The production value of Taiwan’s semiconductor industry is expected to hit NT$4.7 trillion (US$146.1 billion) this year, up 15.6 percent from last year, an Industrial Technology Research Institute (ITRI, 工業技術研究院) expert said yesterday.

Terry Fan (范哲豪), a manager at the institution’s Science and Technology International Strategy Center, told a forum hosted by the institute that the output might grow 6.1 percent to NT$5 trillion next year, driven by advanced process technologies and automotive chip production.

The output of the global semiconductor sector could top US$618.5 billion this year, up 4 percent from last year, Fan said.

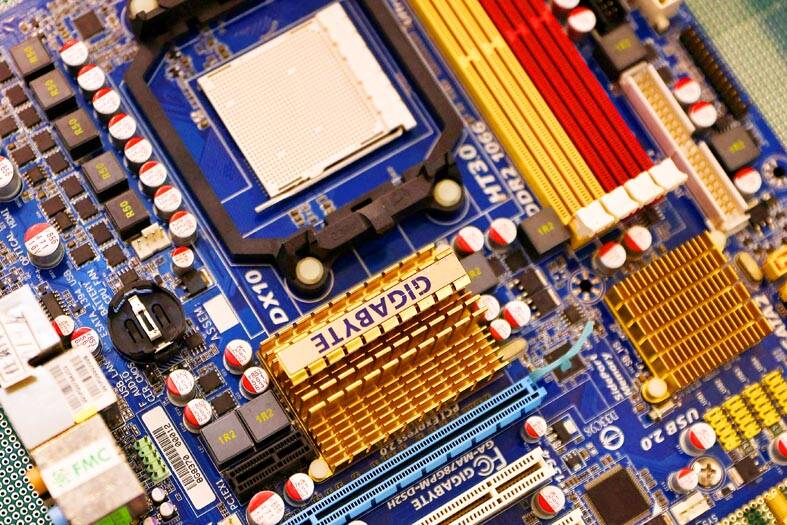

Photo: Ann Wang, REUTERS

However, the industry could experience a decline next year, when the output is expected to drop 3.6 percent year-on-year to US$596.4 billion, following rapid growth over the past few years due to the need for digital transformation during the COVID-19 pandemic, he said.

Fan said the IC sector has seen significant innovation over the past 10 months, such as in 5G, artificial intelligence and high-performance computing, despite global economic disruptions.

Future areas of interest are self-driving electric vehicles, metaverse development and advanced semiconductor technologies, he said.

However, the global supply chain could also face some uncertainties, particularly after the US this year introduced broader curbs on the sale of US-made chips and production equipment to China, he added.

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

Jensen Huang (黃仁勳), founder and CEO of US-based artificial intelligence chip designer Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) on Friday celebrated the first Nvidia Blackwell wafer produced on US soil. Huang visited TSMC’s advanced wafer fab in the US state of Arizona and joined the Taiwanese chipmaker’s executives to witness the efforts to “build the infrastructure that powers the world’s AI factories, right here in America,” Nvidia said in a statement. At the event, Huang joined Y.L. Wang (王英郎), vice president of operations at TSMC, in signing their names on the Blackwell wafer to

‘DRAMATIC AND POSITIVE’: AI growth would be better than it previously forecast and would stay robust even if the Chinese market became inaccessible for customers, it said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday raised its full-year revenue growth outlook after posting record profit for last quarter, despite growing market concern about an artificial intelligence (AI) bubble. The company said it expects revenue to expand about 35 percent year-on-year, driven mainly by faster-than-expected demand for leading-edge chips for AI applications. The world’s biggest contract chipmaker in July projected that revenue this year would expand about 30 percent in US dollar terms. The company also slightly hiked its capital expenditure for this year to US$40 billion to US$42 billion, compared with US$38 billion to US$42 billion it set previously. “AI demand actually

RARE EARTHS: The call between the US Treasury Secretary and his Chinese counterpart came as Washington sought to rally G7 partners in response to China’s export controls China and the US on Saturday agreed to conduct another round of trade negotiations in the coming week, as the world’s two biggest economies seek to avoid another damaging tit-for-tat tariff battle. Beijing last week announced sweeping controls on the critical rare earths industry, prompting US President Donald Trump to threaten 100 percent tariffs on imports from China in retaliation. Trump had also threatened to cancel his expected meeting with Chinese President Xi Jinping (習近平) in South Korea later this month on the sidelines of the APEC summit. In the latest indication of efforts to resolve their dispute, Chinese state media reported that