Apple Inc partners Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團) internationally, and Pegatron Corp (和碩) included Southeast Asia in their expansion plans for this year, in a sign major global contract electronics manufacturers would continue to add production capacity outside China to mitigate geopolitical and economic risks.

“We will continue to grow our scale in mainland China, the Americas and Southeast Asia, and these efforts will blossom in 2023,” Hon Hai chairman Young Liu (劉揚偉) told a company event on Sunday.

Smaller rival Pegatron is to allocate US$300 million to US$350 million this year to capital expenditure, partly to grow capacity in Southeast Asia and increase automotive component production in Mexico, company executives told reporters in Taipei on Sunday.

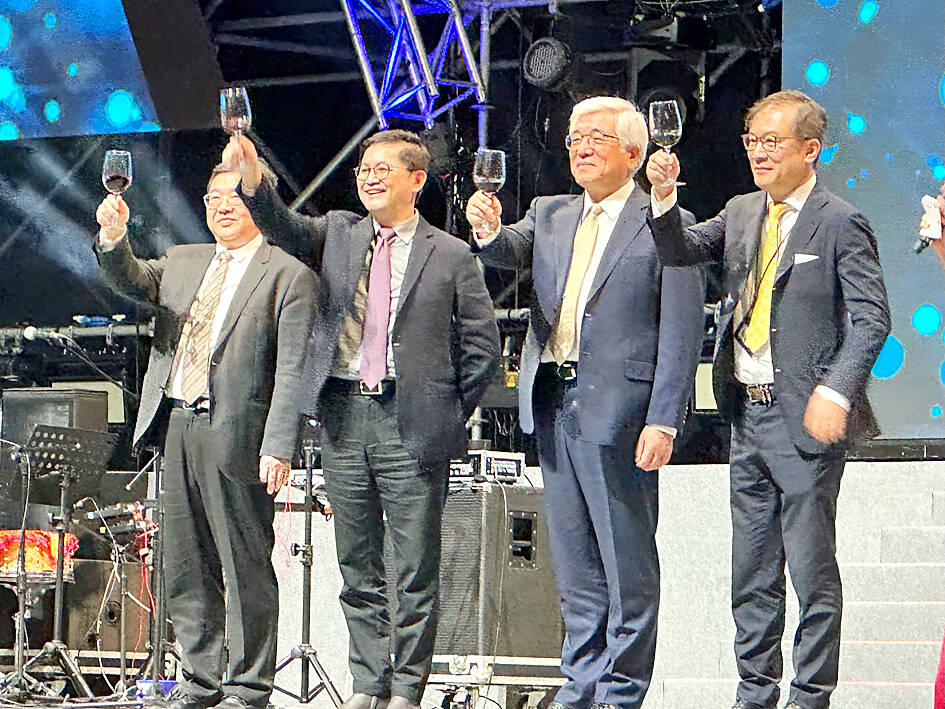

Photo: CNA

Pegatron is also a Tesla Inc supplier.

“Diversification of supply chain is an ongoing trend,” Pegatron co-chief executive officer Johnson Teng (鄧國彥) said.

In addition to producing iPhones in China, Hon Hai and Pegatron make some of Apple’s iconic handsets in India.

Photo: Screen grab from the Internet

Apple is also turning to Vietnam as an alternative manufacturing base for other products including AirPods.

Pegatron is to add capacity in Vietnam and Indonesia, where it already has existing plants, vice chairman Jason Cheng (程建中) said.

The company does not make Apple products in either country.

Hon Hai did not specify which Southeast Asian countries it plans to expand in.

Major contract electronics makers started to significantly build up their manufacturing presence outside China during the former US president Donald Trump era amid the US-China trade dispute.

Some suppliers have been accelerating those diversification efforts amid prolonged COVID-19-induced lockdowns in China that have snarled supply chains.

Meanwhile, Tata Group is close to taking over a major plant in southern India in a deal that would give the country its first homegrown iPhone maker.

The airline-to-software conglomerate has been in talks with the factory’s owner, Taiwan’s Wistron Corp (緯創), for months, and is looking to complete the purchase by the end of March, two people familiar with the process said.

The two firms discussed various potential tie-ups, but talks have now centered on Tata taking a majority of a joint venture, the people said.

Tata is set to oversee the main manufacturing operation, with support from Wistron, the people said, asking not to be named because the plans are not public.

The move would advance India’s efforts to create local contenders to challenge China’s dominance in electronics.

The Indian conglomerate aims to complete a due diligence process by March 31 so that its Tata Electronics arm can formally take over Wistron’s position in a program that gives it government incentives, one of the people said.

The next cycle of incentives is to begin from April 1, which marks the start of India’s financial year.

The acquisition could value Wistron’s only iPhone manufacturing operation in India at more than US$600 million if the Taiwanese company meets the requirements to receive the expected incentives for the current financial year, one of the people said.

Wistron has sought to diversify its business beyond thin-margin iPhone manufacturing into areas such as servers, agreeing to sell its iPhone production business in China to a competitor in 2020.

The company’s 204,000m2 factory is located just more than 50km east of Bengaluru. If the acquisition goes through, Tata would take over all its eight iPhone lines, as well as the plant’s 10,000 workers, including a couple thousand engineers.

Wistron would continue as a service partner for iPhones in India.

With an approval rating of just two percent, Peruvian President Dina Boluarte might be the world’s most unpopular leader, according to pollsters. Protests greeted her rise to power 29 months ago, and have marked her entire term — joined by assorted scandals, investigations, controversies and a surge in gang violence. The 63-year-old is the target of a dozen probes, including for her alleged failure to declare gifts of luxury jewels and watches, a scandal inevitably dubbed “Rolexgate.” She is also under the microscope for a two-week undeclared absence for nose surgery — which she insists was medical, not cosmetic — and is

CAUTIOUS RECOVERY: While the manufacturing sector returned to growth amid the US-China trade truce, firms remain wary as uncertainty clouds the outlook, the CIER said The local manufacturing sector returned to expansion last month, as the official purchasing managers’ index (PMI) rose 2.1 points to 51.0, driven by a temporary easing in US-China trade tensions, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The PMI gauges the health of the manufacturing industry, with readings above 50 indicating expansion and those below 50 signaling contraction. “Firms are not as pessimistic as they were in April, but they remain far from optimistic,” CIER president Lien Hsien-ming (連賢明) said at a news conference. The full impact of US tariff decisions is unlikely to become clear until later this month

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

CHIP DUTIES: TSMC said it voiced its concerns to Washington about tariffs, telling the US commerce department that it wants ‘fair treatment’ to protect its competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday reiterated robust business prospects for this year as strong artificial intelligence (AI) chip demand from Nvidia Corp and other customers would absorb the impacts of US tariffs. “The impact of tariffs would be indirect, as the custom tax is the importers’ responsibility, not the exporters,” TSMC chairman and chief executive officer C.C. Wei (魏哲家) said at the chipmaker’s annual shareholders’ meeting in Hsinchu City. TSMC’s business could be affected if people become reluctant to buy electronics due to inflated prices, Wei said. In addition, the chipmaker has voiced its concern to the US Department of Commerce