China is no longer a place to invest and has left “the free market” under Chinese President Xi Jinping (習近平), said US venture capitalist Tim Draper, an early investor in Tesla Inc and Space Exploration Technologies Corp (SpaceX).

Draper was also an early and prominent investor in Chinese search engine Baidu Inc (百度), but he is now turning his attention to Taiwan, home to companies such as Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker.

“I used to be an investor in China,” he said late on Monday after arriving in Taipei.

Photo: Ann Wang, Reuters

“Then I got an early indication that China was going to leave the free market, and I decided that that was not a place I wanted to invest,” Draper said, without elaborating.

He said he is looking for more opportunities in the space sector, and planned to visit Taiwan’s National Space Organization on Monday night in the tech hub of Hsinchu City.

Draper, whose reality TV show Meet the Drapers just finished its fifth season, said Taiwan was a natural place to look for investments, especially given the stumbling of China’s economy as Xi’s government enacts tough COVID-19 controls.

Photo: Ann Wang, Reuters

In late 2020, China began a crackdown on the once-freewheeling Internet and tech “platform economy,” which includes e-commerce and social media, although the government began easing up this year to try to bolster growth.

China has repeatedly said it remains committed to welcoming foreign investors and opening up. Chinese policymakers last week pledged that growth was still a priority and they would press on with reforms.

Taiwan has a booming tech scene connected to its sprawling semiconductor supply chain. Billionaire Warren Buffett’s Berkshire Hathaway Inc disclosed a more than US$4.1 billion investment in TSMC stock on Monday.

Xi has been stepping up pressure on Taiwan to accept China’s sovereignty claims, and in August held military drills in waters around the nation after US House of Representatives Speaker Nancy Pelosi visited Taipei.

“I’m just hoping that President Xi hasn’t lost his mind completely,” Draper said, referring to a potential Chinese attack on Taiwan.

Draper is also a big fan of “awesome” Elon Musk, even with the drama swirling around Musk’s takeover of Twitter Inc and investor concerns that it is distracting him from his position as CEO of Tesla and SpaceX.

“This is a guy who can get a lot done,” Draper said. “So I think you’ve got a busy person who is getting a lot done, and I’m sure he’s figured out what he’s capable of doing in each place. Good for him.”

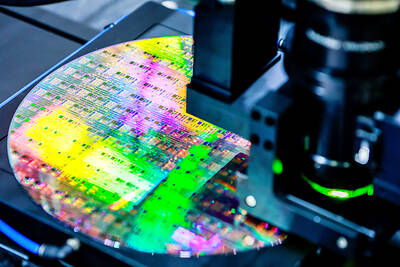

TECH TITAN: Pandemic-era demand for semiconductors turbocharged the nation’s GDP per capita to surpass South Korea’s, but it still remains half that of Singapore Taiwan is set to surpass South Korea this year in terms of wealth for the first time in more than two decades, marking a shift in Asia’s economic ranks made possible by the ascent of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). According to the latest forecasts released on Thursday by the central bank, Taiwan’s GDP is expected to expand 4.55 percent this year, a further upward revision from the 4.45 percent estimate made by the statistics bureau last month. The growth trajectory puts Taiwan on track to exceed South Korea’s GDP per capita — a key measure of living standards — a

Samsung Electronics Co shares jumped 4.47 percent yesterday after reports it has won approval from Nvidia Corp for the use of advanced high-bandwidth memory (HBM) chips, which marks a breakthrough for the South Korean technology leader. The stock closed at 83,500 won in Seoul, the highest since July 31 last year. Yesterday’s gain comes after local media, including the Korea Economic Daily, reported that Samsung’s 12-layer HBM3E product recently passed Nvidia’s qualification tests. That clears the components for use in the artificial intelligence (AI) accelerators essential to the training of AI models from ChatGPT to DeepSeek (深度求索), and finally allows Samsung

Taiwan has imposed restrictions on the export of chips to South Africa over national security concerns, taking the unusual step of using its dominance of chip markets to pressure a country that is closely allied with China. Taiwan requires preapproval for the bulk of chips sold to the African nation, the International Trade Administration said in a statement. The decision emerged after Pretoria tried to downgrade Taipei’s representative office and force its move to Johannesburg from Pretoria, the Ministry of Foreign Affairs has said. The move reflects Taiwan’s economic clout and a growing frustration with getting sidelined by Beijing in the diplomatic community. Taiwan

READY TO HELP: Should TSMC require assistance, the government would fully cooperate in helping to speed up the establishment of the Chiayi plant, an official said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said its investment plans in Taiwan are “unchanged” amid speculation that the chipmaker might have suspended construction work on its second chip packaging plant in Chiayi County and plans to move equipment arranged for the plant to the US. The Chinese-language Economic Daily News reported earlier yesterday that TSMC had halted the construction of the chip packaging plant, which was scheduled to be completed next year and begin mass production in 2028. TSMC did not directly address whether construction of the plant had halted, but said its investment plans in Taiwan remain “unchanged.” The chipmaker started