Solar module manufacturers including TSEC Corp (元晶太陽能) and Motech Industries Inc (茂迪) are building capacity for large, new-generation solar modules to cope with rising demand as the world turns to renewable energy sources.

TSEC plans to complete work in the middle of next year on a new production line, the third of its kind, to produce large modules equipped with M10 solar cells, the company said yesterday.

It also plans to add 500 megawatts of M10 solar module capacity to its existing M10 and M6 lines, it said.

Photo: Chang Hui-wen, Taipei Times

Upon completion, TSEC’s installed capacity of new-generation solar modules would rise to 1.5 gigawatts from about 1 gigawatt this year, it said.

The company’s M10 cell is about 30 percent larger than the previous-generation G1 module, delivering better efficiency, it said.

The large solar cell also has an advantage in installation cost, TSEC said.

“With growing uptake of solar panels at fishing farms and soaring demand for green energy from corporations, TSEC expects the solar market to thrive in 2023,” the company said in a press release. “Government’s policy support and easing a supply chain bottleneck are also factors driving demand.”

The company has received orders for about 50 percent of its high-efficiency M10 and M6 solar module capacity next year thanks to positive customer feedback for the new products, it said.

The newly launched M10s can achieve 21.3 percent efficiency, 5 percent higher than the mainstream G1 solar products in Taiwan, and cut installation costs by more than 13 percent, TSEC said.

Meanwhile, Motech Industries said that its new-generation solar module equipped with N-type TOPCon solar cells, has entered volume production this year.

The product has been certified in Taiwan, it said.

The company has a clear order visibly for the product through the second quarter next year, Motech said.

The new module achieves a high efficiency rate of 22.5 percent, which would help boost land utilization efficiency and lower solar installation costs, Motech said.

Global demand for installation of new solar modules is expected to expand 36 percent annually to about 326 gigawatts next year, market researcher TrendForce Corp (集邦科技) said this month.

The world’s top five markets, Brazil, China, Germany, India and the US, are to make up 63.6 percent of overall global demand, TrendForce said.

In Taiwan, installation demand would reach 2.5 gigawatts after the government in June increased incentives, TrendForce said.

Installations have slowed due to the COVID-19 pandemic this year and last year, it said.

The nation has installed 9.06 gigawatts of solar panels, it said.

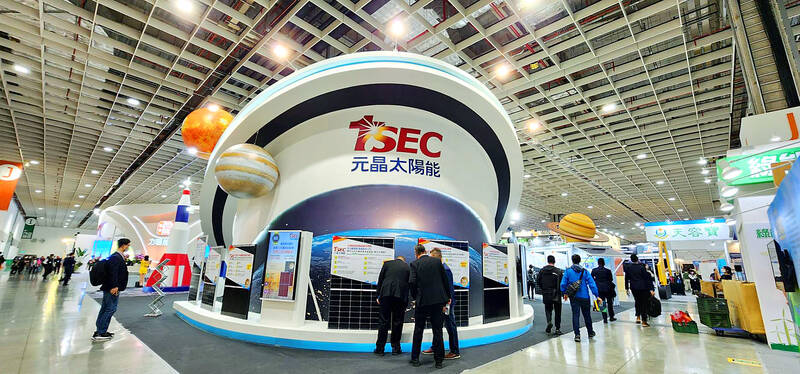

TSEC and Motech unveiled their business updates at the Energy Taiwan trade show in Taipei. The three-day event opened yesterday at the Taipei Nangnage Exhibition Center's Hall 1 and runs throught tomorrow.

Real estate agent and property developer JSL Construction & Development Co (愛山林) led the average compensation rankings among companies listed on the Taiwan Stock Exchange (TWSE) last year, while contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) finished 14th. JSL Construction paid its employees total average compensation of NT$4.78 million (US$159,701), down 13.5 percent from a year earlier, but still ahead of the most profitable listed tech giants, including TSMC, TWSE data showed. Last year, the average compensation (which includes salary, overtime, bonuses and allowances) paid by TSMC rose 21.6 percent to reach about NT$3.33 million, lifting its ranking by 10 notches

Popular vape brands such as Geek Bar might get more expensive in the US — if you can find them at all. Shipments of vapes from China to the US ground to a near halt last month from a year ago, official data showed, hit by US President Donald Trump’s tariffs and a crackdown on unauthorized e-cigarettes in the world’s biggest market for smoking alternatives. That includes Geek Bar, a brand of flavored vapes that is not authorized to sell in the US, but which had been widely available due to porous import controls. One retailer, who asked not to be named, because

SEASONAL WEAKNESS: The combined revenue of the top 10 foundries fell 5.4%, but rush orders and China’s subsidies partially offset slowing demand Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) further solidified its dominance in the global wafer foundry business in the first quarter of this year, remaining far ahead of its closest rival, Samsung Electronics Co, TrendForce Corp (集邦科技) said yesterday. TSMC posted US$25.52 billion in sales in the January-to-March period, down 5 percent from the previous quarter, but its market share rose from 67.1 percent the previous quarter to 67.6 percent, TrendForce said in a report. While smartphone-related wafer shipments declined in the first quarter due to seasonal factors, solid demand for artificial intelligence (AI) and high-performance computing (HPC) devices and urgent TV-related orders

MINERAL DIPLOMACY: The Chinese commerce ministry said it approved applications for the export of rare earths in a move that could help ease US-China trade tensions Chinese Vice Premier He Lifeng (何立峰) is today to meet a US delegation for talks in the UK, Beijing announced on Saturday amid a fragile truce in the trade dispute between the two powers. He is to visit the UK from yesterday to Friday at the invitation of the British government, the Chinese Ministry of Foreign Affairs said in a statement. He and US representatives are to cochair the first meeting of the US-China economic and trade consultation mechanism, it said. US President Donald Trump on Friday announced that a new round of trade talks with China would start in London beginning today,