dependence on Moscow for military hardware.

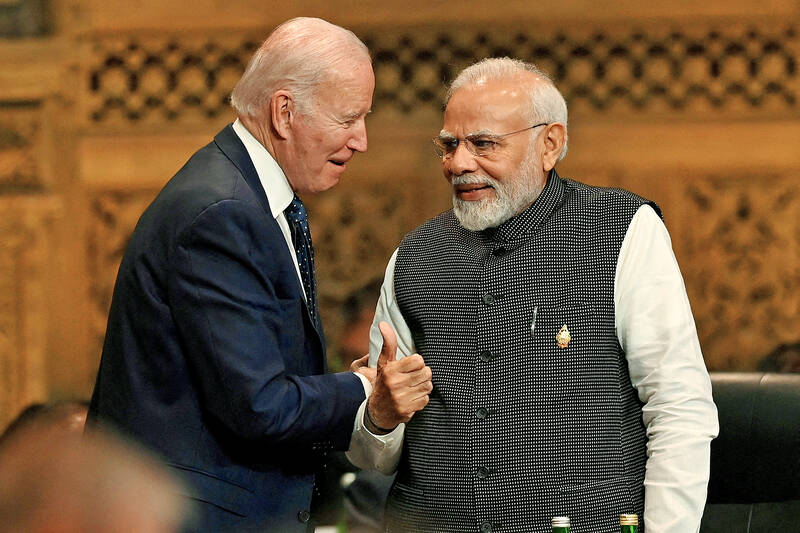

Photo: Prasetyo Utomo / G20 Media Center / handout via Reuters

US National Security Adviser Jake Sullivan and Indian National Security Adviser Ajit Doval met with senior officials from both countries at the White House to launch the US-India Initiative on Critical and Emerging Technologies.

“The larger challenge posed by China — its economic practices, its aggressive military moves, its efforts to dominate the industries of the future and to control the supply chains of the future — have had a profound impact on the thinking in Delhi,” Sullivan said.

Doval was also to meet US Secretary of State Anthony Blinken during his three-day visit to Washington, which ended yesterday.

On Monday, Sullivan and Doval participated in a US Chamber of Commerce event with corporate leaders from Lockheed Martin Corp, Adani Enterprises Ltd and Applied Materials Inc.

Although India is part of the Biden administration’s signature Asian engagement project, the Indo-Pacific Economic Framework, it has opted against joining the trade pillar negotiations.

The initiative also includes a joint effort on high-performance quantum computing and space.

Meanwhile, General Electric Co (GE) is asking the US government for permission to produce jet engines with India that would power aircraft operated and produced by India, said the White House, which added that a review is under way.

New Delhi said that the US government would review GE’s application expeditiously and that the two countries would focus on joint production of “key items of mutual interest” in defense.

The countries also established a quantum technology coordination mechanism and agreed to set up a task force with the India Semiconductor Mission, the India Electronics Semiconductor Association and the US Semiconductor Industry Association to promote the development of semiconductor ecosystems.

India’s space program is to work with NASA on human space flight opportunities and other projects, the Indian statement said.

Separately, a US official on Tuesday made the most direct comments by a US authority to date acknowledging the existence of a deal with Japan and the Netherlands for those countries to impose new restrictions on exports of chipmaking tools to China.

“We can’t talk about the deal right now,” US Deputy Secretary of Commerce Don Graves said on the sidelines of an event in Washington. “But you can certainly talk to our friends in Japan and the Netherlands.”

Bloomberg on Friday last week reported that an agreement had been finalized and two people familiar with the matter later confirmed the news to Reuters.

The US in October last year imposed sweeping export restrictions on shipments of chipmaking tools to China, seeking to hobble Beijing’s ability to supercharge its chip industry and enhance its military capabilities.

For the restrictions to be effective, Washington needed to bring on board the Netherlands and Japan, home to chipmaking powerhouses ASML Holding NV and Tokyo Electron Co, among others.

The US Department of Commerce said in an e-mail that it would continue to coordinate on export controls with allies.

“We recognize that multilateral controls are more effective than unilateral controls, and foreign engagement on these controls is a ... priority,” the agency said.

Last week, officials from the Netherlands and Japan were in Washington discussing a wide range of issues in talks led by Sullivan.

PATENTS: MediaTek Inc said it would not comment on ongoing legal cases, but does not expect the legal action by Huawei to affect its business operations Smartphone integrated chips designer MediaTek Inc (聯發科) on Friday said that a lawsuit filed by Chinese smartphone brand Huawei Technologies Co (華為) over alleged patent infringements would have little impact on its operations. In an announcement posted on the Taiwan Stock Exchange, MediaTek said that it would not comment on an ongoing legal case. However, the company said that Huawei’s legal action would have little impact on its operations. MediaTek’s statement came after China-based PRIP Research said on Thursday that Huawei filed a lawsuit with a Chinese district court claiming that MediaTek infringed on its patents. The infringement mentioned in the lawsuit likely involved

Taipei is today suspending work, classes and its US$2.4 trillion stock market as Typhoon Gaemi approaches Taiwan with strong winds and heavy rain. The nation is not conducting securities, currency or fixed income trading, statements from its stock and currency exchanges said. Authorities had yesterday issued a warning that the storm could affect people on land and canceled some ship crossings and domestic flights. Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) expects its local chipmaking fabs to maintain normal production, the company said in an e-mailed statement. The main chipmaker for Apple Inc and Nvidia Corp said it has activated routine typhoon alert

GROWTH: TSMC increased its projected revenue growth for this year to more than 25 percent, citing stronger-than-expected demand for AI devices and smartphones The Taiwan Institute of Economic Research (TIER, 台灣經濟研究院) yesterday raised its forecast for Taiwan’s GDP growth this year from 3.29 percent to 3.85 percent, as exports and private investment recovered faster than it predicted three months ago. The Taipei-based think tank also expects that Taiwan would see a 8.19 percent increase in exports this year, better than the 7.55 percent it projected in April, as US technology giants spent more money on artificial intelligence (AI) infrastructure and development. “There will be more AI servers going forward, but it remains to be seen if the momentum would extend to personal computers, smartphones and

Catastrophic computer outages caused by a software update from one company have once again exposed the dangers of global technological dependence on a handful of players, experts said on Friday. A flawed update sent out by the little-known security firm CrowdStrike Holdings Inc brought airlines, TV stations and myriad other aspects of daily life to a standstill. The outages affected companies or individuals that use CrowdStrike on the Microsoft Inc’s Windows platform. When they applied the update, the incompatible software crashed computers into a frozen state known as the “blue screen of death.” “Today CrowdStrike has become a household name, but not in