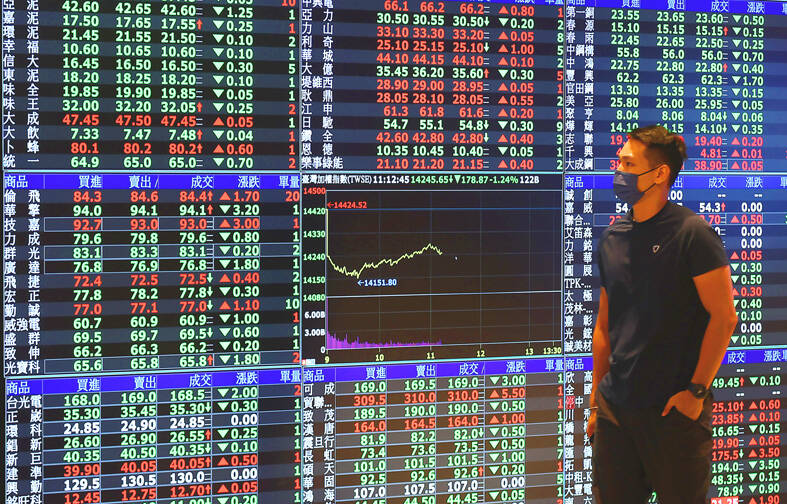

The TAIEX yesterday closed higher on a technical rebound after US markets rallied overnight, dealers said.

Large semiconductor stocks primarily drove the gains, but buying was also seen in the shipping and biotech sectors, they said.

The TAIEX ended up 152.39 points, or 1.05 percent, at 14,705.43 on turnover of NT$193.02 billion (US$6.3 billion).

Photo: CNA

The market opened up 0.46 percent and its momentum continued, especially among semiconductor heavyweights, after a 2.67 percent increase on the Philadelphia Semiconductor Index and a 1.13 percent rise in the tech-heavy NASDAQ on Thursday.

That interest pushed up the local semiconductor sub-index by 2.05 percent by the end of yesterday’s session, and the electronics index rose 1.34 percent.

Contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the most heavily weighted stock in the local market, rose 2.12 percent to close at NT$481.50, and its gains alone contributed about 85 points to the TAIEX’s rise.

“Today’s gains were largely technical in nature after the heavy losses in the local stock market in the past few sessions in line with its US counterparts,” Mega International Investment Services Corp (兆豐國際投顧) analyst Alex Huang (黃國偉) said.

“Market sentiment remained cautious due to worries over a recession in the United States because of large rate hikes by the Federal Reserve,” he said.

Before yesterday’s rebound, the TAIEX had fallen 427.7 points, or 2.85 percent, in the previous three trading sessions.

“TSMC again led the rebound, but the stock is expected to see stiff technical resistance ahead of NT$500 amid lingering worries that the global semiconductor industry would be hurt by inventory adjustments due to weakening demand,” Huang said.

Interest in TSMC spread to other semiconductor stocks.

Boosted by a rebound in the Baltic Dry Index, which gauges freight fares of bulk cargo shippers, the transportation sector rose 1.99 percent, Huang said.

Among major bulk cargo shippers, U-Ming Marine Transport Corp (裕民航運) rose 3.05 percent to close at NT$47.25. Container cargo shippers also attracted buying, with Yang Ming Marine Transport Corp (陽明海運) closing 2.95 percent higher at NT$62.80, and Evergreen Marine Corp (長榮海運) ending up 2.32 percent at NT$154.50.

“As a barometer of the Fed’s policy, the November US consumer price index [to be released on Tuesday] is expected to move the markets,” Huang said.

“More importantly, the upcoming Fed’s policymaking meeting [on Tuesday and Wednesday next week] is worth watching because it will offer clues on what might happen to rates next year,” he said.

According to the Taiwan Stock Exchange, foreign institutional investors bought a net NT$6.26 billion in shares yesterday.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new