The US Federal Trade Commission (FTC) is seeking to block Microsoft Corp’s US$69 billion acquisition of Activision Blizzard Inc, saying the tie-up between the Xbox maker and popular gaming publisher would harm competition.

The commission voted 3-1 in favor of the complaint, which was filed in its in-house court. Regulators said Microsoft’s ownership of Activision could hurt other players in the US$200 billion gaming market by limiting rivals’ access to the company’s biggest games. The transaction would turn Microsoft into the No. 3 gaming company, behind Tencent Holdings Ltd (騰訊) and Sony Group Corp.

“Microsoft has already shown that it can and will withhold content from its gaming rivals,” said Holly Vedova, director of the FTC’s Bureau of Competition. “Today we seek to stop Microsoft from gaining control over a leading independent game studio, and using it to harm competition in multiple dynamic and fast-growing gaming markets.”

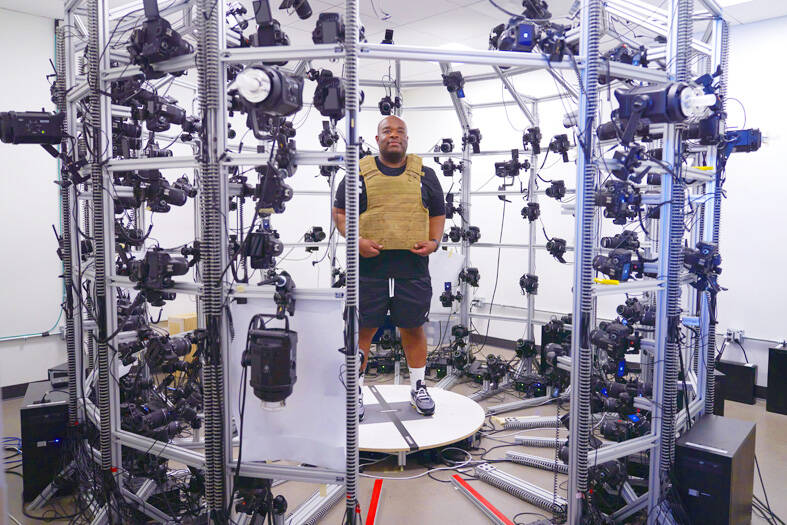

Photo: AP

An FTC official, speaking anonymously to discuss the complaint, said the agency was concerned that Microsoft could deny access, delay availability or degrade the quality of Activision Blizzard’s most popular titles to rival platforms.

Those concerns relate not only to consoles, but also to subscription services and cloud-based gaming, two markets still in development, the official said.

A public version of the complaint is not yet available.

Microsoft’s proposed Activision Blizzard deal is the company’s largest ever and one of the 30 biggest acquisitions of all time. The transaction would give Microsoft some of the most popular video game franchises, such as Call of Duty and World of Warcraft. The Xbox maker already owns the Halo franchise and Minecraft virtual-world-building game.

“We continue to believe that this deal will expand competition and create more opportunities for gamers and game developers,” Microsoft president Brad Smith said.

The company is committed to addressing competition concerns and that it offered concessions to the FTC earlier this week, he said.

“We have complete confidence in our case and welcome the opportunity to present our case in court,” Smith added.

In a letter, Activision Blizzard CEO Bobby Kotick assured employees he was confident that the deal would close.

“The allegations that this deal is anti-competitive doesn’t align with the facts, and we believe we’ll win this challenge,” Kotick said, adding that the combined company would be “good for players,” despite a regulatory environment that he said is “focused on ideology and misconceptions about the tech industry.”

In its release announcing the lawsuit, the FTC cited Microsoft’s decision to make two upcoming titles by newly acquired unit Bethesda Softworks exclusive to Microsoft’s platforms, despite assurances the company gave to EU regulators that it had no incentive to withhold games from rival consoles.

The lawsuit is part of an effort by FTC Chair Lina Khan to more aggressively police mergers, particularly those by the biggest tech platforms.

Since US President Joe Biden appointed her to helm the agency in June last year, it has killed mergers between Lockheed Martin Corp and Aerojet Rocketdyne Holdings Inc, as well as Nvidia Corp’s bid to buy Softbank Group Corp’s Arm.

Although Brazilian antitrust officials cleared the Microsoft-Activision deal in October, other competition regulators, including the UK and the EU, have also raised concerns. Those two bodies are not set to issue decisions on the deal until next year.

MARKET LEADERSHIP: Investors are flocking to Nvidia, drawn by the company’s long-term fundamntals, dominant position in the AI sector, and pricing and margin power Two years after Nvidia Corp made history by becoming the first chipmaker to achieve a US$1 trillion market capitalization, an even more remarkable milestone is within its grasp: becoming the first company to reach US$4 trillion. After the emergence of China’s DeepSeek (深度求索) sent the stock plunging earlier this year and stoked concerns that outlays on artificial intelligence (AI) infrastructure were set to slow, Nvidia shares have rallied back to a record. The company’s biggest customers remain full steam ahead on spending, much of which is flowing to its computing systems. Microsoft Corp, Meta Platforms Inc, Amazon.com Inc and Alphabet Inc are

Luxury fashion powerhouse Prada SpA has acknowledged the ancient Indian roots of its new sandal design after the debut of the open-toe footwear sparked a furor among Indian artisans and politicians thousands of miles from the catwalk in Italy. Images from Prada’s fashion show in Milan last weekend showed models wearing leather sandals with a braided design that resembled handmade Kolhapuri slippers with designs dating back to the 12th century. A wave of criticism in the media and from lawmakers followed over the Italian brand’s lack of public acknowledgement of the Indian sandal design, which is named after a city in the

The US overtaking China as Taiwan’s top export destination could boost industrial development and wage growth, given the US is a high-income economy, an economist said yesterday. However, Taiwan still needs to diversify its export markets due to the unpredictability of US President Donald Trump’s administration, said Chiou Jiunn-rong (邱俊榮), an economics professor at National Central University. Taiwan’s exports soared to a record US$51.74 billion last month, driven by strong demand for artificial intelligence (AI) products and continued orders, with information and communication technology (ICT) and audio/video products leading all sectors. The US reclaimed its position as Taiwan’s top export market, accounting for

INVESTOR RESILIENCE? An analyst said that despite near-term pressures, foreign investors tend to view NT dollar strength as a positive signal for valuation multiples Morgan Stanley has flagged a potential 10 percent revenue decline for Taiwan’s tech hardware sector this year, as a sharp appreciation of the New Taiwan dollar begins to dent the earnings power of major exporters. In what appears to be the first such warning from a major foreign brokerage, the US investment bank said the currency’s strength — fueled by foreign capital inflows and expectations of US interest rate cuts — is compressing profit margins for manufacturers with heavy exposure to US dollar-denominated revenues. The local currency has surged about 10 percent against the greenback over the past quarter and yesterday breached