Masayoshi Son has quietly tightened his grip on Softbank Group Corp during a tumultuous market downturn, edging closer to the point where he could bid to take the world’s largest technology investor private.

The billionaire now owns more than one-third of the company he founded, after aggressive buybacks in the past two months reduced Softbank’s outstanding stock by almost 90 million.

Son’s stake in the company rose to 34.2 percent from 32.2 percent as of the end of September, according to Bloomberg calculations based on company filings. That is up from 26.7 percent as recently as March 2019.

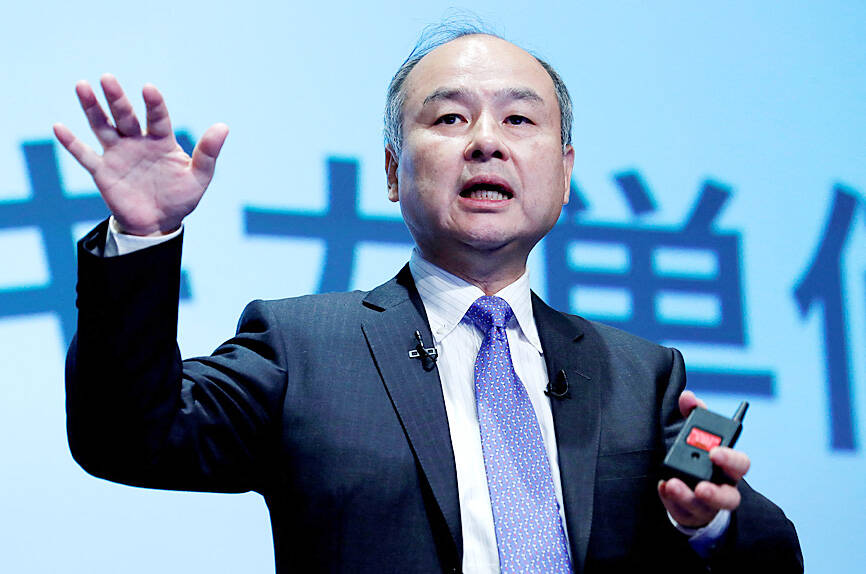

Photo: Reuters

Softbank’s share price reversed losses to close up 2.2 percent after the news yesterday. It was the stock’s biggest rise in three weeks. The benchmark Nikkei 225 Stock Average fell 0.4 percent.

Under Japanese law, Son gains additional rights after breaching one-third ownership. The 65-year-old wields more control over asset sales, some buybacks, mergers and corporate bylaws by having the power to veto any special resolution put before shareholders by activist investors.

Son is also closer to the point where he could mount an effort to take Softbank private, an idea he has repeatedly discussed internally. One option long debated is a “slow-burn” buyout to gradually buy back shares until the founder has a big enough stake to squeeze out remaining investors.

Under Japanese regulations, Son could compel other shareholders to sell if he gets to 66 percent ownership, in some cases without paying a premium.

“There’s not a single reason why Softbank should be listed,” SMBC Nikko Securities senior analyst Satoru Kikuchi said.

The company can raise the funds it needs without being listed and without a public entity’s restrictions and costs, he said.

“It’s not a good fit for the current business model,” he added.

The idea of a buyout has been debated fiercely for years inside Softbank. Advocates argue that going private would free Softbank from regulatory oversight and shareholder scrutiny over investments and staffing. Venture capital peers Tiger Global and Sequoia Capital are closely held.

Son would take the company private if he could afford it, one person familiar with the billionaire’s thinking said.

However, many lieutenants oppose a buyout, said another person close to the situation, who asked not to be identified because the talks are private.

It would be an enormous financial undertaking that would consume management’s attention, and leave it short of cash to make acquisitions and investments.

At Softbank’s current market capitalization, the price of a management buyout (MBO) would be about US$50 billion — about double the size of Michael Dell’s buyout of Dell Inc in 2013 — assuming the need to buy two-thirds of the company.

“He’s not going to have any money left to go out and do the investing that he wants to do,” said Kirk Boodry, an analyst at Redex Research, who publishes on Smartkarma.

Privatization could jeopardize the terms of debt financing for Son personally. About one-third of Son’s Softbank shares are held as collateral, while Son already owed Softbank US$4.7 billion at the end of September.

At an earnings call last month, chief financial officer Yoshimitsu Goto dismissed market speculation that the company’s recent flurry of share repurchases was in preparation for an MBO.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors